China Deals Barometer Report: Slowdown continues in Feb, but interest in chip investments sustains

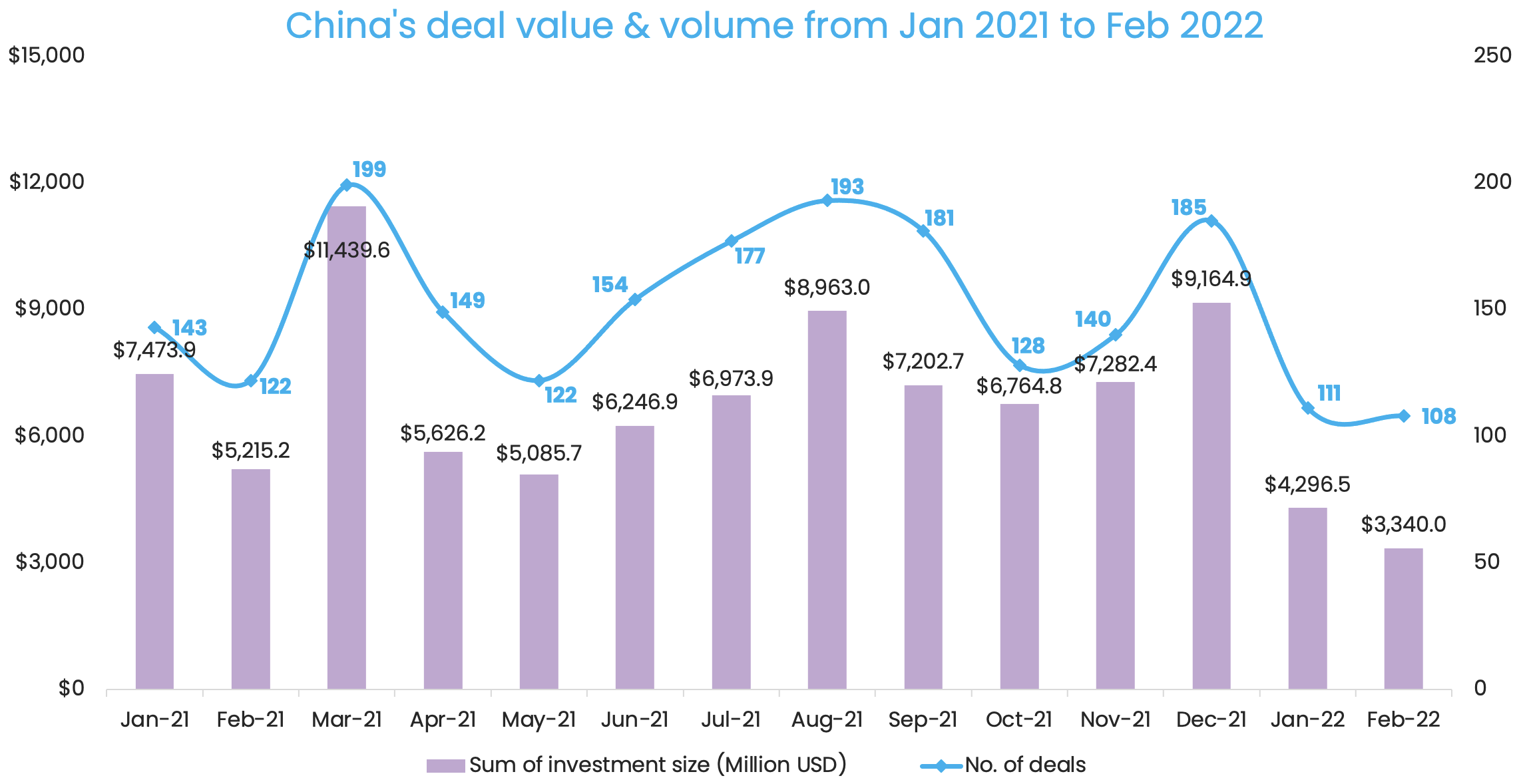

Greater China saw another month of market slowdown as private equity (PE) and venture capital (VC) investments virtually came to a standstill in the first week of February during the Lunar New Year, leading to a 22.3% decline in deal value following January’s funding withdrawal.

Privately-held companies raised over $3.3 billion through 108 deals in February 2022, according to proprietary data compiled by DealStreetAsia. As compared to $4.3 billion across 111 deals in January, the monthly funding value dropped by 22.3%, while the number of transactions slipped by 2.7%.

Investment activity in Greater China has had a slower start in 2022. Although investors usually switch to the slow lane in the first two months of a year, startup financing in January and February 2021 stood at about $7.5 billion and $5.2 billion, respectively – significantly higher compared to the same period this year.

Startup investments in the first two months were also below the monthly average of 2021. For the entire 2021, startups headquartered in Greater China collected a total of $87.4 billion across 1,893 PE-VC deals, with a 55.6% increase in annual deal value from 2020. On average, each month recorded close to $7.3 billion in startup financing.

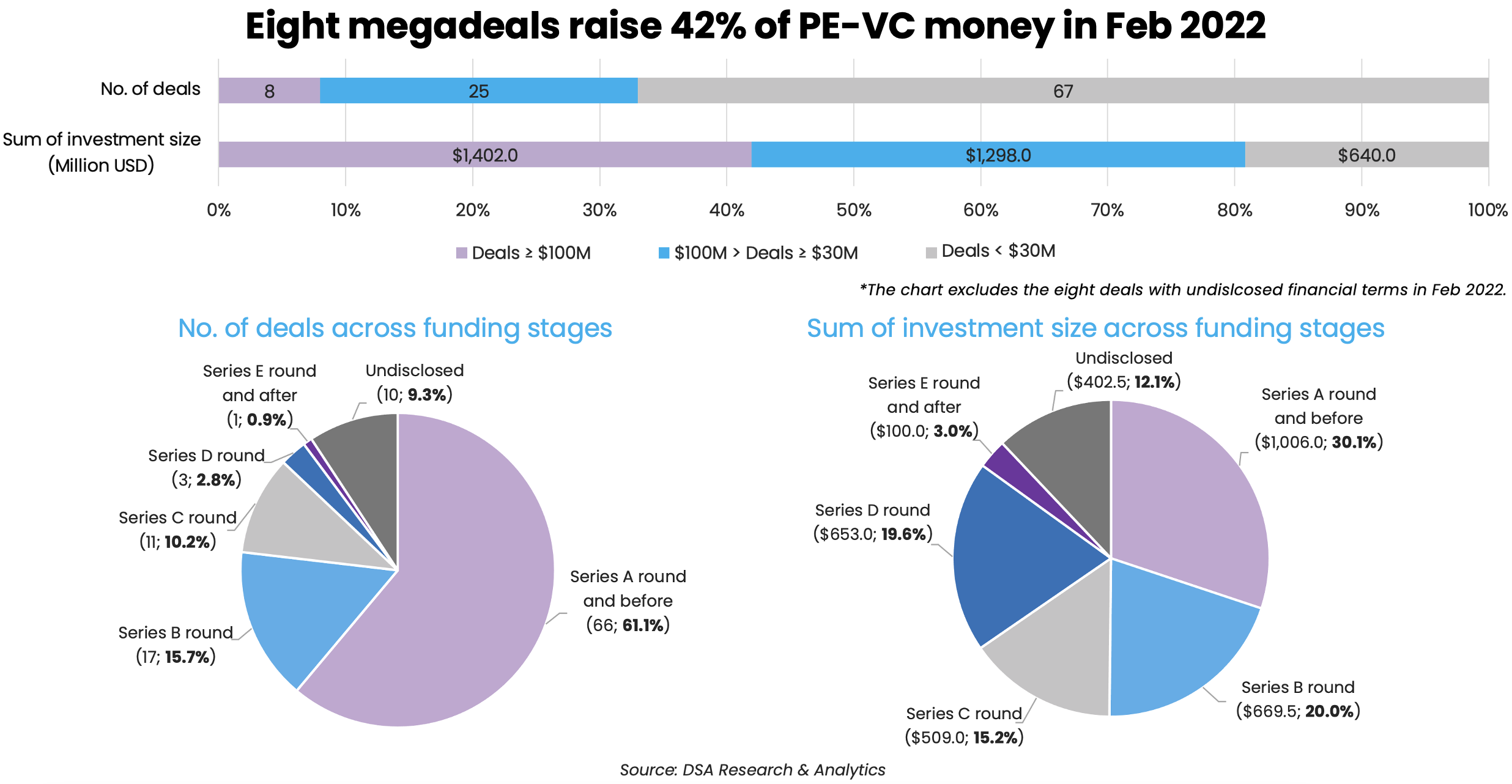

Megadeals halve from Jan

The number of megadeals also witnessed a downtrend with February clocking only eight such transactions compared to 16 in January. The semiconductor industry alone contributed to three of the big-ticket transactions.

Megadeals – or investments worth at least $100 million – collectively secured just over $1.4 billion in February, representing 42% of the month’s total financing.

The number of megadeals halved from 16 in January, which was already a decrease from 24 in December 2021. Their aggregate value also dived by almost 46.2% from about $2.6 billion in January, following a month-over-month (MoM) decline of 56.7% from over $6 billion the month earlier.

In the biggest funding round, semiconductor firm Innoscience Technology secured nearly $474 million in a Series D round led by China’s TI-Capital. Innoscience, which just made its global foray a few weeks before, plans to use the proceeds for the development of its Gallium-Nitride-on-Silicon (GaN-on-Si) power solutions that target next-generation consumer electronics, data centres, and beyond.

The other two semiconductor deals include Beijing-based Smart Logic’s $100-million Series C round and Cygnus Semiconductor’s $100 million fundraising across Series Pre-A+ and Series A rounds led by Matrix Partners China and Wofo Capital.

While software, auto & parts, and business support services each recorded one megadeal in February, the financial services sector saw two mega fundraising deals by Fenbeitong and Yunzhangfang.

Expense management startup Fenbeitong raked in $140 million in a Series C+ round led by DST Global, while Yunzhangfang, which develops online tax and financial management solutions, raised $100 million in a Series E round led by Apax Digital.

Investors’ appetite for early-stage investments increased with over $1 billion being raised across 66 transactions at Series A and earlier funding stages in February. In total, they contributed to more than half of the monthly deal count and almost a third of the value.

Investors evidently made more bets on this funding stage as the proportion of Series A and earlier deals widened to 61.1% in February from 44.1% in January. But the percentage of the capital raised at the stage remained almost on par with the previous month.

List of eight megadeals in Feb 2022

| Startup | Headquarters | Investment size (USD) | Investment stage | Lead investor(s) | Investor(s) | Industry | Vertical |

|---|---|---|---|---|---|---|---|

| Innoscience | Suzhou | $474 million | D | Ti-Capital | Addor Capital, Haitong Innovation, China-Belgium Direct Equity Investment Fund, SAIF Eagle Fund, China Merchants Securities Investment | Semiconductor | N/A |

| G7 | Beijing | $200 million | Trustbridge Partners, CMG-SDIC Capital | Software | Internet of Things | ||

| Inceptio Technology | Shanghai | $188 million | B+ | Sequoia Capital China, Legend Capital | Chow Tai Fook Enterprises Limited (CTFE), Cedarlake Capital, Wuchan Zhongda Group, Meituan, NIO Capital, Eight Roads, Broad Vision Funds | Automobiles & Parts | Autonomous Driving |

| Fenbeitong | Beijing | $140 million | C+ | DST Global | D1 Capital Partners, Prosperity7 Ventures, Whale Rock Capital Management, Emergence, GL Ventures, Ribbit Capital, Eight Roads, Glade Brook Capital, BitRock Capital | Financial Services | Fintech |

| Sobot | Beijing | $100 million | D | SoftBank Group Corp’s Vision Fund 2 | GL Ventures, Yunqi Partners, Mirae Asset Global Investments | Business Support Services | Robotics & Drones |

| Smart Logic | Beijing | $100 million | C | TFTR Investment, CICC Capital, Chipone Technology, Grand Flight Investment | Semiconductor | N/A | |

| Yunzhangfang | Nanjing | $100 million | E | Apax Digital Fund | GF Qianhe Investment, GF Investments (Hong Kong) | Financial Services | Fintech |

| Cygnus Semiconductor | Shanghai | $100 million | Pre-A+, A | Matrix Partners China, Wofo Capital | Bertelsmann Asia Investments (BAI), Walden International, Huajin Capital, Shanghai Henglu Asset Management, Hengtong Optic-Electric, Haiyan Xinan Investment, CDH Venture and Growth Capital (VGC), GGV Capital, Green Pine Capital Partners | Semiconductor | 5G |

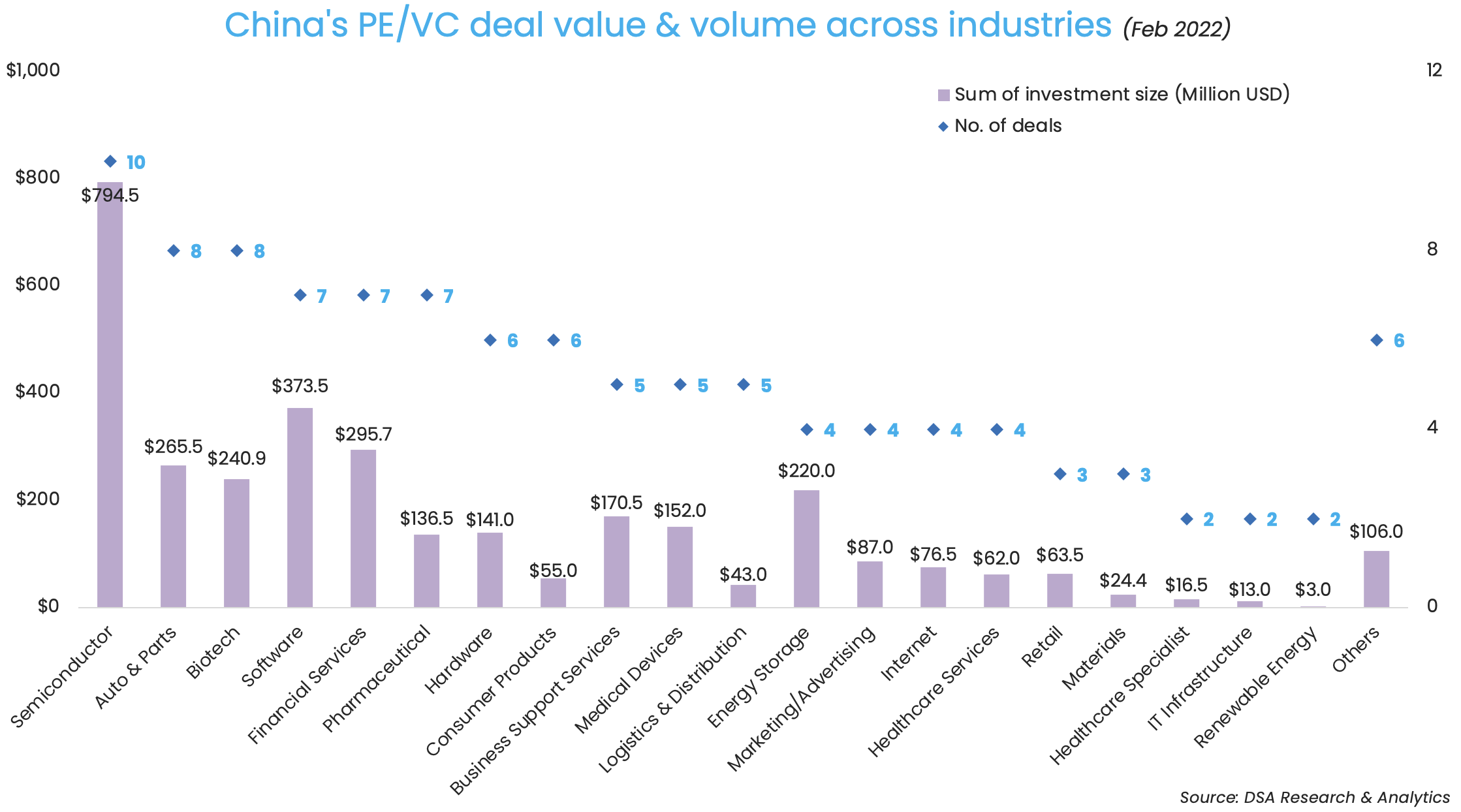

Semiconductor ranks first in deal count

For the third consecutive month, semiconductor kept its perch as the top industry for investors seeking the next generation of hot markets in Greater China with rising capital inflows from both domestic and foreign markets.

Apart from the three megadeals, the industry logged a total of 10 transactions worth a combined $794.5 million, taking it ahead of auto & parts and biotech in terms of deal count. Fundraisers are active players across the whole industry chain, covering chip design and development, manufacturing, assembling, packaging and testing, for vertical adoption across the areas of 5G, big data, AI, IoT, and more.

The government’s sweeping crackdown on the tech industry drove entrepreneurs and venture firms to shift sights from softer Internet businesses to hard-core technologies like semiconductor, biotech, and enterprise software. Although China is still behind Silicon Valley in overall startup financing, the country already surpassed the US in certain hard-tech areas with semiconductors being one of them.

Preqin data shows that Chinese chipmakers, integrated circuit (IC) designers, and other semiconductor startups received $8.8 billion in funding in 2021, more than six times the $1.3 billion raised by similar companies in the US.

Auto & parts and biotech were tied for second place in terms of deal count, with the completion of eight deals each in the month. Startups in the auto & parts space raised slightly more capital than their peers in the biotech industry thanks to the presence of Inceptio Technology, which garnered $188 million in a Series B+ round to accelerate the mass production of its Level 3 and Level 4 autonomous driving trucks.

Sequoia China regains top position

Sequoia Capital China regained its position as the most active investor in China’s venture market with the participation in nine deals, overtaking investment bank China International Capital Corp (CICC) which had topped last month with 11 investments.

An investor of some of China’s biggest tech giants like Alibaba and food delivery firm Meituan, Sequoia China has backed about 600 companies since its inception in 2005 with focus on the TMT, healthcare, and consumer goods & services fields.

Last month, it joined hands with Legend Capital to lead the $188-million Series B+ round in self-driving truck developer Inceptio Technology. In addition to this megadeal, it also participated in three mid-sized investments in nuclear fusion-based energy solutions developer Energy Singularity; Taichi Graphics, which operates an open-source platform for developers, designers, and artists to create digital content; and data intelligence startup Guandata, respectively, as well as another five deals smaller than $30 million.

These top investors remained bullish on investing in China tech, although their path to exit on Wall Street was dented as both Beijing and Washington raised the bar for Chinese listings in the US. Many shifted sights to an initial public offering (IPO) on a mainland stock exchange, boosting the local IPO market to a new high.

According to statistics compiled by Chinese industry researcher CVSource, a total of 613 companies completed an IPO on a stock exchange in mainland China in 2021, of which 415 had received financing from PE-VC investors. It means that PE-VC firms participated in 67.7% of IPOs in mainland China last year. CVSource data shows that their participation rate in IPOs by issuers in the AI, healthcare, and IT sectors even crossed 80%.

Most active investors in Greater China (Feb 2022)

| Investment company | No. of deals | Total value of participated deals (USD) | Lead | Non-lead |

|---|---|---|---|---|

| Sequoia Capital China | 9 | $391.5 million | 3 | 6 |

| GL Ventures | 8 | $482 million | 3 | 5 |

| Legend Capital & Legend Star | 8 | $457 million | 2 | 6 |

| Oriza Holdings and affiliates | 8 | $286.5 million | 3 | 5 |

| CICC Capital and affiliates | 5 | $304 million | 2 | 3 |

| SIG Asia Investment | 5 | $36.5 million | 1 | 4 |

| CDH Investments and affiliates | 4 | $228 million | 1 | 3 |

| GGV Capital | 4 | $161.5 million | 3 | 1 |

| Eight Roads | 3 | $338 million | 0 | 3 |

| SoftBank | 3 | $157 million | 3 | 0 |

| *If one deal is backed by only two investors, we consider neither of the two investors as a lead investor. |

Liya Su contributed to the story.

Note: In our monthly analysis for February 2022, we have put together detailed charts of prominent deals, active investors, deal stages, and the most attractive sectors that have bagged the maximum venture dollars in the Greater China region.

Our database only considers deals officially announced by the related investee, investor(s), and/or financial advisor, while information based on market rumours and news reports citing sources is excluded.

For a more detailed analysis, and to enable comparison between primary and secondary markets, DealStreetAsia has started tracking deals of all sizes since April 2020, as against considering only transactions worth more than $10 million earlier.

We have also introduced a standardised system for industry classification. It currently includes over 50 industries, as well as over 45 new economy and high-tech verticals, which will progressively increase to adapt to local market conditions in our closely watched regions of Greater China, Southeast Asia, and India.

- Caocao Mobility

- CICC Capital

- FerroTec

- semiconductor

- Sequoia Capital China

- software

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

India Deals Barometer Report: Startup fundraising drops 18% sequentially to $3.64b in Feb

After an impressive start in January, startup fundraising in India tapered nearly 18% in value in February...

Venture Capital

SE Asia Deals Barometer Report: Big-ticket transactions push up startup funding to nearly $2b in Feb

Southeast Asian startups raised at least $1.96 billion in private equity and venture capital transactions..