SE Asia Deals Barometer Report: Big-ticket transactions push up startup funding to nearly $2b in Feb

Southeast Asian startups raised at least $1.96 billion in private equity and venture capital transactions in February, with several big-ticket deals accounting for the bulk of the deal value, show proprietary data compiled by DealStreetAsia.

There were only 98 deals registered in February but the amount raised was more than January’s deal value of $1.7 billion gathered from 128 transactions. This represents a 15% month-on-month increase in deal value despite a 23% drop in deal count.

Of the total transactions in the month, which included debt financing, non-equity assistance, and initial coin offerings, the value of 26 deals was undisclosed, the data showed.

Seven mega deals, or transactions worth atleast $100 million, accounted for about 67% of the total deal value. In comparison, there were only two mega deals in January that raised a total of $540 million, the data showed.

Singapore-based Princeton Digital Group’s $500-million private equity funding led by Mubadala Investment Company, a state investor for the Abu Dhabi government, was the biggest deal recorded in February.

Glance, a lock screen content company backed by Alphabet and owned by ad-tech firm InMobi, raised $200 million in Series D funding led by India’s Reliance Jio, the telecom division of Reliance Industries.

February also minted a new unicorn — Singapore-based marketing tech company Insider. The startup raised $121 million in a Series D funding round led by the Qatar Investment Authority, the gulf nation’s sovereign wealth fund.

Deals worth over $100 million in February 2022

| Startup | Headquarter | Investment Size | Investment Round | Lead Investor | Vertical |

|---|---|---|---|---|---|

| Princeton Digital Group | Singapore | $500,000,000 | Private Equity | Mubadala | Software & IT |

| Glance | Singapore | $200,000,000 | Series D | Reliance Jio | Software as a Service (SaaS) |

| Funding Societies (Modalku) | Singapore | $150,000,000 | Debt Financing | Fintech | |

| Funding Societies (Modalku) | Singapore | $144,000,000 | Series C | SoftBank Vision Fund | Fintech |

| Insider | Singapore | $121,000,000 | Series D | Qatar Investment Authority | Marketing tech |

| Next Gen Foods | Singapore | $100,000,000 | Series A | Biotech | |

| Akulaku | Indonesia | $100,000,000 | Series E | SCB Group | Fintech |

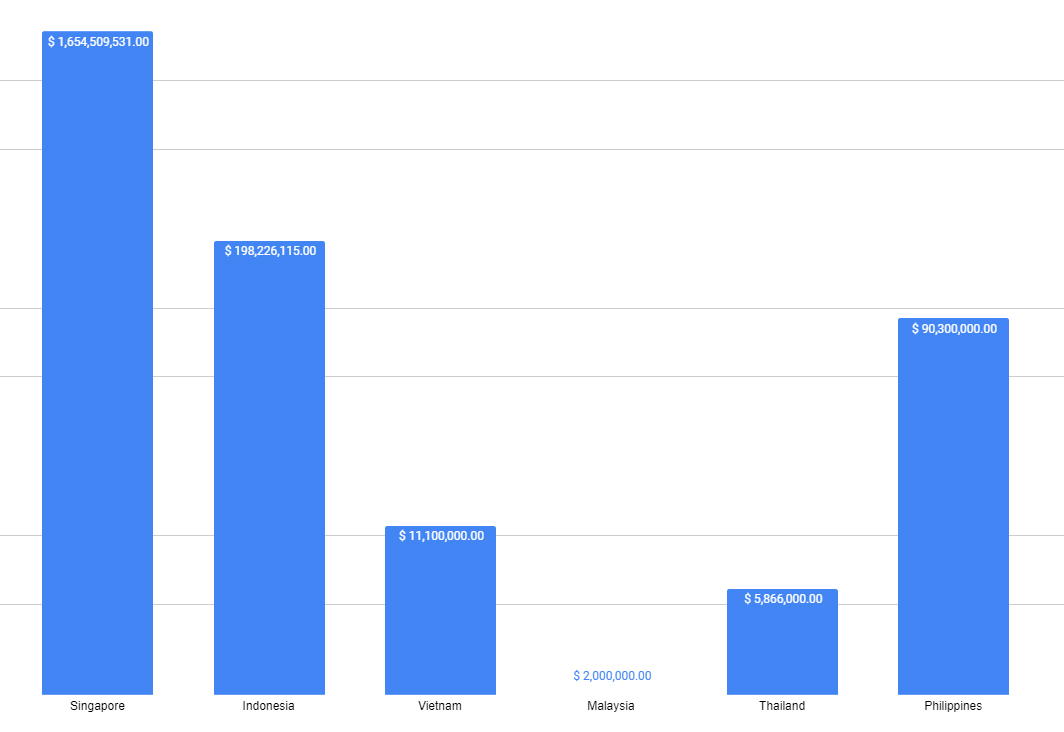

Singapore leads deal volume, value

Private companies in Singapore continued to dominate Southeast Asia’s funding scene in February, with 50 startups in the city-state amassing about $1.65 billion in total investments, or about 84% of the region’s total.

Six of Southeast Asia’s megadeals in February involved Singapore-based startups. These include Princeton Digital, Glance, Funding Societies (Series D and debt financing), Insider, and Next Gen Foods.

Indonesia came in second in terms of deal volume and value. The amount raised by 34 startups in the country in the month stood at $198 million — far lower than Singapore’s tally. About 18 deals, however, did not disclose the amount raised.

Indonesian Digital banking and finance platform Akulaku raised $100 million in funding from Thai lender Siam Commercial Bank (SCB), making it the only Indonesian megadeal.

Indonesia had witnessed a strong 2021 with seven unicorns minted and the local IPO of homegrown e-commerce firm Bukalapak — a sign that exits are visible and feasible in this market. For 2022, Indonesia-focused VCs say they remain bullish.

Meanwhile, the Philippines climbed to the third spot in terms of startup funding in February, with four private firms raising $90.3 million, led by cryptocurrency exchange Philippine Digital Asset Exchange (PDAX), which raised $50 million in Series B funding. New York-based investment firm Tiger Global Management invested $35 million in the said round.

Another Philippines startup, payments processing firm PayMongo, also raised $31 million in a Series B funding round. The firm’s CEO and co-founder Francis Plaza had told DealStreetAsia earlier that the company wants to be the biggest payments processing platform in the country.

Startups in Malaysia, Vietnam, and Thailand raised a combined $18.9 million from a total of 10 transactions.

Fundraising by country in February

Software, fintech corner most funding

Startups in the software and software-as-a-service (SaaS) sectors cornered the most funding in February, overtaking e-commerce, which has been a funding magnet following the onset of the global coronavirus pandemic.

Startups in the software / SaaS sectors raised the most money, at $732 million, from just 13 transactions in February, with Princeton Digital’s $500-million and Glance’s $200-million fundraise leading the pack.

Fintech startups were involved in 24 transactions that raised at least $580 million in February, led by the debt financing and Series C funding of Funding Societies worth a combined $294 million. In 2021, one in every four dollars invested went to fintech, driven by the rising adoption of e-payments and decentralised finance (DeFi).

E-commerce startups, which raised the most money in January, secured only $45.6 million in funding from eight transactions.

Data analytics and AI raised $109.5 million while marketing tech secured $131 million. Healthcare and healthtech scored $97 million in total funding from seven deals, according to data compiled by DealStreetAsia.

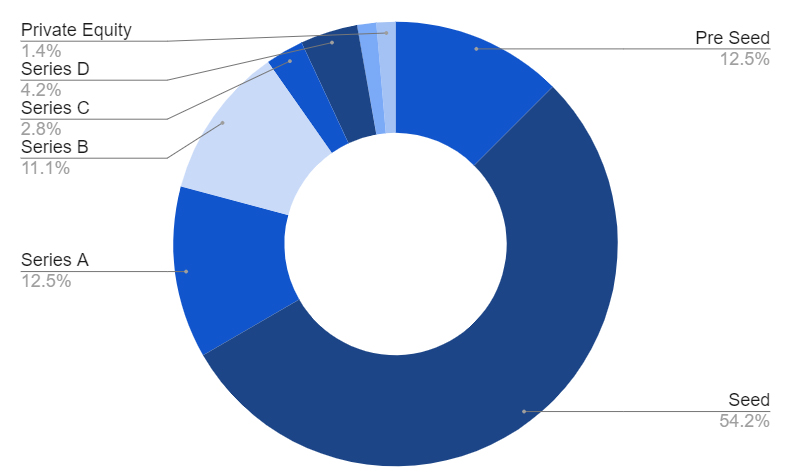

Early-stage rounds continue to dominate

In terms of volume, early-stage fundings continued to dominate in February. There were 39 seed rounds in the month that raised $106 million, followed by nine deals each in pre-seed and Series A rounds that scored $8.4 million and $173 million, respectively.

The month also saw eight Series B rounds that raised $311.9 million and three Series Ds that secured $331 million. There were two Series C rounds and a Series E round that raised $231 million and $100 million, respectively.

Princeton Digital’s $500-million funding was the lone private equity deal in February.

A recent Asia Partners report recently said there remains a Series C and Series D funding gap of about $1.1 billion relative to China in Southeast Asia. This shortfall of growth equity series capital in the region has widened from 2019 when it was about $930 million.

Top deal stages in February by volume

Most active investors

Endeavor Indonesia participated in 10 deals in February in the second batch of its accelerator programme to become the most active investor in the month.

The chosen startups are the Sharia-compliant P2P lender ALAMI, edtech CoLearn, F&B tech startup Esensi Solusi Buana, open finance startup Finantier, earned wage startup GajiGesa, shrimp farming management startup Jala Tech, genetic testing company Nalagenetics, social commerce Raena Beauty, eyewear brand SATURDAYS, and edtech startup Sekolah.mu.

Jakarta-based early-stage investor AC Ventures anchored four deals in Indonesia to become one of the most active investors during the month. Its investments included fintech lending startup Broom, decentralised finance firm Gobi, e-commerce startup BerryBenka, and personal health coaching provider Sirka.

Singapore-based venture capital investor BEENEXT also joined the most active investors’ list, co-leading three investments in February — in group-based food ordering platform Gobble, climate tech startup RIMM Sustainability, and Indonesian agritech startup Semaai.

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

China Deals Barometer Report: Slowdown continues in Feb, but interest in chip investments sustains

Greater China saw another month of market slowdown as private equity (PE) and venture capital (VC)...

Venture Capital

India Deals Barometer Report: Startup fundraising drops 18% sequentially to $3.64b in Feb

After an impressive start in January, startup fundraising in India tapered nearly 18% in value in February...