The authors, Abhijit Sen and Amit Jain, are partners at Deloitte India.

India’s Mergers & Acquisitions (M&A) landscape is entering a new phase marked by strategic discipline, maturing capital flows and a clearer focus on value creation.

Despite global volatility and fluctuating interest rate cycles, India continues to attract serious dealmaking interest from corporates and financial sponsors. The overall sentiment reflects confidence in India’s consumption base, its manufacturing capabilities and the stability of its regulatory environment.

As a result, dealmakers are navigating the current environment with sharper filters, more selective deployment of capital and greater emphasis on integration readiness, per Deloitte research.

Deal volumes over the past three years illustrate this recalibration. Per Deloitte research, total M&A transactions rose from 1,330 in CY2023 to a high of 1,441 in CY2024, before moderating to 1,281 in CY2025.

The slight contraction is less a sign of a weakening appetite and more reflective of a shift towards quality over quantity. Transactions are becoming more strategic in nature, with heightened scrutiny of profitability, unit economics and long-term strategic fit. Indian conglomerates, especially those in manufacturing, renewables and consumer sectors, have reset their portfolios and are now prioritising acquisitions that directly accelerate growth, strengthen adjacencies, or consolidate fragmented markets, as pointed out by MDPI.

The TMT sector continues to lead in volume, with over 420 deals in CY2025.

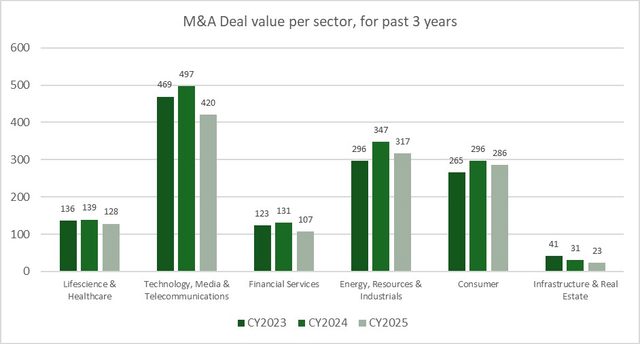

Sector-specific patterns highlight the evolving nature of deal activity. Per Deloitte research, the Technology, Media & Telecommunications (TMT) sector continues to lead in volume, with over 420 deals in CY2025. This growth is driven by strong demand in cloud, cybersecurity, AI engineering and digital infrastructure services.

However, the real story lies in the value mix. Energy, Resources & Industrials (ER&I) recorded a significant surge in deal values, exceeding $49 billion in CY2025, supported by India’s accelerating energy transition, electrification initiatives and supply-chain diversification strategies.

The consumer sector remains resilient with over $26 billion worth of deals, led by premiumisation trends, health and nutrition categories and consolidation among omni-channel retail players. Life sciences and Healthcare have maintained steady activity, with investments flowing into speciality pharma, med-tech, diagnostics and contract manufacturing.

Modern diligence and bespoke deal structures

With rising deal volumes, comprehensive diligence and efficient deal structuring have become essential. A well-curated structure/diligence safeguards the investment while driving value creation and long-term business sustainability.

Diligence refers to a heightened focus on qualitative factors, such as customer loyalty, vendor relationships and overall market reputation. Interviews with customers, suppliers, employees and industry experts offer critical insights into brand strength, integration risks and cultural fit. Modern diligence has moved far beyond traditional historical reviews. Investors today demand and expect deeper, forward-looking insights. They help investors assess long-term scalability, identify potential disruption risks and understand the target’s positioning.

With businesses becoming increasingly digital, IT systems, cybersecurity and data governance have moved to the forefront of diligence. Assessing the strength of the target’s technology architecture, conducting cyber audits and evaluating vulnerability to data breaches are now essential. Any gaps in these areas can significantly impact business risks/continuity, with consequential impact on value.

Given the long-term impact, deal structures must be carefully thought through to ensure that commercial elements are reflected accurately, while also ring-fencing risk. Pre-deal structuring could entail hive-offs of non-core businesses—whether the same should be through a simple transfer or a tax-neutral hive off is a function of multiple commercial, tax and regulatory implications. Similarly, there may be a need to consolidate businesses/shareholding as a prerequisite for deal consummation. Optimising capital structure is also a critical lever in deal structuring to augment cash efficiency and valuation, along with other flexibilities.

In a joint venture situation, besides the ownership/equity distribution, governance/control matters such as Board composition, voting principles, modes of financing, IP and exit/ dispute resolution mechanisms need to be negotiated and well documented. There are also structures surrounding deferred consideration that need to be developed, depending on the parties’ commercial intentions.

When diligence identifies legacy issues, such as tax exposures, litigations and historical operational risks, slump sale or asset sale structures are sometimes preferred. This allows businesses to be carved out completely by ring-fencing certain historical risks. Where risks are relatively low/manageable or legacy continuity is important, equity structure is an option. This ensures seamless ownership transfer without operational disruption.

A maturing Indian M&A market

Deal-flow patterns over the past three years have shown a clear realignment in India’s M&A landscape. Although the volume of domestic transactions has remained stable, with approximately 2% growth since 2023, the deal size has increased by 26%, reflecting strong corporate confidence in the local economy and a renewed focus on consolidating competitive advantages.

In contrast, inbound M&A volume has declined by roughly 12% since 2022 as global investors navigate geopolitical risks, tighter liquidity, higher capital costs and more disciplined valuation expectations. Outbound activity remains steady in the same period, driven by elevated global interest rates and caution stemming from integration challenges in earlier overseas acquisitions. The outbound deals that do proceed are more selective, centred on technology platforms and manufacturing operations, catering to the overseas market, energy-transition assets in Europe and global consumer brands that can be scaled in India.

Cross-border transactions are becoming more strategic in India.

Cross-border transactions are becoming more strategic in India. Inbound interest remains healthy in renewable energy, advanced manufacturing, consumer healthcare and TMT, supported by India’s strong macroeconomic outlook, talent depth and expanding infrastructure. However, foreign buyers increasingly prefer partnership-based structures, such as minority stakes, joint ventures and technology alliances, to manage geopolitical uncertainty while maintaining exposure to India’s growth, per a UN Trade & Development report.

Outbound ambitions have also evolved. Indian corporates are prioritising capability-led acquisitions rather than broad geographic expansion. Digital engineering firms continue to acquire niche US- and Europe-based tech specialists; pharmaceutical companies are targeting specialised Contract Development and Manufacturing Organisations (CDMOs); and renewable-energy players are pursuing storage, battery and grid modernisation technologies. This shift signals a more disciplined and innovation-focused approach to international expansion, positioning Indian companies to build differentiated global capabilities over the next few years.

This shift is also reflected in the intent behind M&A activities. Per Deloitte research, strategic transactions have fallen modestly over the past three years, decreasing by about 5% in CY2025, as companies focus on strengthening core capabilities, whether through backward integration in manufacturing, technology tie-ups in TMT, or consolidation across consumer and healthcare sectors.

Meanwhile, Private Equity investment activity has softened temporarily, driven by a recalibration of deployment strategies, tighter global liquidity conditions and the completion of earlier portfolio restructuring cycles, even as companies continue to tap equity markets and private capital for growth funding.

IPOs are a strategic platform

As India’s deal environment becomes more sophisticated, activity across capital markets and diligence processes is also evolving. India is steadily moving towards becoming the third-largest economy, with a Gross Domestic Product (GDP) expected to reach $7.3 trillion by 2030, per a report by the Government of India’s Press Information Bureau. The capital market has seen a sharp rise.

By November 2025, 93 IPOs have already raised $19.3 billion, per a report by Angel One. With more listings lined up, the consolidated market cap in India is projected to reach $24 billion. Simply put, India’s IPO story is getting bigger, brighter and more confident.

This confidence is a result of the regulatory framework, which has evolved over the past several years and is now commensurate with other global mature markets.

The attractiveness of the Indian capital market is also evident from the growing “value arbitrage” that exists in comparison to other markets. Several high-growth companies that had previously set up structures conducive to overseas listing are now “flipping back” (despite exit taxes in some overseas jurisdictions) to pursue an Indian listing. Multinational companies are also considering India as a dual listing engine, given that the Indian market arbitrage vis-à-vis parent jurisdictions is driven by the country’s future growth potential.

In the mid-market/private businesses segment, the conundrum of a “direct” listing versus the induction of an investor pre-listing persists. While there can be no single standard approach, key drivers for decision-making could include pre-IPO price discovery, value-added governance and other bolt-ons that the investor adds to the business as preparation for listing.

It is also crucial to recognise that an IPO is not an end in itself; it is a means to continually enhance value through operational, technological and organic/inorganic improvements, as well as changes to capital structure and other aspects, over time.

Mature, resilient M&A drives India’s next decade

India’s M&A environment today is defined by maturity, not exuberance. Dealmakers are no longer chasing growth for growth’s sake, but are prioritising resilience, technology adoption, operational integration and long-term value. The rise of private credit, the pivot in cross-border strategies and the growing sophistication in deal structuring all point to an ecosystem that is becoming more aligned with global best practices while retaining its unique agility and entrepreneurial energy.

The coming years are likely to witness renewed acceleration in deal activity as capital becomes more accessible and macro conditions stabilise. But the foundation laid during this period will shape the next decade of India’s M&A growth story, through more disciplined decision-making, sharper strategic intent and more innovative financing models.