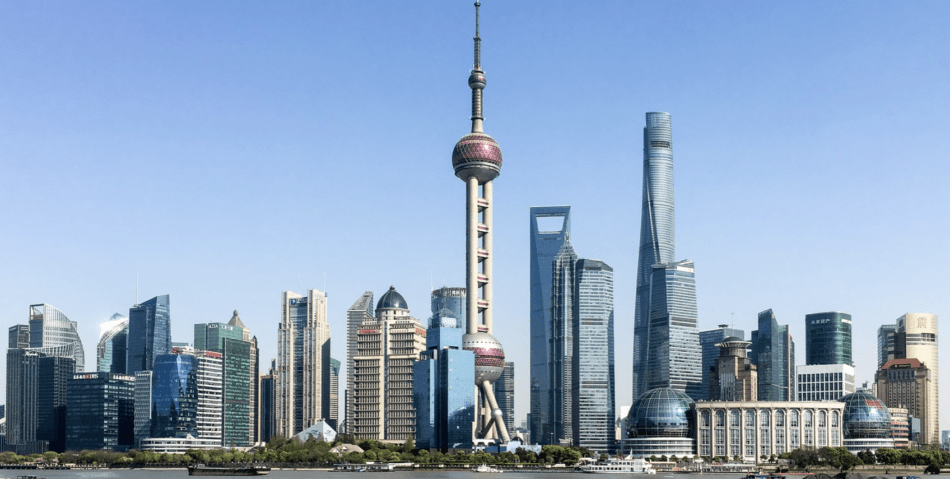

Dealmaking activity in China is back on the growth track as the threat of COVID-19 recedes in many parts of the country. August saw continued month-on-month growth in overall investment, following gains in both deal count and deal value in July.

Continue reading with Data Vantage

Venture-backed company data in SE Asia, India, Pakistan, Bangladesh.

Instant investment updates and valuations.

Tailored search, 3 monthly reports.

Industry-trusted platform.

Already a Subscriber? Log in

Contact us for corporate subscriptions at subs@dealstreetasia.com