China Deals Barometer Report: Startup fundraising scales six-month peak at $5.1b in Aug

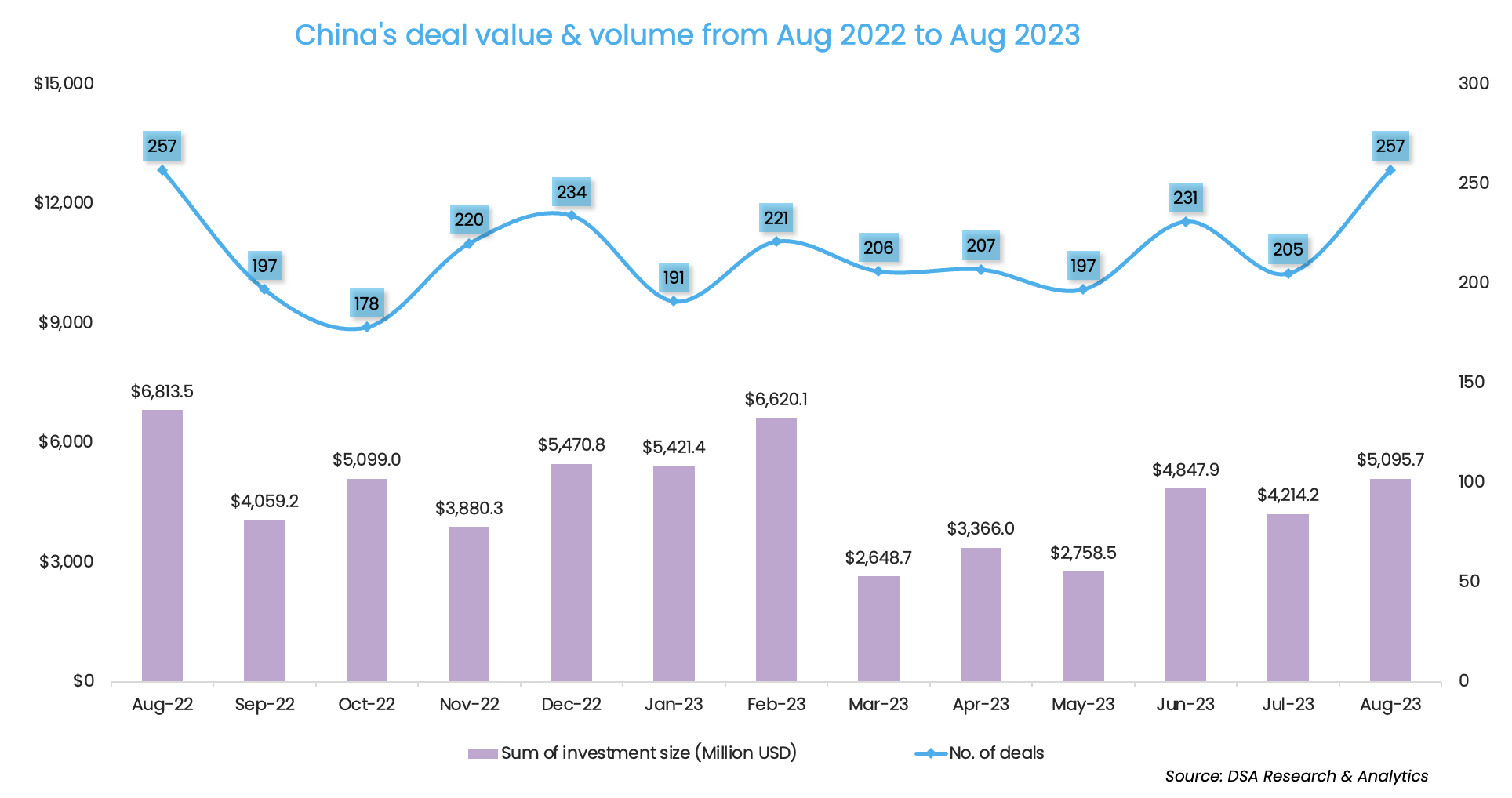

August proved to be a record month for dealmaking in the Greater China market, as startups sealed 257 venture deals — the highest so far this year in terms of deal count.

After a sluggish Q2, PE-VC investments picked up in August, touching a six-month high at $5.1 billion. The monthly proceeds were 20.9% higher than in July, while the deal volume increased 25.4% month-over-month, according to proprietary data compiled by DealStreetAsia.

Collectively, startups in Greater China completed 1,715 venture deals worth almost $35 billion in the first eight months of 2023. Investors have deployed capital more actively this year, as the deal count represented a 17.4% increase over the same period in 2022.

Yet, their appetite to underwrite big cheques continues to be deterred by local and global economic headwinds amid rising geopolitical tensions as the deal value in August was 25.2% less year on year, although the deal count was the same.

The deal value for the first eight months also showed only a negligible 0.9% growth compared with the same period last year.

EV firms clinch mega-deals

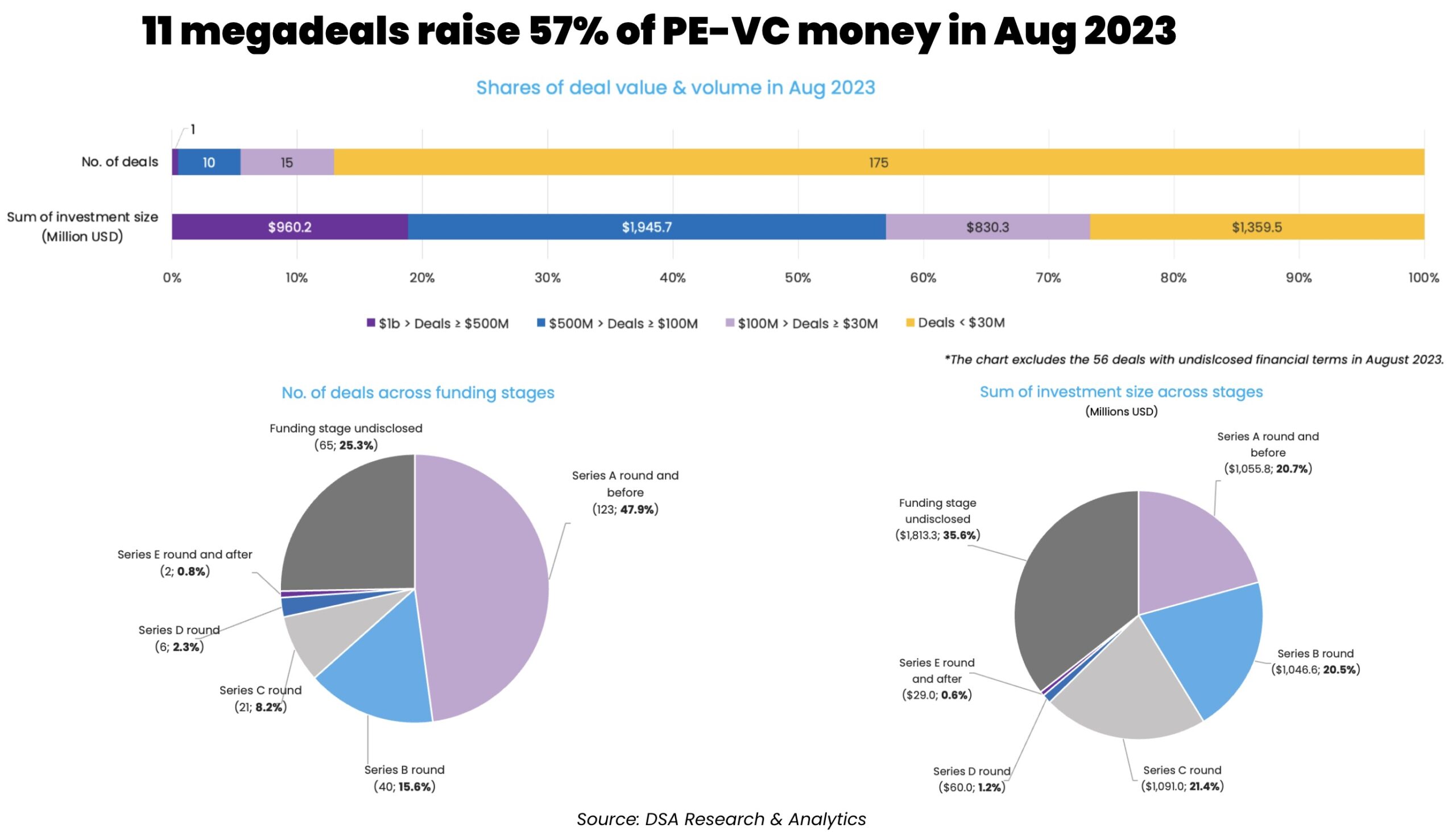

Despite the scarcity of billion-dollar deals, the month saw the completion of 11 mega-deals — investments worth at least $100 million — which together secured $2.9 billion, or 57% of the month’s total fundraising.

The biggest venture deal of the month went to Chinese electric vehicle (EV) maker Hozon New Energy Automobile, which raised 7 billion yuan ($960.2 million) via cross-over financing.

Cross-over financing refers to public market investors and asset managers “crossing over” into the private markets to invest in late-stage companies with a certain level of business maturity and are often ready for an initial public offering (IPO).

AVATR Technology, backed by state-run automaker Chongqing Changan Automobile and EV battery giant Contemporary Amperex Technology (CATL), is another EV firm that sealed a significant transaction in the month, securing 3 billion yuan ($411.5 million) in a Series B financing round.

As the world’s largest EV market, China has seen at least 40 locally-operated auto brands joining the price war after US-based EV maker Tesla slashed the prices of all its Model 3 and Model Y cars in China by 6-13.5% in January, according to multiple reports.

The fundings have given a leg up to the EV players amid tightening competition and weakening demand.

In yet another mega-deal, Hong Kong-based Micro Connect, a microfinance platform, co-founded by former Hong Kong Exchange CEO Charles Li, snapped $458 million in a Series C funding round.

The remaining eight mega-deals were across a wide range of industries including telecommunications, industrial machinery, semiconductors, and business support services, among others.

| Startup | Headquarters | Investment size (Million USD) | Investment stage | Lead investor(s) | Other investor(s) | Industry/Sector | Vertical |

|---|---|---|---|---|---|---|---|

| Hozon New Energy Automobile | Shanghai | 960.2 | Cross-over financing | Automobiles & Parts | Electric/Hybrid Vehicles | ||

| Micro Connect | Hong Kong | 458 | C | Financial Services | Fintech | ||

| AVATR Technology | Chongqing | 411.5 | B | Chongqing Industry Investment Fund of Funds (FoF), BoCom Financial Asset Investment (affiliated with Bank of Communications), Guangzhou Development District Holding Group Limited, Changan Automobile, and others | Automobiles & Parts | Electric/Hybrid Vehicles | |

| Shilan Mingjia Compound Semiconductor | Xiamen | 165.2 | A | Hangzhou Silan Microelectronics, China Integrated Circuit Industry Investment Fund (Phase II), Xiamen Haichuang Development Fund | Semiconductor | N/A | |

| Guodong Network Communication Group | Shanghai | 150 | A Middle Eastern sovereign wealth fund | Telecoms | 5G | ||

| Ouyeel Industrial Products | Shanghai | 138.3 | Strategic Investment | Baowu Green Carbon Fund, Hebei Logistics Industry Group, Xinyu Iron & Steel Group, TBEA, and others | Industrial Machinery | E-Commerce | |

| Jiangsu Guoqiang Singsun Energy | Liyang | 137.4 | A+ | CITIC Securities Investment, Goldstone Investment (affiliated CITIC Securities), CCCC Blue Fund (affiliated with China Communications Construction Company) | CMB International, Zhongtai Venture Capital, Dongfang Electric Corporation-Deyang Municipal Government Fund | Renewable Energy | CleanTech |

| Tianneng New Materials | Huzhou | 137.2 | A | Puhua Capital, CICC Capital | CNBM New Materials Fund, Fuzhe Capital | Energy Storage & Batteries | CleanTech |

| ECHINT IC | Chengdu | 136.9 | B | Matrix Partners China, Brilliant Fund (also known as Beite Fund) | JIC Investment, Shang Qi Capital (affiliated with SAIC Motor Corp), Camel Equity Investment, Xicheng Zhiyuan, and others | Semiconductor | N/A |

| Sinoscience Fullcryo Technology | Beijing | 111.2 | C | Chengtong Mixed Reform Equity Investment Fund Management, CCB Private Equity Investment Management (affiliated with China Construction Bank) | CMG-SDIC Capital, Yuexiu Industrial Fund, ICBC Financial Asset Investment, CAS Star, and others | Power & Utilities | N/A |

| DP Technology | Beijing | 100 | Zhongyuan Capital (affiliated with Shanghai United Media Group), MSA Capital, Loyal Valley Capital, Evergreen Scitech Delta | Business Support Services | AI and Machine Learning |

Investors continued to place their bets on early-stage deals, with investments at Series A and earlier accounting for 47.9% of the total deal count and 20.7% of the total deal value. August saw a subtle shift towards Series B investments where 40 deals, or 15.6% of the total deals took place — compared with 20 deals, or 9.8% in July.

Dealmaking became far less active in funding stages close to public listings — only two startups raised a total of $29 million in the stage of Series E or after.

Chipmakers riding on a tailwind

Investors have rushed into local semiconductor startups — an industry that has long been mired in the China-US tech cold war. China remains the world’s largest semiconductor market, as monthly sales of chips in the country stood at $12.3 billion in June 2023, or 29.6% of global sales, according to the World Semiconductor Trade Statistics (WSTS). The US was the second-largest market, with monthly sales of $9.9 billion, or 23.9% of global sales.

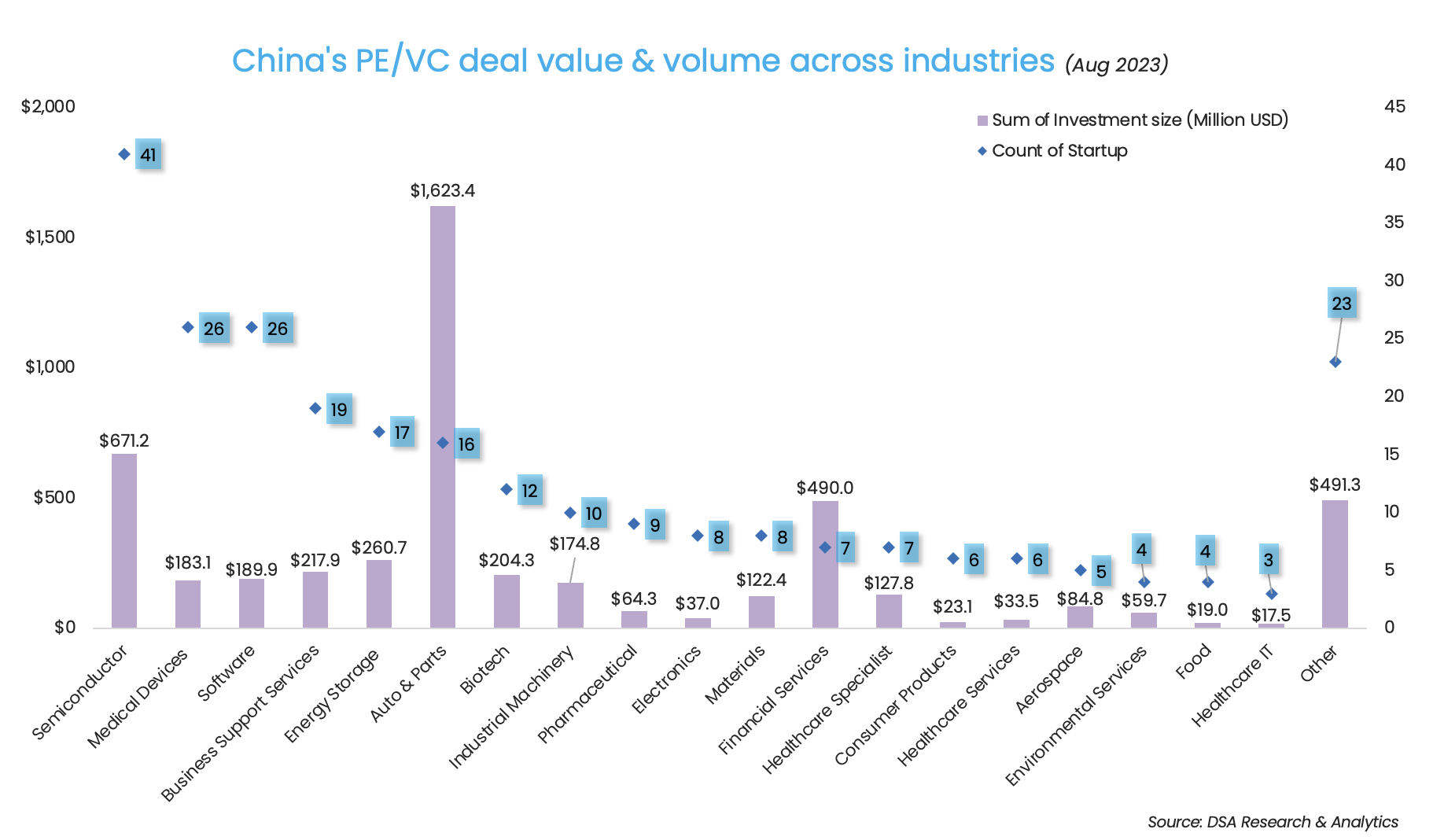

Semiconductor was the most-funded industry in August, which saw 41 startups raising a total of $671.2 million. Two mega-deals took place in the month, including ECHINT’s 1-billion-yuan ($136.9 million) Series B transaction; and Shilan Mingjia Compound Semiconductor’s 1.2-billion-yuan ($165.2 million) Series A round.

China reportedly targets to raise about $40 billion for a new state-backed investment fund dedicated to the semiconductor industry, according to a Reuters report on September 5, citing two people familiar with the matter.

The fund will likely be the biggest among the three funds launched by the China Integrated Circuit Industry Investment Fund, also known as the Big Fund, per the report.

Medical devices and software rose to be the second most-invested sectors as the two industries completed 26 deals separately. However, thanks to the two mega-deals in the EV sector, automobiles and parts ranked as the top raiser in terms of deal value, with the completion of 16 deals worth over $1.6 billion.

Legend Holdings tops investor list

Chinese conglomerate Legend Holdings has backed a total of nine venture deals through its subsidiaries. Collectively, its investee companies raised $162.3 million.

Lenovo Capital and Incubator Group, which focuses more on startup incubation, contributed to four of the group’s nine investments in the month; while Legend Capital, an affiliate that specialises in early- and growth-stage PE-VC deals, invested in five.

Since Lenovo Capital and Incubator Group and Legend Capital co-invested in one of the nine deals, the total deal number backed by the two is eight. Legend Star, the early investment and incubation arm of Legend Holdings, also injected 10 million yuan ($1.5 million) into one startup in August.

| Investment company | No. of deals | Total value of participated deals (Million USD) | Lead | Non-lead |

|---|---|---|---|---|

| Legend Holdings’ affiliates | 9 | 162.3 | 4 | 5 |

| CICC Capital & its affiliates | 6 | 238.1 | 3 | 3 |

| Matrix Partners China | 5 | 194.8 | 1 | 4 |

| Addor Capital | 5 | 30.5 | 3 | 2 |

| CAS Star | 5 | 143.2 | 3 | 2 |

| Fortune Capital | 5 | 69.6 | 3 | 2 |

| Oriza Holdings & its affiliates | 5 | 39 | 1 | 4 |

| Northern Light Venture Capital | 4 | 14.5 | 0 | 4 |

| Lilly Asia Ventures | 4 | 71.1 | 1 | 3 |

| Cowin Capital | 4 | 30.5 | 1 | 3 |

| CDH Investments | 4 | 58 | 1 | 3 |

Note: In our monthly analysis for August 2023, we have put together detailed charts of prominent deals, active investors, deal stages, and the most attractive sectors that have bagged the maximum venture dollars in the Greater China region.

Our database only considers deals officially announced by the related investee, investor(s), and/or financial advisor, while information based on market rumours and news reports citing sources is excluded.

For a more detailed analysis, and to enable comparison between primary and secondary markets, DealStreetAsia has started tracking deals of all sizes since April 2020, as against considering only transactions worth more than $10 million earlier.

We have also introduced a standardised system for industry classification. It currently includes over 50 industries as well as over 45 new-economy and high-tech verticals, which will progressively increase to adapt to local market conditions in our closely watched regions of Greater China, Southeast Asia, and India.

Edited by: Joymitra Rai

Related Stories

Venture Capital

SE Asia Deals Barometer Report: Startup fundraising dives 72% to $486m in Aug

Dealmaking in Southeast Asia dropped by nearly 72% month-on-month in August to just about $486 million...

Venture Capital

India Deals Barometer Report: Startup funding drops to $473m in Aug—the lowest since June 2020

Startup investments in India continued to move south in August as risk capital investors pulled back significantly on funding amid growing market uncertainties.