Greater China Deals Barometer Report: EV frenzy drums up Dec funding activity

Private equity and venture capital investors raced to wrap up 2024 with more signed term sheets, as dealmaking activity rebounded to record highs in December.

In the last month of 2024, privately held companies headquartered in mainland China, Hong Kong, Macau, and Taiwan raised almost $11 billion through the completion of 239 deals, according to proprietary data compiled by DealStreetAsia.

The deal value went up by 87.2% from the $5.9 billion recorded in November, while the deal count struck an uptick of 28.5% month-over-month. Part of the momentum was driven by investors’ “electric vehicle (EV) splurge” — a sector that saw seven out of the 14 mega deals recorded in December.

Although the monthly proceeds soared by 235% compared to December 2023, the deal count remained slightly lower than the previous year (2023) when 248 deals were sealed.

As RMB-denominated government capital dominates the country’s VC-PE ecosystem, 2024 turned out to be a year of adapting and surviving for many including China-focused fund managers who unavoidably tread the thorny path of fundraising from state LPs. But things could soon turn around as the country’s State Council recently urged local governments to drop its economic agenda when backing new funds.

Overall, despite a 19.9% growth in the yearly proceeds, the total number of deals recorded in 2024 remained 14.6% less than the year before. As investors step into 2025, China’s economic growth is projected at 4.5%, according to an estimate by the World Bank.

The estimation was 0.4% more than forecast in June 2024, but the World Bank said in the report that subdued household and business confidence, alongside headwinds in the property sector and structural constraints including low consumption and ageing population, could continue to weigh on the economic growth in 2025.

The hard-to-ignore EV boom

At 14, megadeals or investments worth at least $100 million ruled December’s startup funding scene, contributing to 83.1% of the total monthly proceeds. The mega deal count includes four billion-dollar deals, with three of them in the EV sector.

Chinese smart electric vehicles firm AVATR Technology, backed by state-run automaker Chongqing Changan Automobile and EV battery giant Contemporary Amperex Technology (CATL), emerged as the largest transaction among Chinese EV brands in 2024. The EV brand secured over 11 billion yuan ($1.5 billion), as it eyes an initial public offering (IPO) in 2026.

That was followed by BAIC BJEV, an indirect subsidiary of Chinese state-owned automaker BAIC Group, which pocketed 10.15 billion yuan ($1.39 billion) in strategic financing after the smaller Chinese electric vehicle (EV) player ended 2024 with a rise in sales.

In yet another billion-dollar deal, Chinese state-owned automaker BAIC Motor and South Korean Hyundai Motor have agreed to pump in around $1.1 billion into its joint venture (JV), which seeks to roll out more EV models targeting Chinese consumers and expand across international markets.

The series of billion-dollar deals rides on a record domestic sales growth of 20% year-on-year to over 12 million vehicles in 2025, the Financial Times reported recently, citing estimates from four investment banks and research firms, as China cements its position as the world’s largest EV market despite sales across Europe and the US losing steam.

The remaining mega deals were scattered across logistics, semiconductor, space tech, and generative AI.

List of megadeals (December 2024)

| Startup | Headquarters | Investment size (Million USD) | Unspecified size | Investment stage | Lead investor(s) | Other investor(s) | Industry/Sector | Vertical |

|---|---|---|---|---|---|---|---|---|

| Huaneng Renewables Corporation | Beijing | 2046.8 | China Reform Holdings Corporation, China Post Group Corporation, China Taiping Insurance Holdings, National Green Development Fund (NGDF), China Southern Power Grid | Renewable Energy | CleanTech | |||

| AVATR Technology | Chongqing | 1500.8 | C | Changan Automobile, Chongqing Anyu Private Equity Investment Fund, South Industry Assets Management, BOCOM Financial Asset Investment | Automobiles & Parts | Electric/Hybrid Vehicles | ||

| BAIC BJEV/Beijing New Energy Automobile | Beijing | 1390.5 | BAIC Motor, E-Town Capital, BOCOM Financial Asset Investment, CCB Financial Assets Investment, Beijing Jingneng Green Energy M&A Investment Fund, Beijing Electronics Holding, Ningbo Meishan Bonded Port Zone Wending Investment, Beijing International Trust, Beijing State-Owned Capital Operation and Management Company Limited, Beijing Infrastructure Investment, Beijing Enterprises Group, Pony.ai, Contemporary Amperex Technology Co Ltd (CATL) | Automobiles & Parts | Electric/Hybrid Vehicles | |||

| Beijing Hyundai Motor | Beijing | 1095 | BAIC Investment (subsidiary of BAIC Motor), Hyundai Motor Company | Automobiles & Parts | Electric/Hybrid Vehicles | |||

| Kuayue-Express Group | Shenzhen | 891.2 | JD Logistics | Logistics & Distribution | N/A | |||

| SJ Semiconductor Corporation | Jiangyin | 700 | Wuxi Chanfa Science and Technology Innovation Fund, Jiangyin Binjiang Chengyuan Investment Group, Fortera Capital, Shanghai International Group, Lingang Xinxin Fund of Shanghai Lingang Special Area Administration, Lingang Shuke Fund of Lingang Group, Social Security Fund Zhongguancun Independent Innovation Fund, China Life Private Equity Investment Limited, Golden Link | Semiconductor | N/A | |||

| Zhipu AI/Beijing Zhipu Huazhang Technology | Beijing | 411.8 | Legend Capital (affiliated with Legend Holdings) | Software | AI and Machine Learning | |||

| Changan Kaicheng | Chongqing | 285 | A | Changan Automobile, CCB Investment, Hengtai Equity Investment Fund, South Industry Assets Management, Bingqi Xindongneng Equity Investment Fund, Bethel Automotive Safety Systems, Chongqing Changyu Private Equity Investment Fund, Guangzhou Yuekai Zhidong Industry Equity Investment | Automobiles & Parts | Electric/Hybrid Vehicles | ||

| IM Motors | Shanghai | 191.8 | B1 | Automobiles & Parts | Electric/Hybrid Vehicles | |||

| Gesi Aerospace Technology/Genesat | Shanghai | 137 | A+ | Guokai Science and Technology Innovation Investment, Guosheng Capital, SIMIC Capital, SHFTZ Fund, Zizhu, Guokai Manufacturing Transformation and Upgrading Fund | Aerospace | Space Tech | ||

| Chunqing Technology | Tianjin | 135 | Pre-A+ | Automobiles & Parts | Electric/Hybrid Vehicles | |||

| LandSpace Technology | Beijing | 123.3 | National Manufacturing Transformation and Upgrading Fund | Aerospace | Space Tech | |||

| DeepWay | Hefei | 102.7 | B | Puhua Capital, Zhongan Capital (under Anhui Provincial Investment Group Holding) | China Greater Bay Area Technology and Innovation Fund, CCB Trust, Hefei Industry Investment Holding, Feixi Industry Investment (肥西产投) | Automobiles & Parts | Electric/Hybrid Vehicles | |

| Stepfun | Shanghai | 100 | Yes | B | Shanghai State-owned Capital Investment | Business Support Services | AI and Machine Learning |

Although early-stage investments continued to dominate the country’s venture scene, accounting for 53.1% of the total deal count, investments at the Series A stage or earlier only took a meagre portion of the funding of $1.3 billion, or 11.8% of the month’s total proceeds.

Chipmakers continue to ride on tailwind

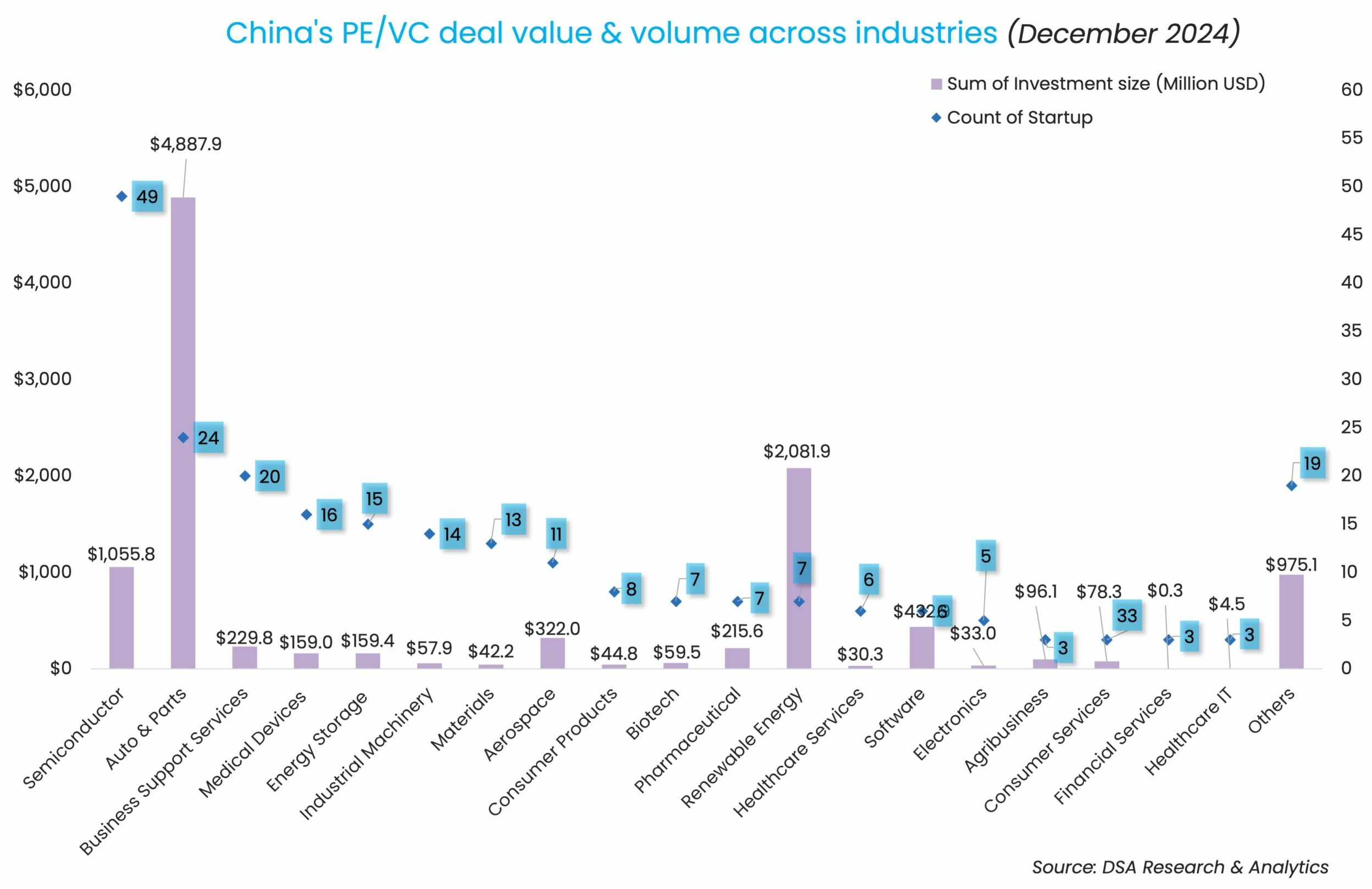

Semiconductor topped the chart as the most-invested sector by deal count. The sector saw the completion of 49 deals, despite only collectively raising $1.1 billion. The deal flow into the chipmaking sector, however, was largely contributed by SJ Semiconductor’s $700-million investment.

The round saw participation from Fortera Capital, a private-equity firm under the Shanghai State-owned Capital Investment, state-owned Shanghai International Group, and China Life Insurance arm China Life Private Equity Investment, among others.

Surprisingly, December turned out to be a rather quiet month for the red-hot semiconductor sector as the majority of the deals were small in size. But as geopolitical tension between China and the US continues to intensify, investment gushing into the sector will hardly take a break.

As proof, China’s third state-backed 344-billion-yuan ($47.5 billion) investment fund, also known as Big Fund III, which is aimed at propelling the country’s self-sufficiency in chipmaking, commenced investments by backing two new funds in late December.

Suzhou Capital Group takes the lead

Suzhou Capital Group, a state-owned investment group set up to propel the venture capital development of Suzhou City in China’s eastern Jiangsu province, emerged as the top investor in December. The state-owned investor injected capital into seven startups in December, however, the financial details of most of the transactions were not disclosed.

Set up in June 2022, Suzhou Capital Group oversees several investment vehicles such as Suzhou International Development Venture Capital Holding; Suzhou Angel FoF; and Suzhou Fund, among others.

Early-stage venture capital firm Addor Capital, backed by state-affiliated Jiangsu High-tech Investment Group, invested in six deals in December, making it the second most active investor of the month. The six startups raised an aggregate of $46.5 million.

Most active investors in China (December 2024)

| Investment company | No. of deals | Total value of participated deals (Million USD) | Lead | Non-lead |

|---|---|---|---|---|

| Suzhou Capital Group | 7 | 14 | 0 | 7 |

| Addor Capital | 6 | 41.2 | 1 | 5 |

| Tianjin Kechuang Angel Capital (under Tianjin Technology Innovation Center) | 4 | 0 | 4 | 0 |

| MPC (previously known as Matrix Partners China) | 4 | 27.8 | 2 | 2 |

| Beijing Artificial Intelligence Industry Investment Fund (北京市人工智能产业投资基金) | 4 | 28 | 0 | 4 |

| Legend Capital (affiliated with Legend Holdings) | 4 | 84.8 | 1 | 3 |

| Lightspeed China Partners | 4 | 33.6 | 0 | 4 |

| Shenzhen Capital Group | 4 | 37.6 | 1 | 3 |

| Shunwei Capital | 4 | 14 | 1 | 3 |

| Kylinhall Partners | 4 | 4.5 | 1 | 3 |

| CAS Star | 4 | 21.1 | 2 | 2 |

| Fortune Capital | 4 | 29.5 | 3 | 1 |

| State Development and Investment Corporation (SDIC) & affiliates | 4 | 42 | 3 | 1 |

| China Reform Holdings Corporation | 4 | 84.5 | 2 | 2 |

Note: In our monthly analysis for December 2024, we have put together detailed charts of prominent deals, active investors, deal stages, and the most attractive sectors that have bagged the maximum venture dollars in the Greater China region.

Our database only considers deals officially announced by the related investee, investor(s), and/or financial advisor, while information based on market rumours and news reports citing sources is excluded.

For a more detailed analysis, and to enable comparison between primary and secondary markets, DealStreetAsia has started tracking deals of all sizes since April 2020, as against considering only transactions worth more than $10 million earlier.

We have also introduced a standardised system for industry classification. It currently includes over 50 industries, as well as over 45 new economy and high-tech verticals, which will progressively increase to adapt to local market conditions in our closely watched regions of Greater China, Southeast Asia, and India.

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

SEA Deals Barometer Report: Startup funding surges in Dec as megadeals resurface

At the fag end of a grim year, startups in Southeast Asia raked in big moolah from investors in December, ending 2024 on an optimistic note.

Venture Capital

India Deals Barometer Report: Startup fundraising plunges 17% MoM to $1.4b in Dec

Indian startups ended the year with funding proceeds worth $1.38 billion in December, down 17% from $1.66 billion in November, according to proprietary data compiled by DealStreetAsia. At 98, however, the volume of venture capital (VC) and private equity (PE) transactions was up 19% from November’s tally of 91 deals.