SE Asia Deal Barometer Report: VC funding

in startups dips 48% to $652m in August

Venture Capital investors pumped in a mere $652 million in Southeast Asia’s burgeoning startup ecosystem in August, a 48% drop from July’s $1.26 billion.

This is primarily because of the paucity of big-ticket VC transactions in the region — there were only two deals that saw capital infusion of $100 million or more last month.

While Malaysian used-car marketplace Carsome Group raised $170 million, Singapore-headquartered crypto-finance venture Matrixport raised $100 million at a valuation of over $1 billion.

In terms of overall volume, Southeast Asia witnessed 69 venture capital (VC) deals in August, which is just marginally more compared to 66 in July, per proprietary data compiled by DealStreetAsia.

The deals include those publicly announced by the companies and ACRA filings seen by DealStreetAsia – DATA VANTAGE. The overall amount also does not include the 12 fundraising deals that did not disclose figures.

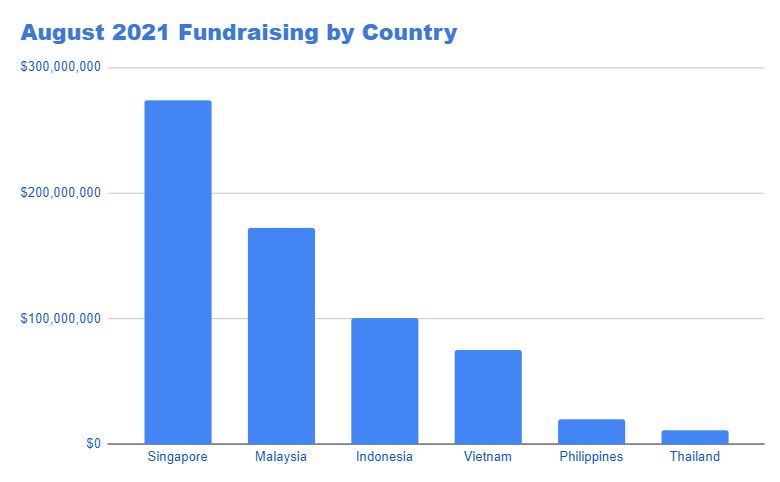

Singapore, Indonesia are SE Asia's top VC destinations

By geography, Singapore continued to corner the highest number of VC deals with investors pumping in about $274 million across 26 transactions in the city-state.

Meanwhile, Indonesian startups raised $100 million from 15 venture capital deals.

In terms of value, however, Malaysia stood second after Singapore with Carsome making headlines for raking in the highest amount in the region from investors including Taiwanese chipmaker MediaTek. The country witnessed only five deals last month.

Together, all three countries accounted for about 83% of the disclosed fundraisings in August.

Vietnam raised $75.3 million from 14 venture deals while startups in the Philippines bagged $19.7 million from six funding rounds, including the $12.5 million funding in Philippine Digital Asset Exchange (PDAX), a cryptocurrency exchange.

Thailand’s three startups — Wisesight, FlowAccount, and Builk One Group — raised at least $11 million.Seed, Series A rounds dominate

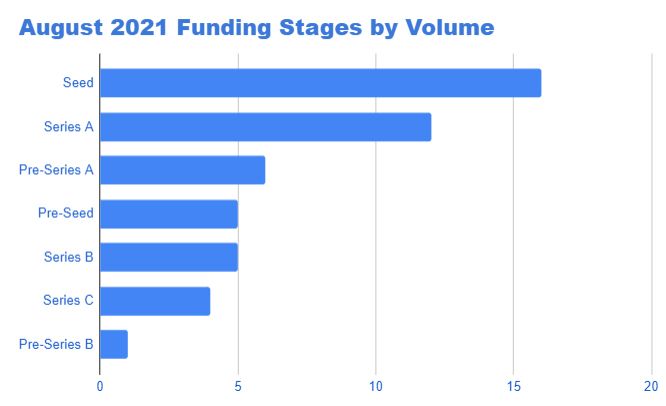

Seed rounds dominated the deals table in August in terms of volume, with 16 startups garnering a total of $24.5 million. These include the $6.5 million seed funding in Singapore SaaS platform Momos, which was led by Sequoia and Alpha Wave Incubation, and the $6 million investment in Nektar.ai, a sales productivity startup also based in Singapore.

There were 12 Series A rounds that raised at least $123.3 million, with Indonesian cryptocurrency exchange Pintu leading the pack. The Jakarta-headquartered firm garnered $35 million from US-based Lightspeed Venture Partners and existing investors.

In Series B and Series C rounds, startups raised a combined amount of $244.3 million.

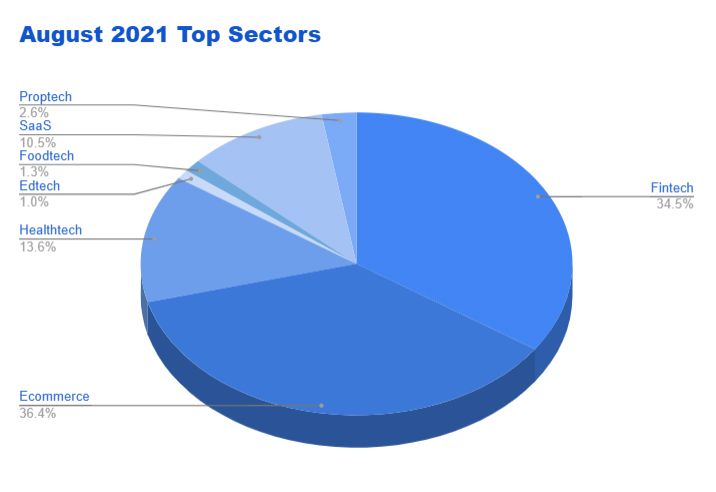

Ecommerce, fintech lead sectors

New economy sectors such as e-commerce and fintech continued to witness maximum traction in August, cornering at least $210.4 and $199.5 million, respectively, from 21 deals.

There were at least eight investments in the healthtech sector worth $79 million, while Software-as-a-service secured $60.5 million from seven announced deals.

Startups in the foodtech, edtech, and proptech sectors raised $7.7 million, $5.6 million, and $5 million, respectively.

Sequoia Capital India’s startup accelerator programme Surge, venture capital firm East Ventures, and Insignia Ventures Partners were among the most active investors in August, based on the compiled data.

In the April-June quarter of this year, Southeast Asia’s startups raised at least $5.6 billion from PE and VC deals, more than double the capital raised in Q2 2020, finds the report by DealStreetAsia – DATA VANTAGE.

According to SE Asia Deal Review: Q2 2021, deal volume in the second quarter soared to new highs at 230 transactions, up from 211 in the first quarter.

The top three fundraisers in Q2 were Trax ($620 million), VinCommerce ($410 million), and The CrownX ($400 million).

Among markets, Singapore attracted the largest share of capital in the quarter at $2.85 billion. Meanwhile, Indonesian startups collected $1.48 billion during the period led by Bukalapak’s $400 million round.

Share this story with your friends and colleagues.

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

China Deals Barometer Report: PE-VC investments grow for third consecutive month to $9b in Aug

China and Hong Kong based Companies raised a combined $13.7 billion through IPOs in the front…

Venture Capital

India Deals Barometer Report: After hitting a record high, startup funding in India falls to $4.6b in August

India startups raised $4.68 billion across 257 deals in the first quater of 2021 to touch a five-quater high.