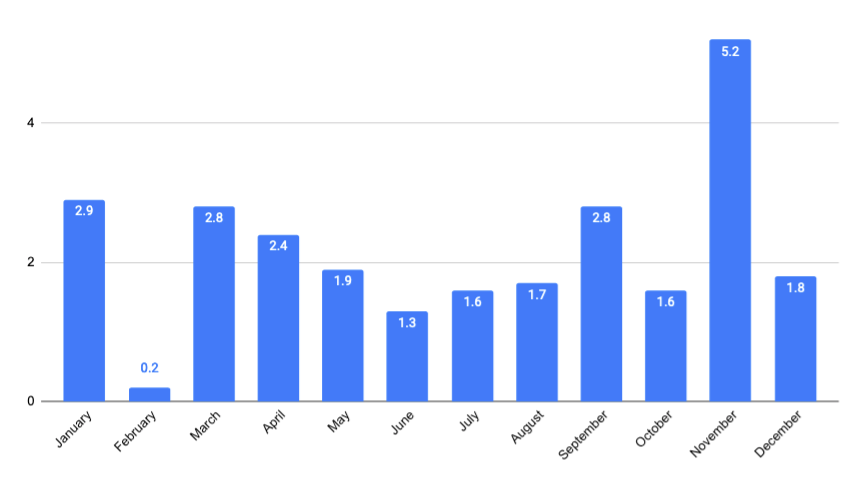

SE Asia Deals Barometer Report: Startup fundraising slows 65% to $1.8b in Dec

Startups in Southeast Asia amassed as much as $1.8 billion in December, registering a 65% drop from November’s record $5.2 billion, according to proprietary data compiled by DealStreetAsia.

Even as the number of mega deals (those that were worth $100 million or above) last month was similar to that of November, the drop in total value is on account of lower ticket sizes at which these transactions were clocked.

There were five mega deals in December that racked up a total of $979 million. Meanwhile, in November, startups raised a whopping $4.3 billion through a similar number of large-ticket transactions.

In terms of overall volume, too, there was a slight drop in December with the total number of deals standing at 84 (primarily venture capital) versus that of 119 in November.

In October and September 2021, startups in the region garnered $1.6 billion and $2.8 billion, respectively.

In the entire year, privately-held companies in the region raised a total of about $26.2 billion.

Deal value by month ($billion)

In the biggest transaction in December, Vietnamese integrated retail platform The CrownX closed a $350-million primary investment from global private equity (PE) firm TPG, the Abu Dhabi Investment Authority (ADIA), and SeaTown, a wholly-owned indirect subsidiary of Singapore state investor Temasek.

The funding pegged the post-money valuation of The CrownX at $8.2 billion.

Meanwhile, another Vietnamese firm – payment app Momo – secured mega funding of $200 million in its Series E round in December, led by Japanese bank Mizuho and backed by Hong Kong-based Ward Ferry Management, Goldwater Capital, and Kora Management.

In other big-ticket transactions – all sealed in Singapore – sports media platform Group One, the parent company of ONE Championship and ONE Esports, raised a total of $324 million across two deals, while online language learning platform LingAce secured $105-million in its Series C round.

The megadeals ($100m and above) of December 2021

| Startup | Headquarters | Investment Size | Stage | Lead Investor/s | Vertical |

|---|---|---|---|---|---|

| The CrownX | Vietnam | $350,000,000 | Private Equity | Retail | |

| Momo | Vietnam | $200,000,000 | Series E | Mizuho Bank | Fintech |

| ONE Championship | Singapore | $174,000,000 | Venture – Series Unknown | Media & Entertainment | |

| One Championship | Singapore | $150,000,000 | Private Equity | Guggenheim Investments, Qatar Investment Authority | Media & Entertainment |

| LingoAce | Singapore | $105,000,000 | Series C | Owl Ventures, Sequoia Capital India | Edtech |

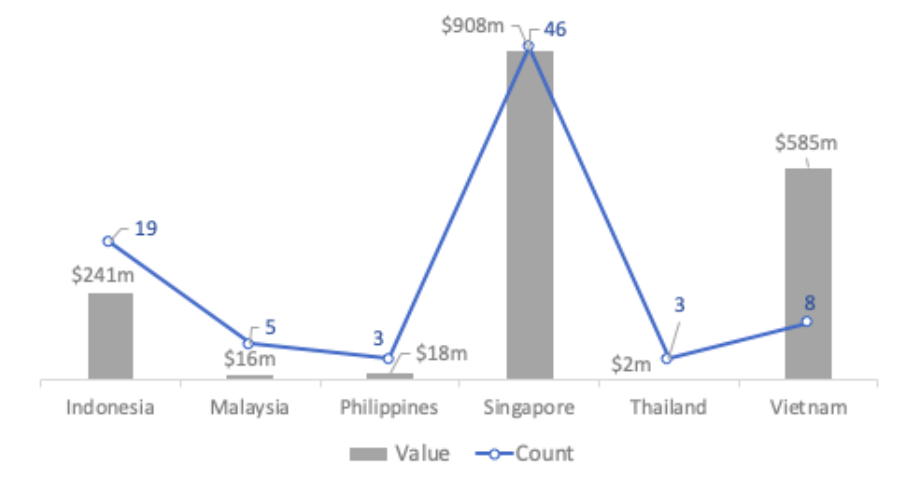

Vietnam overtakes Indonesia in deal value

While startups in Singapore continued to corner the biggest chunk of funding at $908 million, Vietnam overtook Indonesia for the first time in terms of deal value last month thereby amassing a total of $585.2 million.

In Indonesia, however, emerging businesses raked in a mere $241.5 million even as the startup ecosystem in the country is bustling with activity.

Vietnam’s performance was largely due to the two megadeals that raised a combined $550 million in funding.

The Philippines took the fourth slot in terms of deal value, with 3 local private firms raising $18.5 million. Malaysia and Thailand raised $16.1 million and $2 million, respectively.

Fundraising by country in December

Early-stage deals continue to dominate

The December data compiled by DealStreetAsia showed that early-stage startups continued to evince higher investor interest compared to their peers that required growth capital.

Last month, as many as 45 deals were sealed in their Series A-stages or earlier in Southeast Asia. Of that, seed rounds accounted for 24 transactions.

In contrast to that, there were only eight Series B and four Series C transactions during the month.

Startups in new-age digital sectors such as financial services, e-commerce, and data analytics continued to dominate deal activity in terms of volume as the pandemic served as an accelerant to all of them.

Fintech and financial services, too, saw significant traction, accounting for 24 deals that raised a combined $584 million in December.

Meanwhile, e-commerce startups were involved in eight transactions that scored $34 million. Data analytics, on the other hand, raised $28 million from five deals.

Most active investors

A good number of investors were involved in the 84 deals that Southeast Asia witnessed in December.

However, notable lead investors, included Singapore-based Monk’s Hill Ventures, venture capital firm East Ventures, Jakarta-based early-stage investor AC Ventures, and Arise, the joint debut fund of Indonesian Telkom-backed MDI Ventures and Finch Capital.

Share this story with your friends and colleagues.

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

China Deals Barometer Report: Startup funding jumps 26% in Dec to $9.2b as chipmakers take off

Startup investments ended on a high note in 2021 with almost $9.2 billion being raised across 185 deals in Greater China...

Venture Capital

India Deals Barometer Report: Indian startups mop up $4.86b in PE-VC funding in Dec, deal count at two-year high

Indian startups raised over $4.86 billion in December 2021 across a record 201 private equity (PE) and venture capital (VC) transactions...