India Deal Review: After two-month relief, PE-VC investments plunge 65% in Nov

After showing signs of recovery in September and October, private equity and venture capital investments into Indian startups once again plunged to hit $483.6 million in November—a drop of 65% over October when startups had collectively raked in $1.38 billion.

At 76, the deal volume in November was also down over 16.5% from 91 in the previous month, according to proprietary data compiled by DealStreetAsia.

On a year-on-year basis, too, the deal value fell almost 63%. Indian startups garnered $1.3 billion, across 131 transactions, in November 2022.

Investments this year peaked in May when Indian startups scooped up $1.55 billion across 89 transactions. Post that fundraising stayed below the $1-billion mark until August, and started to recover only from September.

A funding crunch was prevalent throughout 2023 as domestic and global investors, who raised record funds in the previous year, refrained from allocating the capital this year owing to global economic and political turmoil.

The dearth of funds to keep their businesses afloat forced many startups to cut costs, lay off people, and even shut shop.

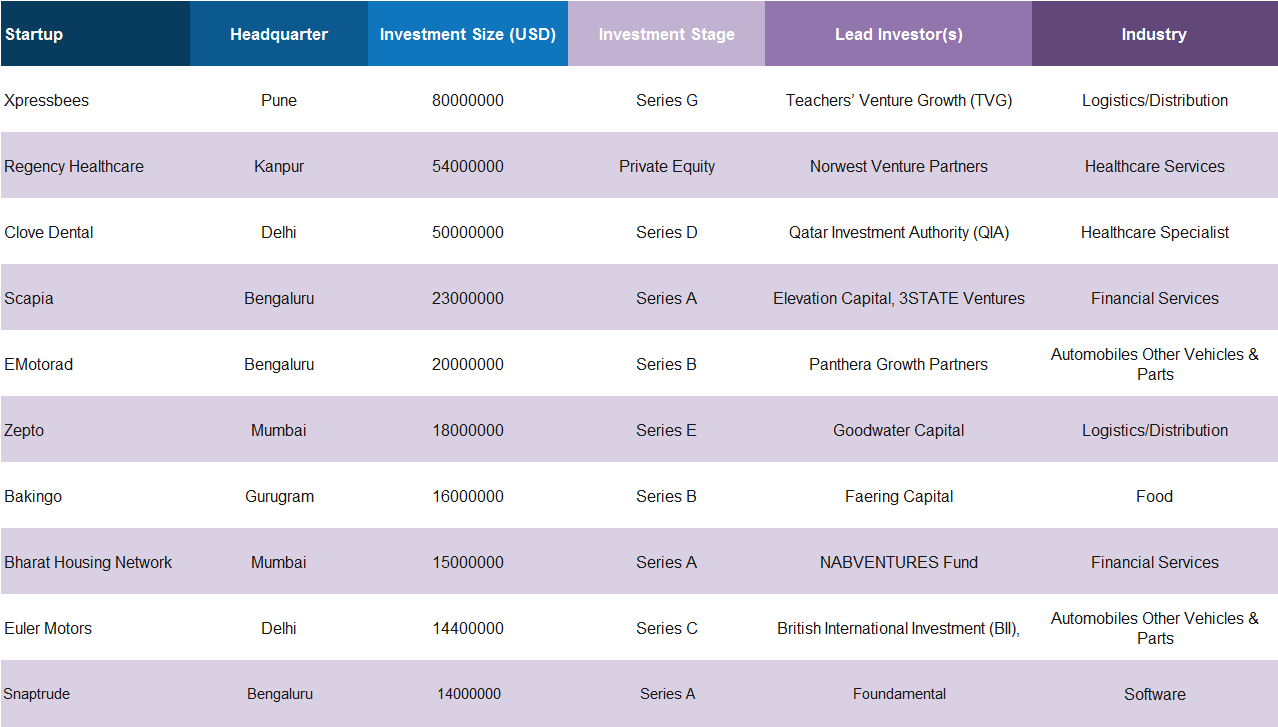

No $100-million plus deal (mega round) was reported during the month. In comparison, three startups raised mega rounds in October. Logistics unicorn Xpressbees’ $80-million funding round marked the largest transaction in November.

Top ten deals in India in November 2023

Further, no startup entered the unicorn club in the month as late-stage startups were unable to raise money owing to unfavourable market conditions.

So far in 2023, only Zepto has entered the unicorn club from India. While there were at least 45 new unicorns minted in 2021 with a combined valuation of a little over $97 billion, there were only 24 last year with a combined valuation of $50 billion, according to data from DealStreetAsia DATA VANTAGE.

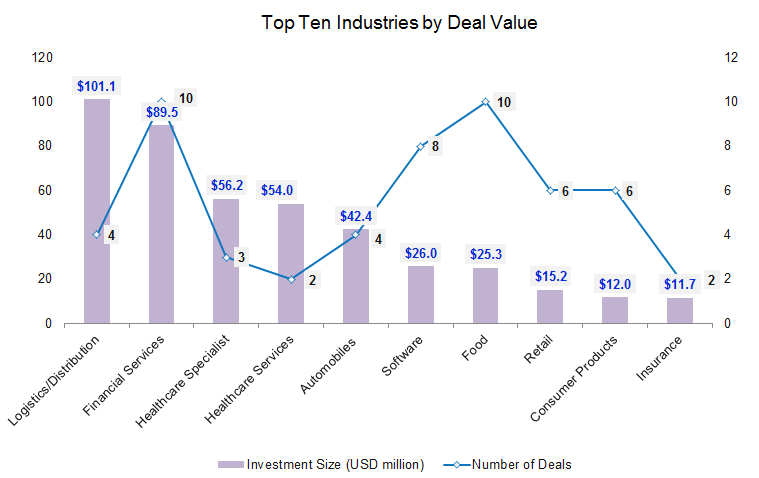

The logistics industry tops the chart

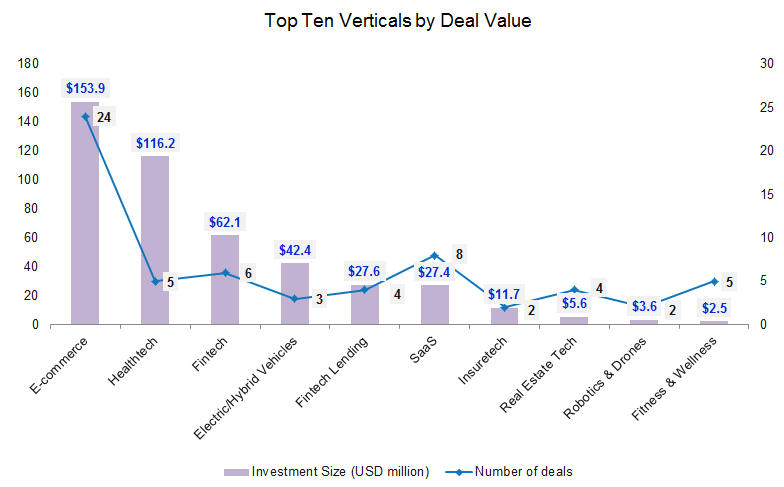

Logistics/distribution emerged as the most funded industry in the month with a total of $101.1 million in funding across four transactions.

Within logistics, Xpressbees raised the largest round of $80 million from Teachers’ Venture Growth (TVG), the late-stage venture and growth investment arm of the Ontario Teachers’ Pension Plan (OTPP). The deal also marked TVG’s first investment in India.

The logistics unicorn had last secured $40 million from Malaysia’s sovereign wealth fund Khazanah Nasional in April this year. The firm entered the unicorn club in February last year, after raising $300 million in a Series F round at a valuation of $1.2 billion.

Other logistics startups that raised capital in November include Zepto ($18 million), General Autonomy ($3 million) and Bull Agritech.

Startups within financial services followed with total investments worth $89.5 million across 10 transactions. This is 60% down from October when financial services startups had raised $220.4 million across 14 deals. Travel fintech startup Scapia led the industry with $23 million funding from Elevation Capital and Flipkart co-founder Binny Bansal’s Three State Ventures.

Other prominent deals within financial services include Bharat Housing Network ($15 million), Kiwi ($13 million), PhiCommerce ($10 million), Slice ($9 million), and Moneyboxx Finance ($9 million).

The healthcare specialist industry occupied the third spot after raking in investments worth $56.2 million across three deals. Global Dental Services, parent of tech-enabled dental services provider Clove Dental, led the pack with an equity investment of $50 million from Qatar Investment Authority (QIA). Other two deals within the industry were Hearzap and Varco Leg Care.

Together the top three industries—logistics/distribution, financial services, and healthcare specialist—raised a total of $247 million, accounting for about 51% of the total deal value in the month.

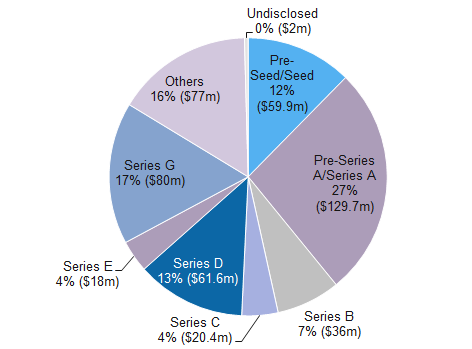

Early-stage deal value soars

While the overall investment sentiment was subdued during the month, the value of pre-seed and seed stage deals rose 31% to touch $59.9 million in November from $45.8 million in October. The volume was, however, down to 26 from 33 in the previous month.

In the largest seed round, sustainable packaging startup Fibmold raised $10 million led by Omnivore and Accel. Other seed rounds during the month were sealed by Coverself ($8.2 million), Stackr Labs ($5.5 million), Dashtoon ($5 million), Varee ($4 million), and Growcoms ($3.5 million).

Startups at pre-Series A and Series A stages secured a total of $129.7 million across 22 transactions, registering a growth of about 25% in deal value over October. Travel fintech startup Scapia raised the largest Series A round of $23 million led by venture capital firms Elevation Capital and 3STATE Ventures. Other startups that raised Series A rounds in the month include Bharat Housing Network ($15 million), Snaptrude ($14 million), Kiwi ($13 million), Baaz Bikes ($8 million), Sequretek ($8 million), Innovist ($7 million), and GrowXCD Finance ($6 million).

Growth-stage deals, defined as Series B or post-Series B rounds (including private equity rounds), accumulated $270 million across 10 transactions in November, accounting for 39.4% of the total deal value in the month. The deal value was, however, down 55% over October, when growth-stage deals raked in a total of $599 million.

Xpressbees ($80 million), Clove Dental ($50 million), EMotorad ($20 million), Zepto ($18 million), Bakingo ($16 million), and Purple Style Labs ($8 million) were among the startups that raised growth rounds in the month.

Most active investors

Angel investing platform Inflection Point Ventures (IPV) topped the investors’ chart with a total of five investments. The firm led funding rounds in ready-to-drink cocktail startup O’ Be Cocktails, D2C beauty startup Conscious Chemist, online frozen food delivery company FroGo, customer service request aggregator Onedios, and D2C fresh food brand Happy Nature.

Venture capital Accel and Alteria Capital made three investments each. Accel’s investments include Fibmold, Snaptrude, and Innovist while Alteria Capital backed Euler Motors, Sequretek, and EMotorad.

Other prominent investors in the month were BEENEXT, Ah! Ventures, Artha Venture Fund, Elevation Capital, InfoEdge Ventures, JITO Incubation & Innovation Foundation (JIIF), Omidyar Network India, Peak XV’s Surge and Matrix Partners India.

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

China Deals Barometer Report: Startup funding deals hit a three-month high of 219 in Nov

Venture investors flocked to seal deals in the Greater China region in November ahead of the year-end holiday season.

Venture Capital

SE Asia Deals Barometer Report: At $382m, startup fundraising plunges to lowest this year in Nov

November was another reminder of the challenges that persist in startup fundraising in Southeast Asia.