India Deals Barometer Report: Fundraising by Indian startups falls 27% to $3.4b in September

Fundraising by Indian startups fell by about 27% to $3.36 billion last month from August when startups collectively garnered $4.6 billion, according to proprietary data compiled by DealStreetAsia.

Investments saw a drop for the second consecutive month since July, when startups garnered a record $11 billion through 180 transactions, led by big-ticket deals.

In terms of volume, however, there was a 26% jump in September from that of August. As many as 193 private equity and venture capital deals were clocked last month, while the number stood at 153 in August.

Of the total transactions in September, the value of 33 deals was undisclosed, the data showed.

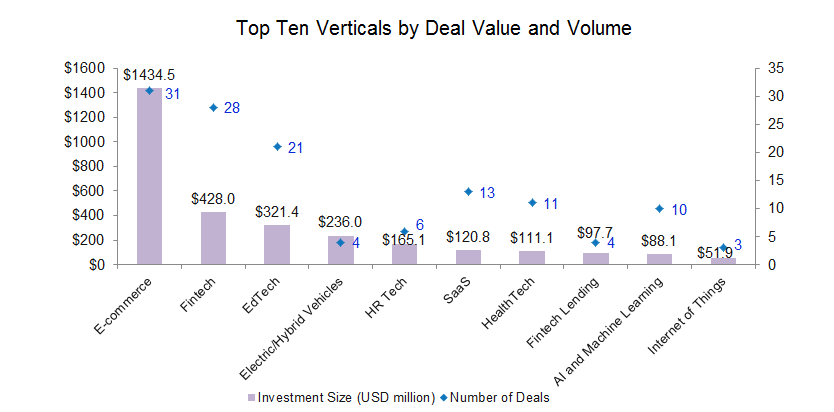

There were about nine mega deals (that was worth $100 million or more) in the month, which accounted for about 59% of the total deal value. These include social e-commerce startup Meesho, online marketplace for used cars and two-wheelers Cars24, electric vehicles Ola Electric, logistics platform Delhivery, edtech companies Byju’s and Vedantu, and merchant commerce platform Pine Labs.

In the month’s biggest deal, Meesho raised $570 million in its Series F round led by US asset manager Fidelity and Eduardo Saverin’s B Capital after which its valuation more than doubled to $4.9 billion in less than six months. Existing investors SoftBank Vision Fund, Prosus Ventures, and Facebook also participated in the round.

In yet another big deal, Cars24 raised over $450 million in equity and debt in its Series F round led by SoftBank Vision Fund 2, DST Global and Falcon Edge. The majority of $340 million that came in as equity in the used car marketplace also saw the participation of Tencent and existing investors Moore Strategic Ventures and Exor Seeds.

The round nearly doubled Cars24’s valuation to $1.84 billion from $1 billion last November.

September also saw at least three startups enter the unicorn club, including edtech company Vedantu, professional networking and jobs platform Apna, and mobile gaming startup MPL.

Unicorn is a moniker used for privately held companies that are valued at $1 billion and above.

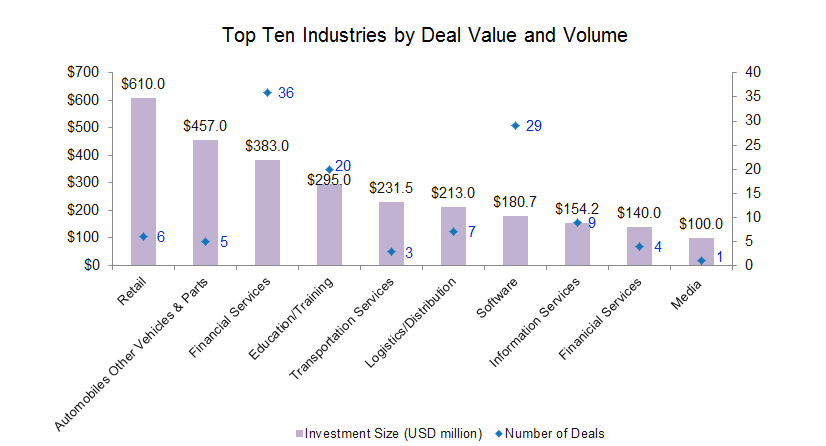

Meesho deal pushes retail to top

The retail industry was pushed up to the top led by fundraising by Meesho. Startups within the retail industry, led by e-commerce, secured the highest funding worth $610 million through six deals. Startups operating in the sector that secured funding last month include B2B platform for factories Bijnis, O2O social commerce platform Coutloot, and contactless store Gobbly.

Accelerated by the pandemic, the Indian e-commerce industry is set to grow by 84 per cent to $111 billion by 2024, according to a report by Affle’s MAAS, a unified mobile advertising platform.

The automobiles industry occupied the second spot through five deals, led by Cars24’s funding round. While the financial services slipped to the third spot from first last month in terms of deal value, it led the funding by volumes. Startups within the financial services industry raised $383 million across 36 deals.

Together retail, financial services, and automobile industries accounted for about 43% of the total deal value in September.

India’s edtech sector, too, has seen unprecedented growth since the onset of the pandemic as most schools and universities remained shut for most parts of the year. The educational institutions are now being opened in a phased manner. Education/training startups garnered about $295 million through 20 deals in September.

Early-stage startups attract investors

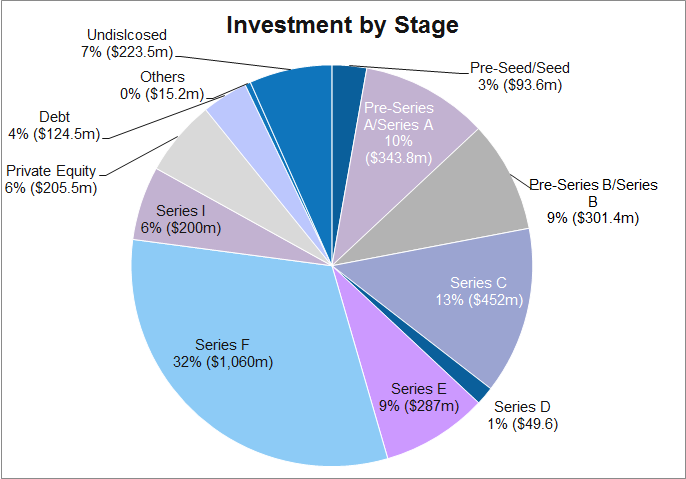

Deal volumes were led by early-stage transactions in September. The month saw at least 77 pre-seed and seed stage deals worth $93.6 million as against 51 transactions worth $91.7 million in August.

Investors in India that have aggressively chased growth-stage deals earlier have also started evincing interest in early-stage deals. Startups in pre-Series A and Series A stages raked in about $343.8 million across 46 transactions.

In terms of value, growth-stage startups led fundraising in September.

Companies in the Series B or post-Series B rounds collected an aggregate of $2.45 billion through 36 investments. This comes to about 73% of the total deal value in the month.

Most active investors

Sequoia Capital India, along with its startup accelerator Surge, topped the investors’ list in September too with at least 14 investments compared to 10 in August. In the month, it led investments in mobile-commerce enabler Bikayi, digitisation platform for SMBs FloBiz, AI-enabled personal finance platform Bright Money, SaaS company Lio, debt platform CredAvenue, and crypto startup Coinshift .

Venture Catalysts, along with its early-stage startup fund 9Unicorns, also made at least 14 investments in startups including fintech startups CredRight and Homeville, electric ride-hailing platform BluSmart, chit-fund platform The Money Club, Easy to Pitch, and industrial robotics startup Peppermint, among others.

Indian Angel Network made at least seven investments, while Lightspeed, Titan Capital, Elevation Capital, IIFL AMC, and LetsVenture made six investments each.

Share this story with your friends and colleagues.

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

China Deals Barometer Report: Startup funding slides in Sept to $7.2b, deal volume slips too

At 181 deals, September’s deal count had a small retreat from August, when a total of 193 deals…

Venture Capital

SE Asia Deal Barometer Report: Southeast Asia’s startups raise $2.8b in Sept, up 35% over Aug

Startups in Southeast Asia continued their dealmaking momentum in September, raising $2.8 billion…