Indonesian consumer brand operator Hypefast is laying the groundwork for a potential initial public offering (IPO) by mid-2027, as it shifts towards a more integrated retail operating model to stabilise earnings ahead of a listing.

Founder and chief executive Achmad Alkatiri, however, told DealStreetAsia in an interview that the company’s immediate focus is not the listing itself but to ensure that by the end of 2026, Hypefast can demonstrate a fully functional retail ecosystem with tighter control from manufacturing through to distribution.

That includes expanding offline distribution hubs, improving AI-powered direct-to-consumer (D2C) websites, and streamlining in-house production capabilities to support the brands it owns and may acquire in the future. “We want to show that the ecosystem is real and working at scale,” Alkatiri said.

While the company has internal margin targets ahead of a listing, he said the priority is to build a consistent and credible path towards those levels rather than chasing short-term profitability.

Hypefast’s IPO timeline, he stressed, remains flexible. Although mid-2027 is the company’s current reference point, the management is conscious that capital market sentiment, particularly towards consumer and retail businesses, can shift quickly. As a result, the IPO is being treated as a strategic option rather than a fixed deadline.

The more measured approach follows a period of restructuring that materially reshaped the business. In FY2024, group revenue slipped to $46.4 million, down 4.9% from $48.8 million a year earlier, but Hypefast returned to profitability, posting a net profit of $1.68 million compared with a $3.69-million loss in FY2023, according to its audited financial statements for the year ended December 31, 2024.

The turnaround was driven less by topline growth than by cost discipline and portfolio rationalisation. Administrative expenses fell 29.4% year on year to $8.4 million in FY2024 from nearly $11.9 million previously, reflecting organisational restructuring initiated in 2023.

That cost reset followed a series of restructuring moves in 2023, including a workforce reduction of around 30% in August that year, according to local media reports.

FY2023 also included a one-off write-off related to discontinued brands, recorded as a loss on sale of brand, which did not recur in 2024. Lower interest expenses following a reduction in outstanding borrowings further supported the earnings recovery.

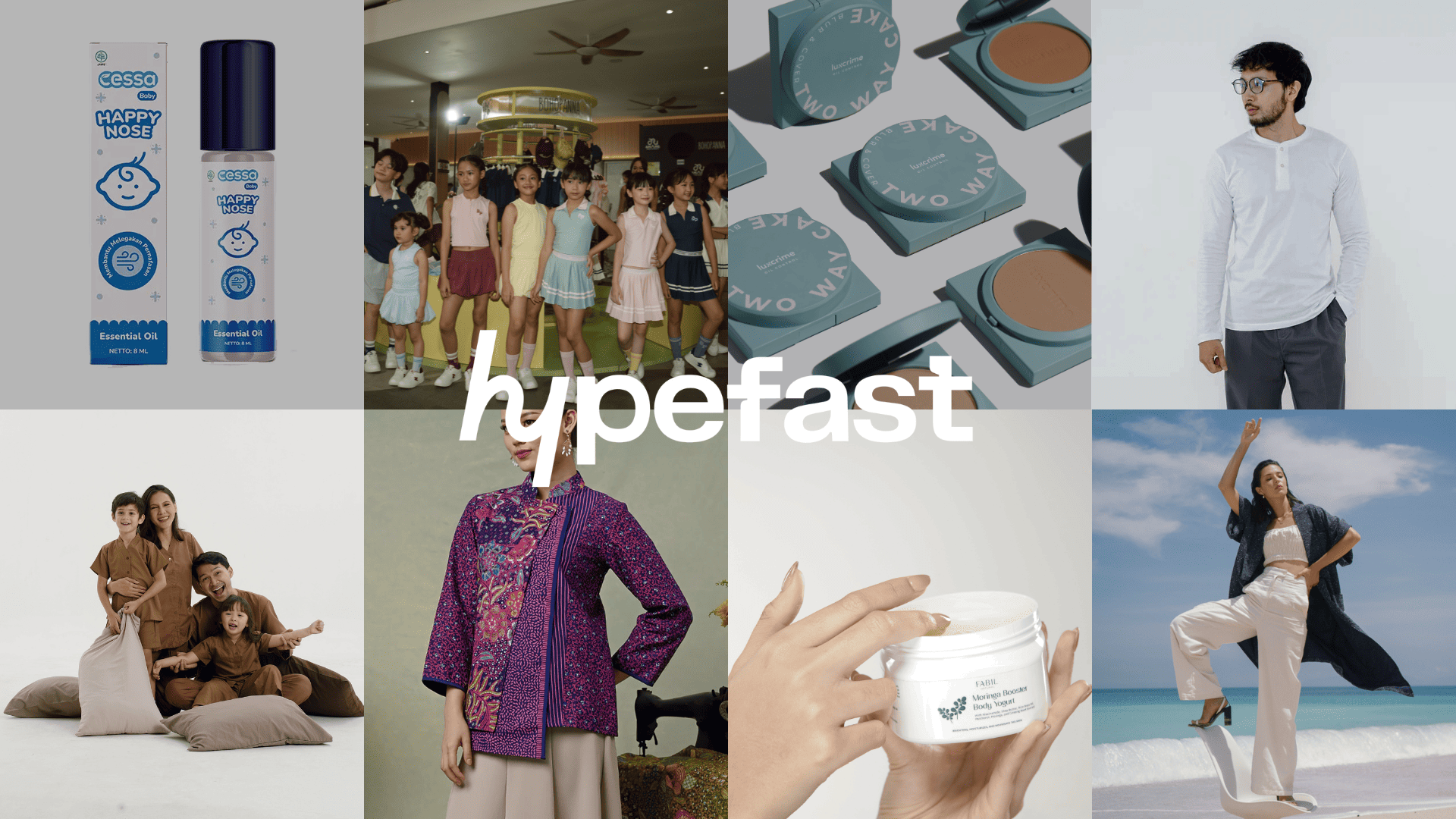

As part of the portfolio clean-up, Hypefast exited several underperforming brands in 2023, even as it added Fabil Natural to its portfolio during the same period. Currently, the company operates eight brands across the beauty, apparel, and lifestyle categories, including Luxcrime, Cessa, Bohopanna, Koze, Nyonya Piyama, Nona Rara Batik, and Wearstatuquo.

The company’s operating cash flow turned positive in FY2024 at $5 million, reversing a $2.6-million outflow a year earlier. Cash and cash equivalents rose to $6.65 million at the year-end, up from $4.73 million in FY2023, improving the group’s balance sheet flexibility.

During the year, $4.46 million in convertible notes were converted into equity and recorded as advances for share capital. Hypefast still carried $1.35 million in short-term borrowings as at end-FY2024, according to its audited accounts. Alkatiri said the company has since fully repaid the remaining debt in 2025.

The financial turnaround has coincided with changes in its operating model. In January 2026, Hypefast announced a shift towards operating as a full-stack retail infrastructure for local brands, moving beyond its earlier positioning as a brand aggregator.

Under this model, the company has been strengthening internal production capabilities to shorten product development cycles and improve margin capture. On the distribution side, Hypefast’s offline network now spans more than 10,000 physical retail points across Indonesia.

In parallel, the company has rolled out dedicated D2C websites for individual brands, equipped with AI-based features aimed at reducing reliance on third-party marketplace algorithms and providing greater revenue stability.

Alkatiri said this “agility at scale” approach underpins Hypefast’s pitch to prospective public market investors. Unlike traditional FMCG distributors that focus primarily on logistics and sell-through, or global brand houses that rely heavily on outsourced partners, Hypefast integrates brand building, manufacturing partnerships, warehousing, logistics, online and offline sales, and data-driven marketing under one platform.

From a capital perspective, the company does not expect to rely on further pre-IPO fundraising to sustain operations. While Hypefast remains open to strategic funding opportunities that could accelerate growth or strengthen the platform, Alkatiri said internal cash generation is currently sufficient to support working capital requirements and organic expansion.

After a period marked by portfolio rationalisation, FY2024 saw no material brand disposals, suggesting the company has entered a more selective phase.

The management’s focus is now on maximising the value of existing portfolio brands using the full-stack platform while remaining open to acquisitions where there is a clear strategic fit. Evaluation criteria include consumer traction, margin profile, scalability, and alignment with the group’s operating ecosystem.

Looking ahead, Alkatiri said the company has remained profitable into FY2025, supported by continued cost discipline and optimisation across both online and offline channels. Whether that operational progress translates into a successful listing, however, will depend not only on execution but also on whether public market investors are willing to back a consumer platform built around operational depth rather than headline growth, he concluded.