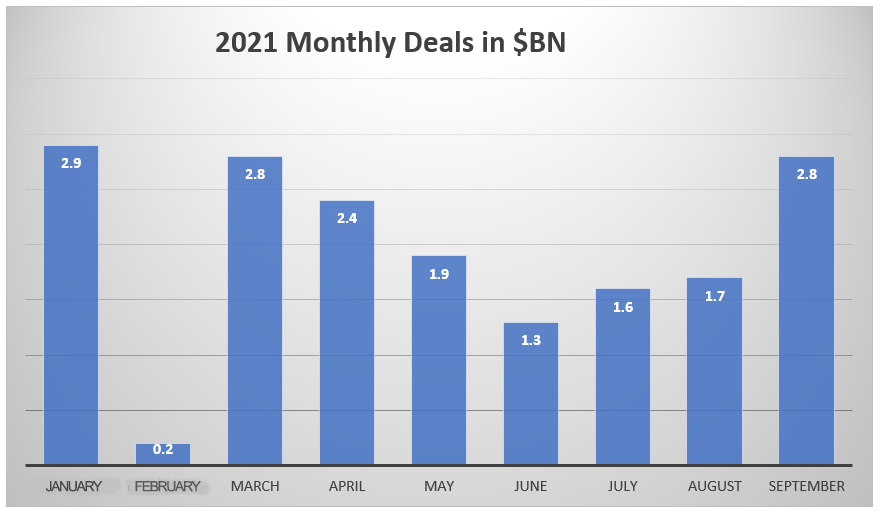

SE Asia Deal Barometer Report: Southeast Asia’s startups raise $2.8b in Sept, up 35% over Aug

Startups in Southeast Asia continued their dealmaking momentum in September, raising $2.8 billion in funding from at least 98 deals, up 35% from the previous month, data compiled by DealStreetAsia shows.

The data covers venture capital and private equity investments, grants, corporate funding rounds, initial coin offerings, debt financing, and convertible note offerings.

The September tally was the highest since March when startups in the region had raised the same amount from 76 deals. The top month this year has been January, with proceeds of $2.9 billion.

Buoyed by the September performance, the third quarter fundraising tally rose to $6 billion. The quarter also saw the region birth 11 new unicorns. Q3 capped a strong nine-month performance that saw startups raise at least $17.8 billion, more than twice the $8.6 billion raised in the whole of 2020.

Singapore-based logistics firm Ninja Van’s $578 million Series E round was the highest in September, followed by tech firm Advance Intelligence Group, which raised $400 million in a Series D funding round.

The month of September saw seven megadeals, or funding rounds worth $100 million and above, that raised a combined $1.8 billion in funding.

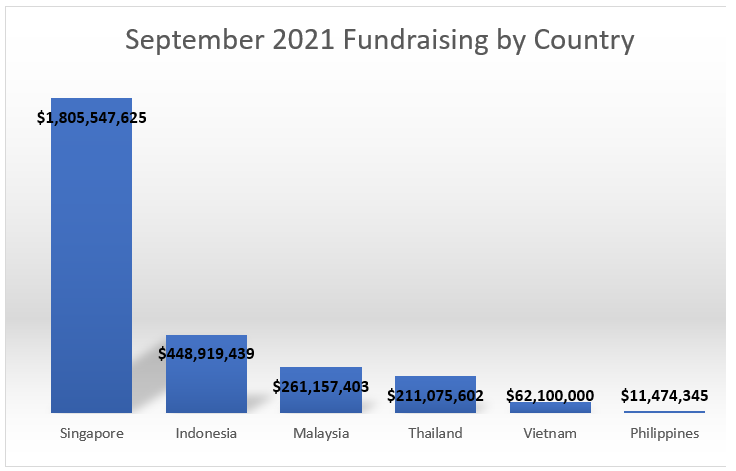

Singapore corners 65% of total funding

Singapore startups were the most active in September, cornering the lion’s share of the region’s deal value and volume. Startups in the city-state bagged $1.8 billion, or 65% of the total funding in September, from 47 transactions.

Four out of the seven megadeals in September also involved Singaporean startups. These included Ninja Van, Advance Intelligence Group, Boltech’s $210 million Series A round, and Aspire’s $158 million Series B funding.

Indonesian startups, meanwhile, raised $448.9 million from 27 deals. The country had only one megadeal in September – Xendit’s $150 million Series C round, which transformed the digital payment platform into a unicorn.

In Malaysia, local startups bagged $261.2 million in funding from four deals, thanks to Carsome’s $170 million Series D round that cemented the used car marketplace as the country’s largest tech unicorn valued at $1.3 billion.

Thailand also saw its first fintech unicorn last month after digital payments firm Ascend Money raised a $150 million funding round that valued it at $1.5 billion. The round was backed by US-based investment firm Bow Wave Capital Management and existing investors CP Group and Ant Group.

Vietnamese startups inked 12 funding deals valued at $62.1 million while companies in the Philippines raised $11.4 million from three deals.

The seven megadeals ($100m and above) in September 2021

| Startup | Headquarters | Investment size (USD) | Investment Stage | Lead Investors | Other Investors | Industry / Sector |

|---|---|---|---|---|---|---|

| Ninja Van | Singapore | $578,640,986 | Series E | Geopost | Bcapital Fund, L.P., Zamrud Sdn Bhd, Monk’s Hill Ventures, Alibaba Singapore, B Capial Opportunities Fund I L.P. | Logistics |

| Advance Intelligence | Singapore | $400,000,000 | Series D | SoftBank Vision Fund 2, Warburg Pincus | EDBI, Gaorong Capital, Northstar Group, Vision Plus Capital | Fintech |

| Bolttech | Singapore | $210,000,000 | Series A | EDBI, Mundi Ventures | Activant Capital, Alpha Leonis Partners, B. Riley Financial, Dowling Capital Management, Tarsadia Investments, Tony Fadell | Fintech |

| Carsome | Malaysia | $170,000,000 | Series D | MediaTek | 500 Startups Southeast Asia, Asia Partners Fund Management, Catcha Group, Daiwa PI Partners, Gobi Partners, MUFG Innovation Partners, Ondine Capital | Ecommerce |

| Aspire | Singapore | $158,000,000 | Series B | Undisclosed | AFG Partners, Alexandre Prot, B Capital Group, CE Innovation Capital, DST Global, Gerry Giacoman Colyer, Hendra Kwik, Hummingbird Ventures, MassMutual Ventures Southeast Asia (MMV SEA), Moses Lo, Picus Capital, Pierpaolo Barbieri, Steve Anavi, Taavet Hinrikus | Fintech |

| Xendit | Indonesia | $150,000,000 | Series C | Tiger Global Management | Accel, Amasia, Goat Capital | Fintech |

| Ascend Money | Thailand | $150,000,000 | Series C | Bow Wave Capital Management | Ant Group, Charoen Pokphand Group | Fintech |

Fintech, logistics continue to hog capital

New economy sectors such as fintech, e-commerce and logistics continued to witness maximum traction in September, a trend in action since January of this year, partly because most of the region’s markets are still under COVID-19 restrictions.

Fintech accounted for at least 27 deals worth $1.4 billion while e-commerce saw 16 transactions that raised $511 million. Logistics and logistics tech only had four deals during the month but these deals raised a combined $584 million, thanks to Ninja Van’s mega funding.

Startups in the business solutions sector raised $63 million while those in healthcare and healthtech gathered $51 million in funding. Meanwhile, SaaS startups raised $45 million from five deals.

Among funding stages, seed rounds continued to dominate the deal table in terms of volume with 29 transactions. There were 20 Series A and 13 Series B funding rounds.

Venture capital firm East Ventures, Monk’s Hill, and Alpha JWC Ventures were among the most active lead investors in September.

Home to a relatively young private capital market, Southeast Asia is bound to see a continued acceleration of deal activities, albeit at a more moderate pace, fund managers told DealStreetAsia -DATA VANTAGE recently.

Share this story with your friends and colleagues.

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

China Deals Barometer Report: Startup funding slides in Sept to $7.2b, deal volume slips too

At 181 deals, September’s deal count had a small retreat from August, when a total of 193 deals…

Venture Capital

India Deals Barometer Report: Fundraising by Indian startups falls 27% to $3.4b in September

Investments saw a drop for the second consecutive month since July, when startups…