SE Asia Deals Barometer Report: Startup funding in SE Asia off to a slow start with $1.7b raised in Jan, down 41% YoY

Fundraising in Southeast Asia had a slow start to the year as megadeals dried up ahead of the Lunar New Year holidays.

Startups garnered just over $1.7 billion in January across 126 venture capital and private equity deals, show proprietary data compiled by DealStreetAsia.

The amount raised last month, which also included debt financing and issuance of convertible notes, was lower than the $1.8 billion raised in December and down 41% from January 2021, when startups had raised $2.9 billion.

Twenty-four out of the 126 transactions in January did not disclose financial details.

The lower funding value in January can be attributed to the scarcity of megadeals, or funding rounds worth $100 million or more.

Data compiled by DealStreetAsia showed that there were only two megadeals — defined as deals worth atleast $100 million — during the month. They were the $290 million Series E funding in Malaysia-based auto marketplace Carsome and the $250 million Series F in Moglix, a Singapore-registered B2B e-commerce platform for manufacturing goods.

Deals worth over $100 million in January 2022

| Startup | Headquarter | Investment Size (USD) | Investment Stage | Lead Investor/s | Industry/Verticals |

|---|---|---|---|---|---|

| Carsome | Malaysia | $290,000,000 | Series E | SeaTown Holdings, Qatar Investment Authority, 65 Equity Partners | E-commerce |

| Moglix | Singapore | $250,000,000 | Series F | Alpha Wave Global, Tiger Global Management | E-commerce |

Carsome’s Series E funding took place ahead of the company’s planned US listing and raised its valuation to approximately $1.7 billion.

Moglix, on the other hand, said its Series F funding round, which was co-led by alternative asset manager Alpha Wave Global and Tiger Global Management, valued it at $2.6 billion.

The two megadeals accounted for roughly one-third of the total funds raised in January.

Singapore startups lead the pack

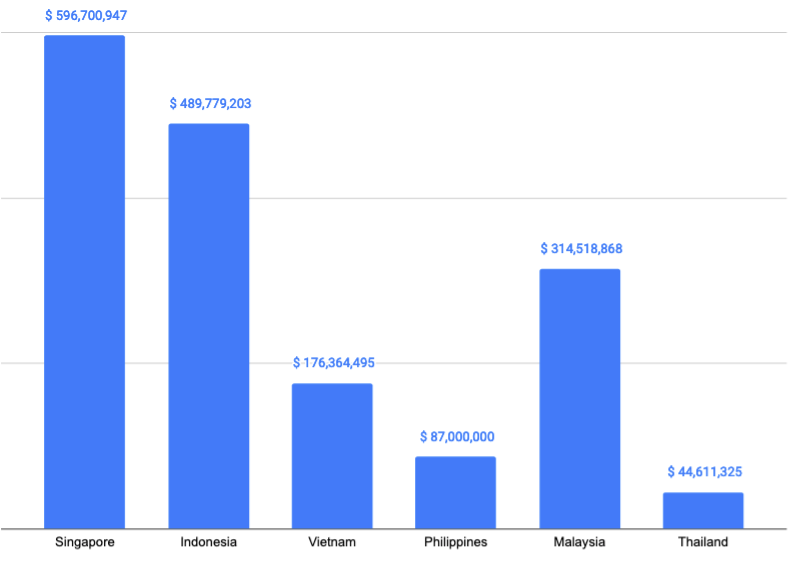

Startups in Singapore continued to dominate the region’s private funding scene in January, with 52 companies in the city-state amassing about $597 million in total investments.

With the exception of Moglix’s $250 million funding, all the other deals were valued at less than $85 million each. The second biggest deal in the country was Spenmo’s $85.35 million Series B round led by Tiger Global.

Indonesia came in second in terms of both deal value and volume, with 30 startups raising about $490 million in the month. Agritech startup eFishery’s $90-million Series C funding was the biggest in the country, followed by Bukukas (now Lummo), which raised $80 million in Series C funding.

Indonesia had a record 2021 with seven unicorns and a local IPO of homegrown e-commerce firm Bukalapak — a sign that exits are visible and feasible in this market. For 2022, Indonesia-focused VCs say they remain bullish.

Meanwhile, Malaysian startups scored $314.5 million from 15 deals while Vietnam’s 19 funding transactions raised $176.3 million. The Philippines saw five deals that raised $87 million, while five Thailand startups secured $44.6 million.

Fundraising by country in January

E-commerce, fintech remain funding magnets

Based on DealStreetAsia’s compilation, e-commerce startups raised the most money in January, netting $784 million from 19 deals. Financial technology (fintech) firms, meanwhile, were involved in the most number of deals at 29 but raised only about $480 million.

In 2021, one in every four dollars invested went to fintech, driven by the rising adoption of e-payments and decentralised finance (DeFi).

Singapore payables software startup Spenmo’s $85.35 million Series B funding, on the other hand, was the largest among fintech deals in January, followed by Indonesia’s Bukukas, which raised $80 million.

Meanwhile, edtech startups raised $82 million from 13 deals while data analytics companies secured $41 million from eight transactions.

Early-stage deals remain the favourites

Data compiled by DealStreetAsia showed that startups in their earlier funding stages continued to be more popular than their growth- and later-stage peers in terms of deal count in January.

Investor appetite for emerging businesses in Southeast Asia was evident in the 79 deals sealed in Series A-stages and earlier last month. Of that, seed rounds accounted for 39 transactions. Series A rounds accounted for 26 deals.

There were 12 Series B deals and four Series C transactions last month. Moreover, the region also saw three private equity deals, six debt financing transactions, and six corporate funding rounds.

Top deal stages in January

Fundraising unlikely to dry up

For the entire 2021, private investments in homegrown companies reached $25.75 billion as Southeast Asia minted more unicorns than ever before. The region welcomed 25 startups that had surpassed $1 billion in valuation last year.

In an earlier interview, Jessica Huang Pouleur, a partner at Openspace Ventures, told DealStreetAsia that quality startups will continue to see robust funding this year and that the next phase of growth will be more prominent in markets like the Philippines and Thailand.

Golden Gate Ventures partner Justin Hall earlier told DealStreetAsia that an extraordinary influx of capital had been the biggest driver behind fundraising in 2021 and 2020, but fundraising is unlikely to dry up.

“I think we will be approaching a cautious slowdown as investors, especially institutional LPs and later-stage investors, wait and see how the forecast rate hikes in the United States and Europe will begin affecting capital allocation and expected returns,” said Hall.

- SE Asia Deal Review

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

China Deals Barometer Report: Startup financing halves to $4.3b in Jan in run-up to Lunar New Year

Startup financing in Greater China more than halved in January 2022, in the run-up to the week-long Lunar New Year holiday...

Venture Capital

India Deals Barometer Report: Indian startups kickstart 2022 with $4.43b funding in January

Making a good start into the new year, Indian startups raised over $4.43 billion in Jan 2022 across 199 PE and VC transactions...