The alleged financial fraud involving founders and the former top management of Indonesia’s aquaculture firm eFishery has sparked scrutiny over the company’s investors, including how much they may have gained financially as a result of the company’s inflated growth and valuations in the past.

eFishery’s cap table history reveals that 15 entities engaged in secondary transactions, with the largest volumes of shares transferred involving entities controlled by Singapore-based VC firm Wavemaker Partners and Southeast Asian private equity major Northstar Group.

It is important to note, however, that secondary transactions are a standard liquidity mechanism in venture investing and should not be interpreted as investors benefitting from the alleged fraud.

Wavemaker Partners, which has invested a total of $10.3 million through three funds and a separate co-investment vehicle with World Bank’s IFC, has transferred 6.4 million shares in eFishery. However, the majority, 4.1 million shares were transacted between two separate funds under its management, indicating an internal portfolio rebalancing rather than an outright exit.

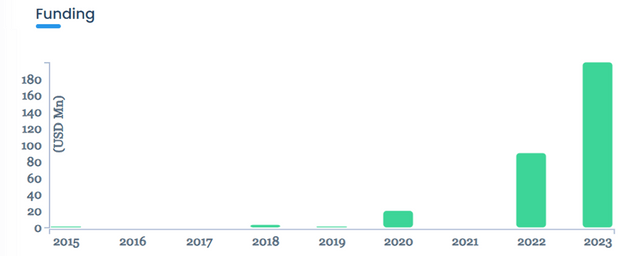

Notably, 90% of these transactions occurred in 2022, indicating that most of Wavemaker’s secondary activity took place prior to eFishery’s major valuation uplift in the following year. eFishery completed its $200-million Series D in July 2023 at $1.35 billion, pricing its shares at $14.39 each.

Source: DATA VANTAGE

Northstar, which joined eFishery’s cap table in August 2020, has invested a total of $20.4 million through two entities, NS Aquanaut Limited and NS Nautilus Limited. Its most recent investment, valued at $3 million, was made via NS Nautilus in May 2023 as part of the Series D round.

While NS Aquanaut has retained all its shares, NS Nautilus has transferred 2.4 million shares in eFishery to multiple entities, including existing shareholders such as Swiss-based impact investor responsAbility Investments and Malaysia’s public service retirement fund, KWAP. All of these transactions took place between July and August 2023.

Both Wavemaker and Northstar continue to hold stakes in eFishery through their respective entities until now, with Wavemaker controlling 6.04% (including through its co-investment vehicle with IFC) and Northstar holding 6.37%, according to DealStreetAsia’s DATA VANTAGE calculations.

Green tech shows resilience

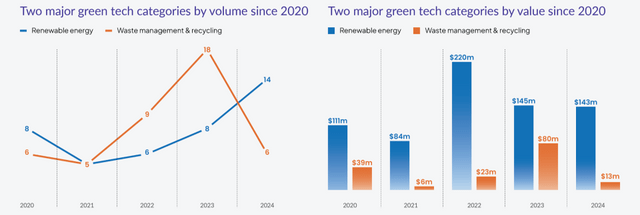

Green tech ranked as the fourth most active business vertical by deal volume in Southeast Asia in 2024, showing resilience despite a modest correction due to the lack of late-stage funding, according to DealStreetAsia’s Mapping SEA and Indonesia’s 2024 Journey report.

Regional startups in the sector secured 37 equity deals worth $276 million, marking a year-on-year decline of 17.7% in volume and 3.2% in value.

Renewable energy led the sector with 14 deals, raising a total of $143 million. Indonesia’s solar panel provider Xurya secured the largest round at $55 million, followed by Singapore-based BECIS with $53 million.

Source: DATA VANTAGE

In contrast, waste management solutions saw a sharp decline, with deal volume down 66.7% and value plummeting 83.8%, largely due to a lack of innovation and reliance on similar business models.

While green tech remains a key sector, investor appetite is shifting towards scalable, high-growth solutions, particularly in renewable energy, where market demand and policy tailwinds continue to drive funding momentum.

Other updates from DATA VANTAGE

Indonesian direct-to-consumer (D2C) eyewear brand SATURDAYS successfully doubled its revenue to $8.8 million in 2023, enabling the company to narrow its losses for the year, reflecting improved operational efficiency and stronger market demand.

CYBAVO, the Singapore-based subsidiary of crypto finance firm Circle Internet Financial, saw its revenue more than triple to $2.2 million in 2023, driven by the gradual recovery of the global crypto market.

One Animation, a Singapore-based 3D animation studio and content producer, recorded a 43% revenue drop in 2023 but managed to strengthen its bottom line. The company was acquired by London-based Moonbug Entertainment in May 2022.

Singapore-based Carzuno, a car subscription services startup that was acquired by Dubai-based Carasti in March 2024, posted $3.6 million in revenue in 2023, marking a 19% year-on-year increase. The revenue growth contributed to a reduction in the company’s annual losses.

Singapore-based industrial robotics startup Eureka Robotics doubled its revenue to $706,100 in 2023, but its losses widened, indicating higher operational and scaling costs as the company pursued growth.