SE Asia Deals Barometer Report: Startup fundraising dives 72% to $486m in Aug

Dealmaking in Southeast Asia dropped by nearly 72% month-on-month in August to just about $486 million, the third lowest so far this year, as the number of big-ticket deals dropped during the month, show proprietary data compiled by DealStreetAsia.

There were only 49 deals in the month, compared with 73 transactions in July that raised $1.78 billion in total—the highest so far this year. The July deal value was buoyed by the $845 million that e-commerce giant Lazada pocketed from its parent company Alibaba.

On a year-on-year basis, too, the drop was stark at 76% as startups in the region had raised $2.05 billion from 105 deals in August 2022.

The deals compiled by DealStreetAsia include venture capital, debt financing, private equity, and corporate rounds. There were 5 transactions that did not disclose the funding amount.

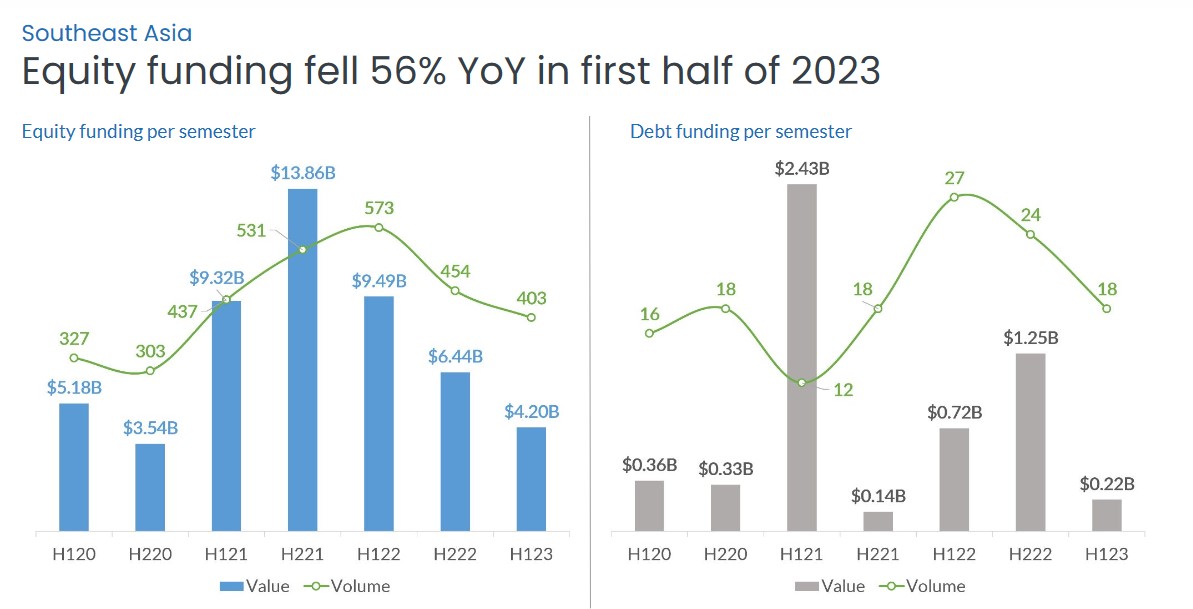

The August figure brings the total amount raised by startups in Southeast Asia so far this year to at least $6.43 billion from 619 deals. For the entire 2022, total funding in the region had dropped 32% to $15.8 billion from 2021’s record highs.

Meanwhile, in the first six months of 2023, Southeast Asian startups raised $4.2 billion in total proceeds from 403 deals. This marks a 30% sequential and a 56% year-on-year drop.

Elusive megadeals

Data compiled by DealStreetAsia show that there were only two megadeals—transactions worth at least $100 million—in August, bringing the total number of megadeals so far this year to 19.

August’s two megadeals raised a combined $200 million, accounting for about 41% of the total amount raised in the month.

Atome Financial, a Singapore-based, buy-now-pay-later company, targetting unbanked and underbanked consumers, renewed its $100 million debt facility with HSBC Singapore in August. The startup said it will use the funds to expand its services in the Philippine market and develop new consumer financing products.

Vietcap Securities, a securities market player in Vietnam, also secured a $100-million capital-backed loan from Mega International Commercial Bank in August.

The two megadeals of August 2023

| Startup Name | Headquarters | Amount Raised | Funding Stage | Lead Investor | Vertical |

|---|---|---|---|---|---|

| Atome | Singapore | $100,000,000.00 | Debt Financing | HSBC Bank Singapore | Fintech |

| Vietcap | Vietnam | $100,000,000.00 | Debt Financing | Mega International Commercial Bank | Fintech |

In July, there were four megadeals that had raised a combined $1.22 billion, or about 68% of the total amount raised that month.

The month of May posted the most number of megadeals so far this year at five, but the total amount raised was only about $649 million that month.

No startup in Southeast Asia made it to the unicorn club in August and only one company has earned the tag so far this year—eFishery, which became Indonesia’s latest unicorn after its $108-million funding round in May.

In 2022, eight privately held startups in the region earned the much sought-after unicorn tag. In 2021, there were a record 23 startups in the region that crossed $1 billion in valuation.

Singapore remains regional funding hub

Geographically, Singapore reinforced its position as the regional hub for startups and investments in August.

Data compiled by DealStreetAsia showed that startups based in the city-state bagged $223 million from 27 transactions, accounting for about 46% of the total funds raised in the month.

Atome’s $100-million debt financing topped Singapore’s funding activities last month, followed by the $35 million that wealth management platform Endowus raised in a funding round backed by Citi Ventures and MUFG Innovation Partners.

Founded in 2017, Endowus is an independent digital wealth platform, licensed by the Monetary Authority of Singapore, helping investors with expert advice and access to institutional financial solutions for a fee.

While Indonesia saw 10 funding deals in August, startups in the archipelago managed to raise only $106.6 million in total, lower than Vietnam’s $157 million from 8 transactions.

Vietcap’s $ 100 million debt funding lifted the total amount raised by private Vietnamese companies last month.

Renewable energy company Copper Mountain Energy also raised $20 million in debt financing while Vietnamese B2B marketplace Telio was understood to have secured $15 million in a new funding round anchored by London-based investment firm Granite Oak.

In Indonesia, the highest funding amount was only $50 million, raised by electric two-wheeler maker PT Ilectra Motor Group (popularly known as ALVA) in a Series B funding round. The round was led by Horizon Ventures.

Malaysia recorded a modest activity with two deals amounting to just $110,000. Both the Philippines and Thailand had two deals for the month; however, the funding amounts were not disclosed.

Most funded sector: Fintech

The financial technology sector maintained its leading position in August, clocking 10 transactions that raised a combined $256.1 million. This underscores the continual growth and interest in fintech in the region.

The two megadeals in the month, Atome Financial and Vietcap Securies, were both fintech deals.

Following closely, Greentech secured seven deals, raising $31.6 million, indicating a rising interest in sustainable and eco-friendly innovations in the region.

The largest deal in this sector was secured by Vietnam’s Copper Mountain Energy Solar, which raised $20 million from the Swiss fund for sustainable development responsAbility.

Healthtech and healthcare, combined, witnessed six deals that raised $10.3 million, a sign of the region’s continued focus on improving health infrastructure and solutions. DotBio, a Singapore-based biopharmaceutical company, bagged the largest amount at $5.6 million in a pre-Series A financing round led by Proxima Ventures, Gaorong Capital, and AIM-HI Accelerator Fund.

Early-stage investments in favour

Dissecting the funding stages, there was a clear inclination towards early-stage investments in August.

Seed stage funding led the chart with 16 deals. This was trailed by Series A and pre-seed funding, recording seven and six deals, respectively.

The top seed deal in August was the $13 million raised by Singapore-based Web3 startup ZTX. The round was anchored by Jump Crypto, the cryptocurrency arm of proprietary firm Jump Trading.

ZTX is the joint blockchain initiative of US Web3 investor Jump Crypto and ZEPETO, the largest avatar social network in Asia with over 400 million lifetime users.

Meanwhile, there were three pre-Series A and three Series B rounds in August. The month witnessed only one Series C round—the $35 million funding of wealth management platform Endowus.

Furthermore, the diversity in funding mechanisms was evident in the month, with two private equity rounds, four debt financing deals, a convertible loan, and a corporate round. Five deals did not disclose their funding stages.

Edited by: Pramod Mathew

Related Stories

Venture Capital

China Deals Barometer Report: Startup fundraising scales six-month peak at $5.1b in Aug

August proved to be a record month for dealmaking in the Greater China market, as startups sealed 257 venture deals — the highest so far this year in terms of deal count.

Venture Capital

India Deals Barometer Report: Startup funding drops to $473m in Aug—the lowest since June 2020

Startup investments in India continued to move south in August as risk capital investors pulled back significantly on funding amid growing market uncertainties.