China Deals Barometer Report: Startup fundraising volume, value sees a decline in July

Startup fundraising in Greater China dipped slightly in both deal value and volume terms in July, which recorded 205 deals worth $4.2 billion.

Deal value in July dropped by 13.1% compared to the preceding month while deal count decreased by 11.3% from the previous month, according to proprietary data compiled by DealStreetAsia. The month of July also saw a slight drop of 0.8% in deal value compared with the corresponding period last year, while the deal count decreased by 13.1%.

Although China’s reopening bodes well for the country’s economic recovery this year, its 6.3% GDP growth in Q2 fell below expectations of 7.3%, per Reuters. The sluggish economic recovery, coupled with ongoing geopolitical tensions, is expected to continue to weigh on the country’s PE-VC fundraising scene.

Fundraising has been teetering so far this year, with the aggregate deal value up just 7.3% year-on-year to around $30 billion in the first seven months of 2023, showing that investors remain cautious about making heavy bets amid the market downturn.

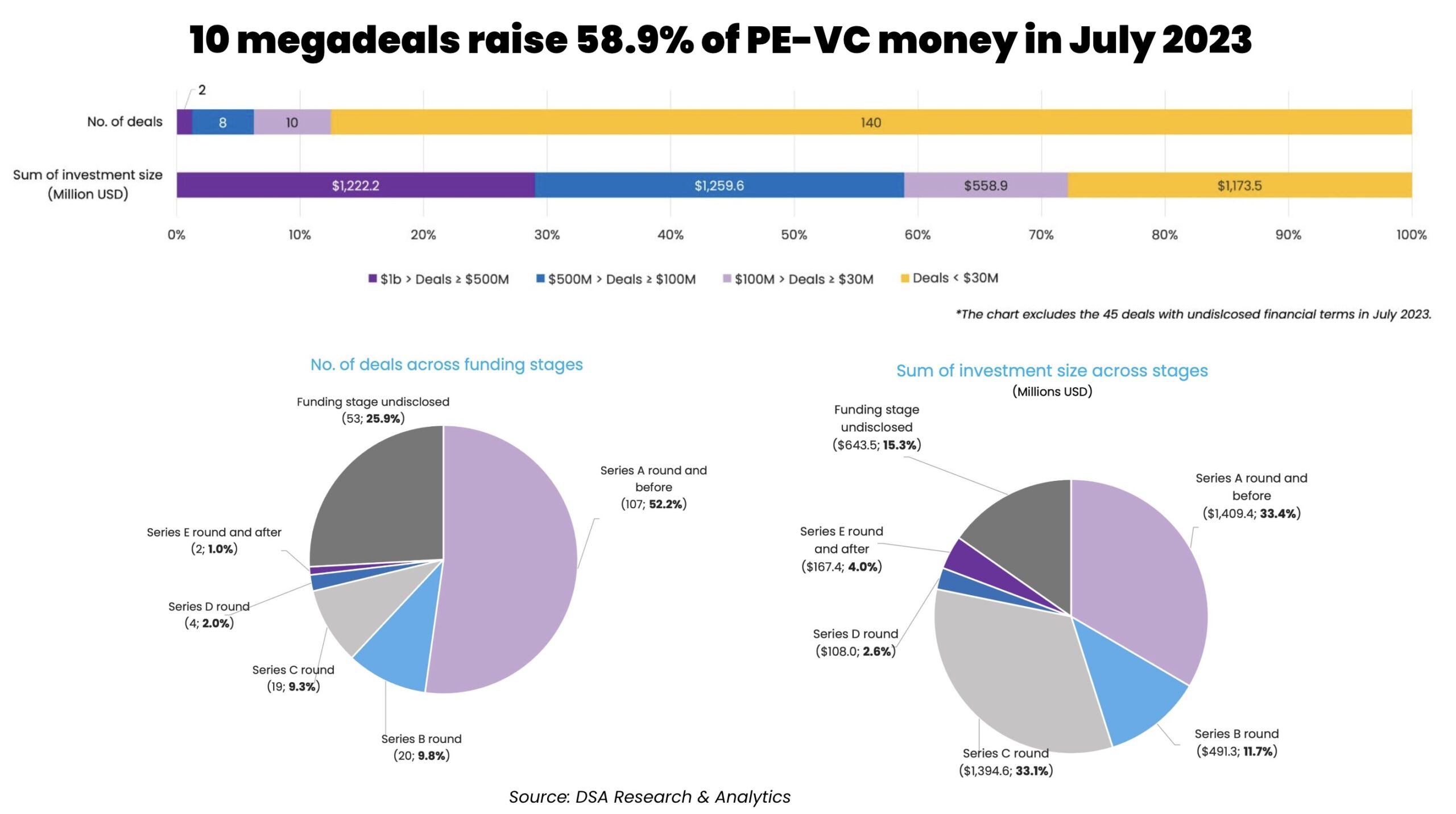

Megadeals prop up startup fundraising

There were 10 megadeals — transactions worth at least $100 million — in July, which raised a combined $2.5 billion. The big-ticket deals account for 58.9% of the total fundraising proceeds, and 5% of the total deal count.

Energy storage firm Xiamen Hithium Energy Storage Technology was the biggest fundraiser last month. The firm raised over 4.5 billion yuan ($622.2 million) in its Series C funding round led by Beijing Financial Street Capital Operation Group (BFS Capital) and China Life Private Equity Investment, an arm of China Life Insurance, to finance the expansion of production facilities, among others.

Beijing Sinotau International Pharmaceutical Technology (Sinotau), another megadeal in July, bagged over 1.1 billion yuan ($151.8 million) to advance the R&D and clinical trials of its radiopharmaceutical pipeline, after moving towards an initial public offering (IPO) in mainland China.

In another significant transaction in the month, electric and hybrid truck maker Farizon, which is owned by automaker Geely, snapped up $600 million in a Series-A funding round, led by Boyu Capital and Yuexiu Industrial Fund.

The remaining seven megadeals were across a wide range of industries including energy storage & batteries, transportation services, materials, and business support.

Investors continued to favour startups in their early funding stages — investments at Series A and earlier. These stages accounted for 52.2% of the month’s total deal count. The early-stage deals amassed $1.4 billion, or 33.4% of the total deal value.

The investment sentiment at the growth- and late-stage funding had seen signs of recovery in July, with 39.7% of the proceeds, or $1.7 billion going into investments at Series C or later stages. This marked a significant rise from 19.6% or around $950.2 million in June.

Megadeals in Greater China (July 2023)

| Startup | Headquarters | Investment size (Million USD) | Unspecified size | Investment stage | Lead investor(s) | Other investor(s) | Industry/Sector | Vertical |

|---|---|---|---|---|---|---|---|---|

| Hithium Energy Storage Technology | Xiamen | 622.2 | C | Beijing Financial Street Capital Operation Group (BFS Capital), China Life Private Equity Investment (affiliated with China Life Insurance), BOC Asset Management, and others | Zhongbing Guotiao, Matrix Partners China, Hefei Industry Investment Holding Group, and others | Energy Storage & Batteries | CleanTech | |

| Farizon | Hangzhou | 600 | A | Boyu Capital, Yuexiu Industrial Fund | United Clean Energy (Singapore), Sichuan Linjiang Industry Group, Hidden Hill Capital (affiliated with GLP), and others | Automobiles & Parts | Electric/Hybrid Vehicles | |

| Chint Solar/Astronergy | Haining | 280.1 | C | Yangtze Green Fund (set up by National Development and Reform Commission, China Three Gorges Corporation), Yuexiu Fund, and others | Energy Storage & Batteries | CleanTech | ||

| Sinotau International Pharmaceutical Technology | Beijing | 151.8 | SDIC Venture Capital, Goldstone Investment (affiliated CITIC Securities), China Structural Reform Fund, and others | Pharmaceutical | Biotech | |||

| T3 Go/ T3 Mobility | Nanjing | 139.9 | A+ | Hongtai Aplus | Transportation Services | Ridesharing/Transport | ||

| Dyness/ Daqin New Energy Tech | Suzhou | 139.6 | Yes | C, B | B: Youshan Capital, C: CICC Capital | B: Eastern Bell Capital, Lion Partners Capital, Qinghao Capital, C: L Catterton, Jinqiu Fund (锦秋基金), Pegasus Capital, Qinghao Capital | Energy Storage & Batteries | CleanTech |

| DAS Solar | Quzhou | 139.6 | Yes | Pre-IPO | Beijing Financial street Capital Operation Group, Kingray Capital, GLP-C&D Investment Fund | SPIC Industrial Fund Management, Sinopec Capital, Huatai Juhua Industry Investment Fund (set up by Huatai Zijin Investment ),and others | Energy Storage & Batteries | N/A |

| TopOlefin Technology | Quzhou | 138.9 | B | Kingray Capital, Raystone Capital | Shangrong Capital Management, FG Venture, Zhejiang SUPCON Technology, and others | Materials | N/A | |

| CloudMinds/Dataa Robotics | Shanghai | 138.1 | C | China-Singapore Guangzhou Knowledge City Investment & Development, Shanghai Guosheng Group, Shuimu Capital/Watere Capital | Business Support Services | Robotics & Drones | ||

| ENNOVA Tourism | Beihai | 131.6 | Equity Financing | Tibet Tourism | Transportation Services | N/A |

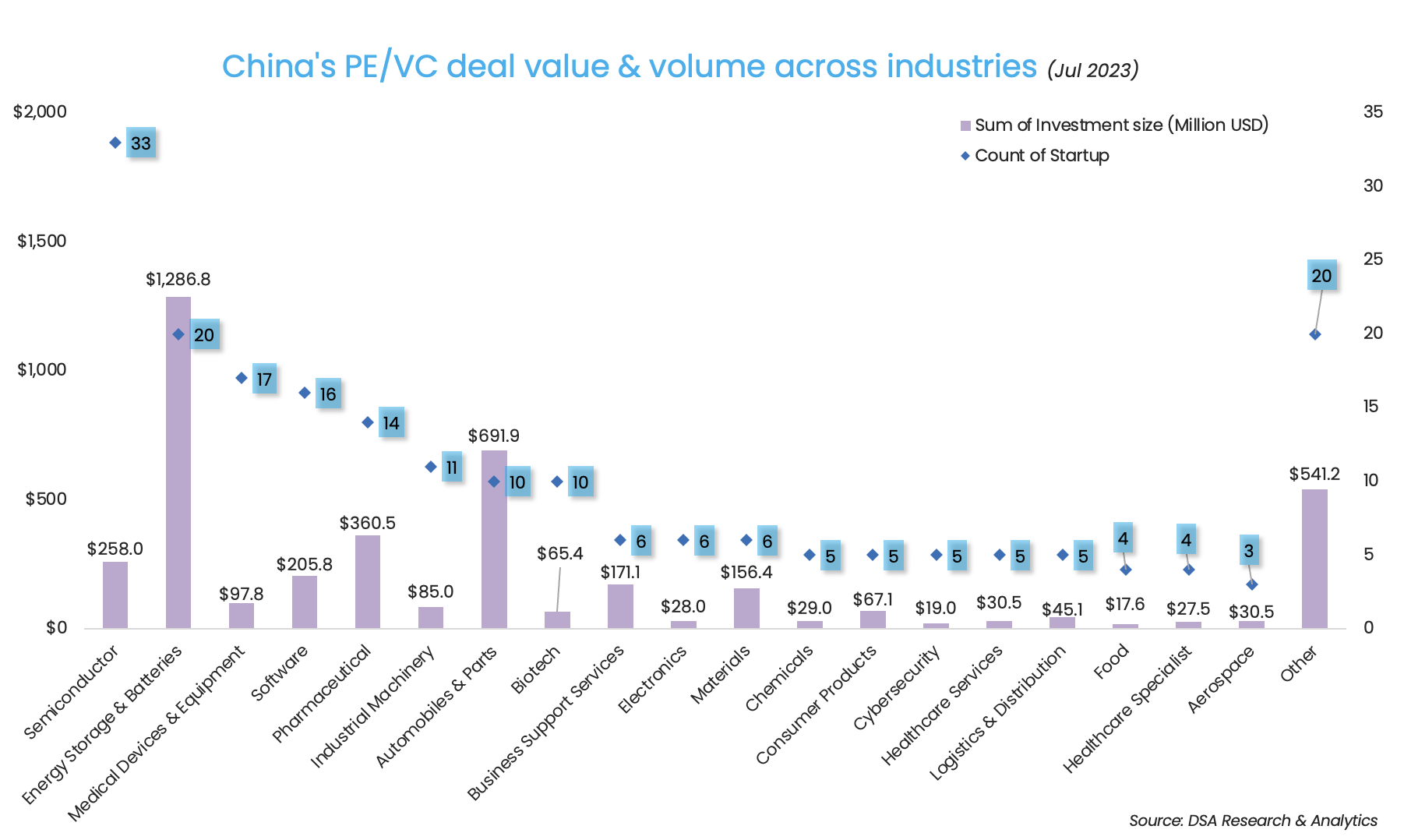

Energy storage grabs interest

The energy storage sector continued to ride on a tailwind in July, sealing 20 deals worth $1.3 billion. In one of the biggest deals in this sector, Astronergy, a subsidiary of electrical components manufacturer Chint Group, raked in 2 billion yuan ($280.1 million) in a Series C financing round.

Energy storage and batteries — which rose to be one of the key drivers in the country’s energy transition — outshined semiconductors since May and snapped the most funds from investors. In comparison, chip-making firms closed 33 deals worth only $258 million in the month.

Four of the month’s megadeals belonged to the energy storage sector including Dyness, a major manufacturer and provider of energy storage solutions, as well as photovoltaic cells and modules maker DAS Solar.

Addor Capital tops investor list

Early-stage venture capital firm Addor Capital, backed by state-affiliated Jiangsu High-tech Investment Group, topped the investor list, participating in seven deals. The seven startups raised a total of $29.5 million.

CICC Capital, the flagship private equity unit of Chinese investment bank China International Capital Corp Ltd, and its affiliates ranked second in terms of deal count. The state-affiliated investors pumped around $1.1 billion into six privately owned Chinese firms.

China Life Insurance, the country’s largest state-owned financial insurance corporation and its affiliates, was the top investor in terms of deal value. The firm and its affiliates injected around $1.2 billion into four startups.

| Investment company | No. of deals | Total value of participated deals (Million USD) | Lead | Non-lead |

|---|---|---|---|---|

| Addor Capital | 7 | 29.5 | 3 | 4 |

| CICC and affiliates | 6 | 1093.2 | 3 | 3 |

| Legend Holdings’ affiliates | 4 | 45 | 3 | 1 |

| Eastern bell Capital | 4 | 182 | 1 | 3 |

| HongShan (previously Sequoia Capital China) | 4 | 173.2 | 0 | 4 |

| China life’s affiliates | 4 | 1151.3 | 1 | 3 |

| Cowin Capital | 4 | 24.3 | 4 | 0 |

| FreesFund | 4 | 125.5 | 0 | 4 |

| Orient Jiafu Asset Management | 3 | 11.3 | 2 | 1 |

| Lotus Lake Capital | 3 | 263.5 | 0 | 3 |

| Matrix Partners China | 3 | 625.2 | 2 | 1 |

| GAC Capital (affiliated with GAC Group) | 3 | 111.3 | 2 | 1 |

| Goldport Capital | 3 | 88.8 | 1 | 2 |

| Glory Ventures | 3 | 33.2 | 2 | 1 |

| State Development & Investment Corporation (SDIC) and affiliates | 3 | 871.2 | 2 | 1 |

| MiraclePlus | 3 | 8.4 | 0 | 3 |

| GLP & affiliates | 3 | 601.5 | 2 | 1 |

| Hillhouse Capital Group & affiliates | 2 | 14.5 | 0 | 2 |

Related Stories

Venture Capital

SE Asia Deals Barometer Report: Lazada's capital raising lifts startup funding to 11-month high of $1.78b in July

Investors poured $1.78 billion into Southeast Asian startups in July this year—an 11-month high.

Venture Capital

India Deals Barometer Report: Startup investments drop to 3-year low at $564m in July

Indian startups are staring at an uncertain future as private equity and venture capital investments in the country dropped to a three-year low at $564 million in July, according to proprietary data compiled by DealStreetAsia.