Partner content in association with

From the pandemic to the golden era: The steady march of Indonesia’s digital economy

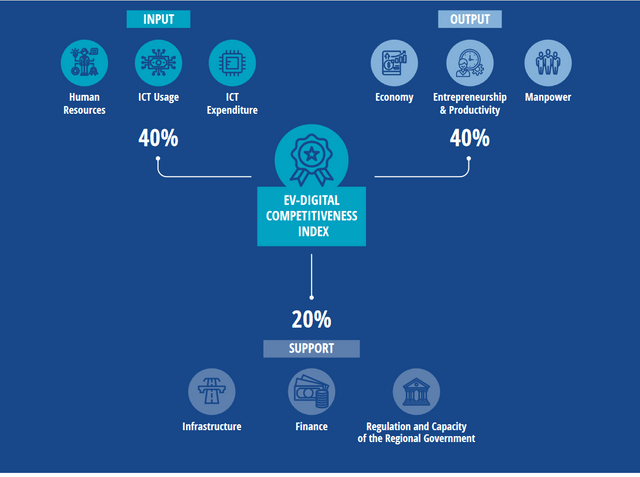

Courtesy: EV-DCI 2022

East Ventures – Digital Competitiveness Index 2022 measures the recent progress along the road to the golden era of Indonesia’s digital economy

The golden era of Indonesia’s digital economy has been keenly anticipated for a while now. After 2021, it appears closer than ever before. Despite pandemic-led disruptions, 2021 saw seven unicorns being minted, and an unprecedented amount of fundraising at $9.4 billion, according to DealStreetAsia estimates.

In the preface to the East Ventures – Digital Competitiveness Index (EV-DCI) report, East Ventures co-founder and managing partner Willson Cuaca said, “Throughout the pandemic, every high-touch activity has been forced to shift to virtual. Not only did internet penetration increase significantly, but society’s awareness to further utilise the digital sector as an economic propeller also escalated. This ‘new normal’ continues to advance the Indonesian economy to recover and become more stable.”

The funds raised last year and through 2022 will fuel growth across e-commerce, fintech, and logistics — sectors that cornered the lion’s share of capital and dominated the Top 10 deals in Indonesia in 2021. However, this growth is based on a few critical assumptions — that the spread of digital connectivity through the Indonesian archipelago will improve. And that a new class of consumers will emerge from outside traditional markets such as metros and Tier I cities. For the digital economy in Indonesia to truly realise its potential, its spread needs to be both wide and deep, not just one at the expense of the other.

For the third year in a row, the EV-DCI offers a penetrating insight into the qualitative experience of digitalisation across all 34 provinces and cities of Indonesia. The report is created by East Ventures in collaboration with Katadata Insight Center and PwC Indonesia.

Digital connectivity is on the rise year after year

The topline findings are encouraging: the median of EV-DCI for 34 provinces is 35.2, a rise from 32.1 last year and 27.9 the year before. This score is arrived at after combining 50 different indicators classified under three sub-indexes — Input, Output and Support.

Between Input (human resources, information and communication usage and expenditure) and Output (economy, entrepreneurship and productivity and manpower), 80% of the weightage is split evenly. A final 20% weightage is assigned to Support which includes infrastructure, finance, regulation, and capacity of the regional government. The Support sub-index gets a lower weightage to ensure that direct inputs and outputs to the digital economy are given their due, over indirect factors.

The improved rating on EV-DCI thus indicates a better performance across all these parameters. In addition, the disparity between provinces is at its lowest level so far — 48.3% falling from 61.9% just two years ago in 2020.

While DKI Jakarta and West Java have taken the Top 2 spots, there is disruption further down the ranks. Among the Top 5 provinces, Yogyakarta enters the Top 5 at three, and Banten has moved up to the fourth place. The biggest climber is West Papua which makes it to the Top 20 at 19, up 11 spots from last year.

The biggest factors influencing these changes are the expansion of 4G networks and the digital transformation of MSMEs. The ability to produce digitally skilled college students has given Banten an edge. West Papua, the largest climber, grew on the back of a recently introduced online literacy programme by the Ministry of Communication and Information (Kominfo), cooperating with the National Digital Literacy Movement, Siberkreasi. Created for MSMEs, it was supported by digital infrastructure in the region being optimised and more internet users in the workforce. West Papua has now taken the lead in digital competitiveness in the traditionally underdeveloped East of Indonesia.

Offering his perspectives in the EV-DCI 2022 report, Airlangga Hartarto, Coordinating Minister for Economic Affairs said, “The infrastructure support will not be fully equal nor similar in all parts of Indonesia — but they will not be left behind. Satellite connectivity will be one of the prioritised solutions, while also enabling digital technology such as IoT to be utilised in those regions to help agriculture, manufacturing, healthcare, and many other sectors.”

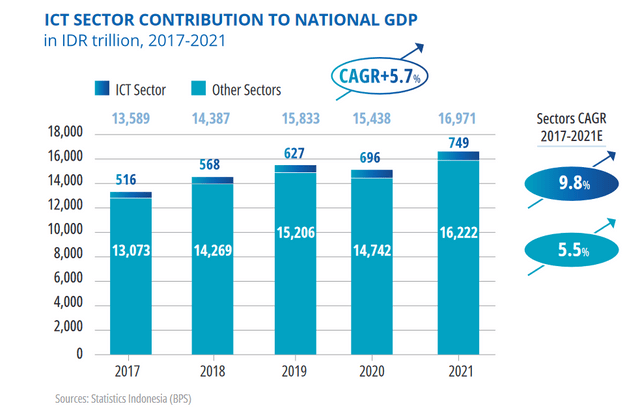

Information communications and technology (ICT) — the engine that’s driving digitalisation

The ICT sector in Indonesia has proved to be incredibly resilient. Even in 2020, when the GDP experienced a pandemic-led contraction, ICT grew to IDR 696 trillion (roughly $48.6 billion). Since 2017 it has experienced steady year-on-year growth of 9.8% and is currently pegged at IDR 749 trillion (approximately $52.3 billion). It is expected to grow by 10.3% in 2022.

Peering below the hood of these statistics, ICT is the engine of growth and a driving force behind Indonesia’s economic recovery. It supports a range of services necessary to catapult Indonesia further into its golden era. Among these are:

Digital government: Governmental interventions are needed to make Indonesia more digitally agile. This includes changes in policy and regulatory framework and focusing on digital infrastructure. The Indonesia Digital Roadmap 2021 – 2024 from Kominfo outlines plans for the launch of 5G services across 13 locations by 2024. The targeted destinations are the six provincial capitals, five priority tourist spots, the new capital Nusantara, and a manufacturing industry complex. 4G services will be extended across the least developed regions alongside 342,000 km of fibre optic cable installation. The government is building Tier 4 national data centres in four locations – Bekasi, Batam, the new capital city, and Labuan Bajo, over and above the private investments in the space.

Digital society: It is essential to upskill and reskill citizens, not just to keep them relevant in a digital era but to ensure they make the most of the opportunities it offers. Digitalisation is expected to create 5 million more jobs and require 600,00 digital talents each year.

However the demand is far greater than supply. In an interview published in the EV-DCI 2022 report, Traveloka president Caesar Indra said, “Research by the IMD World Digital Competitiveness Ranking 2021 showed that Indonesia is ranked 53rd of 63 countries. The Global Innovation Index which measures a country’s innovation capability, reported that Indonesia has remained in the same position from 2018 to 2020, and that in 2021, Indonesia fell to the 87th rank out of 131 countries. This demonstrates that the high value of the digital economy has not paralleled growth of digital competitiveness in the country.” He cited building “exceptional digital human resources” as a key challenge, and believed the solution lay in “a collaboration across sectors between the industry players, government, society, and other stakeholders to enhance and equalise digital talents in Indonesia.”

Steps are being taken to address the situation. The National Digital Literacy Movement, a three-tiered program that relies on public-private partnerships aims to narrow the gap between the demand for and supply of digital talent. The goal is to produce an additional 12.5 million digitally literate people each year.

Digital business: This forms the most visible part of the ICT push. Traditional models across products and services like education, finance, health, and retail embrace digitally-driven disruption.

A vast untapped potential exists in e-commerce with only 25% using online platforms for business. B2B e-commerce accounts for only 27% of the total e-commerce market. Educating MSMEs on the convenience, safety, and potential to grow business by effectively harnessing social media and data analytics, will give a fillip to the space.

The pandemic brought into sharp focus the low penetration levels of health services in Indonesia: 0.5 physicians per 1,000 people; only 40 internationally accredited hospitals, and an unequal distribution of physicians. It leaves the space wide open for interventions such as telemedicine and virtual consultations. Digital health is expected to hit almost a billion dollars of CAGR in 2022, up 63% from 2017.

Fintech is flourishing across various verticals like payment solutions, lending, even wealth management with rising investor interest in decentralised finance and the stock markets. It plays a huge role in driving financial inclusion, as previously unbanked and underbanked populations could easily access financial services such as credit and were given the opportunity to participate in capital markets. According to the Financial Services Authority or OJK, the borrower accounts now stand at 71.8 million, an increase of 287% from 2019 to 2021. The Indonesia Central Securities Depository or KSEI stated that the capital market investors had seen a 93% surge to 7.5 million, even as mutual funds investors went up by 115.41% in 2021.

In the EV-DCI 2022 report, Moses Lo, founder and CEO, Xendit commented on the transformation in the fintech space and said, “We have seen a change in MSMEs, merchants and start-ups who used to have very traditional mindsets on what payments need to look like, including the methods and integration. The biggest challenge is to educate the market about where different players sit in the environment. For example, differentiating the job scope between the payment provider and e-commerce.”

The strategy that Xendit has deployed so far has involved interfacing with local communities, and educating them about the benefits on offer. Lo said, “Suddenly, the barrier to entry for adopting digital payment methods in some small villages is not much higher relative to the barriers faced by other massive businesses. Our strategy is to learn the playing field and make it very much more accessible for small businesses to start accepting different payment methods.”

A sustainable digital economy: A vital aspect of the building blocks for the digital golden era is a sharper focus on ESG. There are excellent reasons to build this into models from the ground up — the advantage of starting afresh with a digitally-driven model means companies are less invested in old, often environmentally unsound modes of operation. Besides, PwC’s State of Climate Tech report reveals a 210% global increase in year-on-year investments in technologies that address or reduce the impacts of climate change. Younger consumers too favour more socially responsible companies.

A recent collaborative study with LPEM FEB UI at the end of 2021 was cited by Grab Indonesia’s president Ridzki Kramadibrata in the EV-DCI 2022 report. The study focused on Kupang and Jayapura and aimed to co-relate some of the developments in Eastern Indonesia in relation to the existence of Grab. It was found that the level of lighting in areas where Grab is present has grown twice as rapidly — a sign of increasing business activity improving the economic level of the area. Kramadibrata said, “The second finding is creating a new business opportunity. Approximately 30% of GrabFood merchants and 50% of GrabKios are new ventures. Digitalisation enables Grab to create new entrepreneurs in Eastern Indonesia.” Grab also found a higher proportion of e-wallet ownership — 87% — among its users compared to non-users and that 60% of the driver partners had insurance. Besides, 60% of new Grab partners in these regions were women amply demonstrating the opportunities for gender empowerment.

There are many challenges to be navigated on the ESG front: a lack of proficiency among industries; varying standards on ESG reporting across industries and markets, and the difficulties in quantifying the effect of ESG. ICT can help with digital technology enabling companies to codify and track their progress and ESG metrics.

However, the EV-DCI has laid out a clear roadmap to be followed by a rapidly digitalising Indonesia. The full report has details on the profile of competitiveness by province and city; and in-depth perspectives on the impact of digitalisation on key verticals including e-commerce, education, ESG, fintech, healthtech, logistics, and tourism. There are insights on digitalisation from key figures from the government, and some of Indonesia’s best digital companies. All of which present a holistic view of the dawn of Indonesia’s golden era.

This article was created in collaboration with East Ventures. A full copy of EV-DCI 2022 is available for download at east.vc/dci/