India Deals Barometer Report: Startup investments drop to 3-year low at $564m in July

Indian startups are staring at an uncertain future as private equity and venture capital investments in the country dropped to a three-year low at $564 million in July, according to proprietary data compiled by DealStreetAsia.

Startup funding in India had hit a bottom low of $416 million in June 2020, post the COVID-19 outbreak.

The fundraising in July also marked a drop of about 13% over June, when startups had collectively scooped up $652 million, as investors continue to tighten their purse strings amid the heightened economic volatility. The month also saw the deal count slipping to 76 from 90 in the previous month.

On a year-on-year basis, the funding value dropped almost 36% from $885 million last year. The deal volume, too, fell by the same percentage from 119 transactions in July 2022.

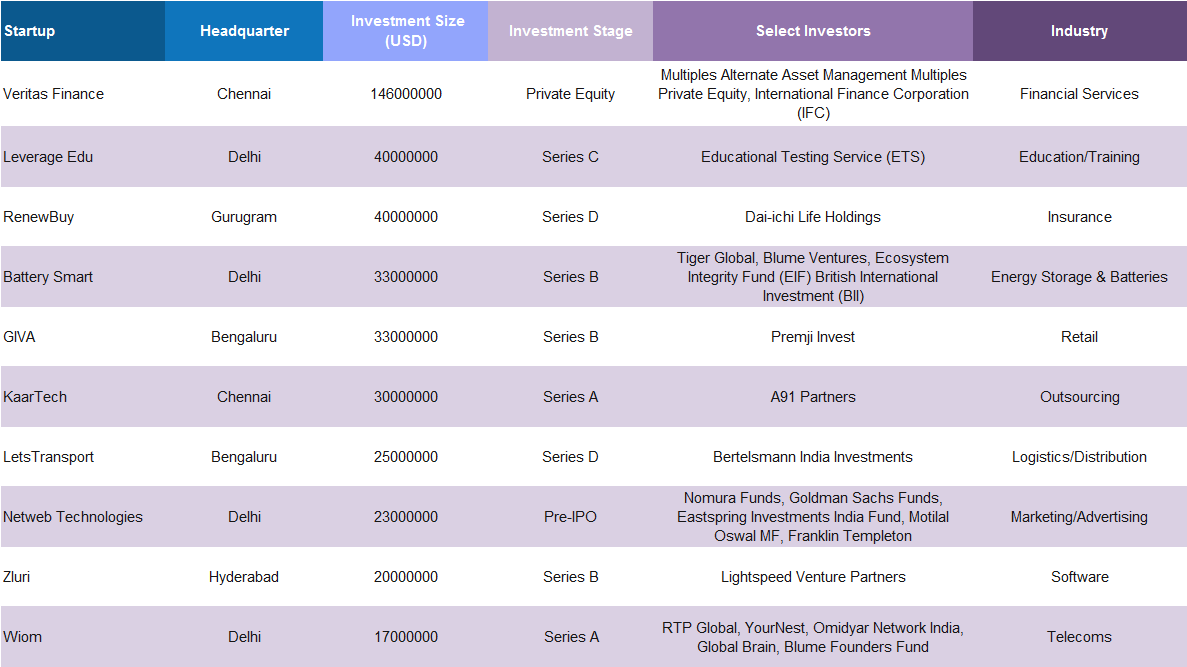

The only mega deal, or transaction worth at least $100 million, was closed by Chennai-based Veritas Finance, a non-banking financial company (NBFC) that focuses on lending to micro, small, and medium enterprises (MSMEs) in India.

The company raised as much as Rs 1,200 crore (around $146 million), of which the majority of Rs 1,050 crore was pumped in by Renuka Ramnath-led Multiples Alternate Asset Management Multiples Private Equity along with its co-investor International Finance Corporation (IFC).

Top 10 funding deals in July

No Indian startup has made it to the unicorn club in over three quarters, the longest dry spell since 2018. Goa-based Molbio Diagnostics was the last to turn unicorn in September 2022 after raising $85 million in a funding round led by Singapore-based Temasek.

Amid an extended funded winter, startups continue to cut costs and lay off staff to stay afloat. Thousands lost their jobs amid a deepening funding winter in 2022, and the layoff spree continues in 2023.

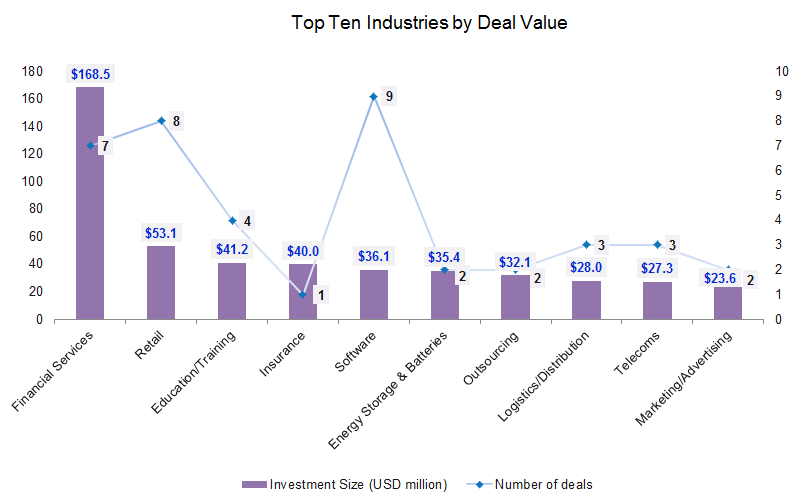

Financial services leads the pack

Financial services remained the most funded industry in the month, raising a total of $168.5 million across seven transactions. While the volume halved, the value rose 34% over June. Among the top fundraisers were Veritas Finance ($146 million), Efficient Capital Labs ($7 million), Shardeum ($5.4 million), Varashakti Housing Finance ($4.3 million), and FincFriends ($3.5 million).

Retail startups accounted for the second-largest share at $53.1 million in terms of deal value. Eight retail startups that raised funding in the month included GIVA ($33 million), SmartDukaan ($10 million), Freakins ($4 million), Solethreads ($3.7 million), DusMinute ($1.4 million), Louis Stitch ($609,756), Redesyn ($426,584), and Vinculum Group.

In comparison, startups in the retail industry secured a total of $121.5 million through eight transactions in June.

Four startups within the education/training industry, led by LeverageEdu, raised an aggregate of $41.2 million. LeverageEdu, an edtech platform that caters to students looking to study overseas, alone raised $40 million in its Series C funding round led by Princeton-based language testing conglomerate ETS. The financing also saw the participation of existing investors such as Blume Ventures, DSG Consumer Partners, and Kaizenvest PE.

The other three deals within the education sector were Immersive Labz ($1 million), Just Learn ($198330), and Metabook XR.

Together the top three industries – financial services, retail, and education/training – raised a total of $262.8 million, accounting for about 47% of the total deal value in the month.

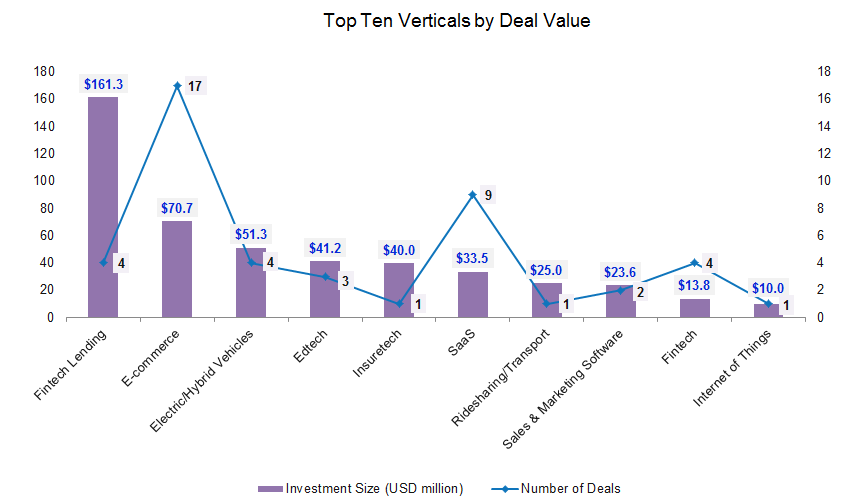

Meanwhile, fintech lending, e-commerce, and electric/hybrid vehicles were the top three funded verticals with $161.3 million, $70.7 million, and $51.3 million funding, respectively.

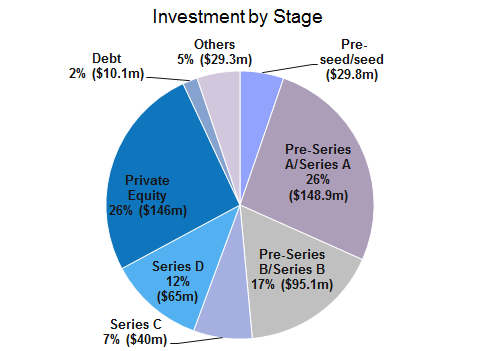

Growth-stage deals grab lion’s share

In terms of value, growth-stage startups led the fundraising in July. Companies in the Series B or post-Series B rounds (including private equity rounds) collected an aggregate of $337 million through eight transactions, accounting for about 60% of the deal value in the month. This is, however, marginally low compared with $384 million worth of growth-stage deals closed in June.

The prominent growth-stage deals in July included Veritas Finance ($146 million), Leverage Edu ($40 million), RenewBuy ($40 million), Battery Smart ($33 million), GIVA ($33 million), and LetsTransport ($25 million).

Pre-seed and seed stage deals were down almost 68% to $29.8 million from $92.1 million in June. The deal volume was also down to 22 from 36 in the previous month. Among the prominent seed deals were Shardeum ($5.4 million), Effectiv ($4.3 million), Freakins ($4 million), Pingsafe ($3.3 million), Blit ($3 million), and Hector Global ($2.1 million).

Meanwhile, startups in the pre-Series A and Series A stages collectively garnered $148.9 million across 32 transactions. This is almost double the amount raised in June. In the biggest Series A round, digital transformation consulting company KaarTech raised $30 million as part of fresh funding from A91 Partners.

Debt funding was also down to $10.1 million across two transactions in July from $38.1 million across four transactions in the previous month.

Top investors

Blume Ventures, along with its Blume Founders Fund, was the top investor in July with a total of seven investments. The venture capital firm led investments in engineering hardware startup Ethereal Machines, blue-collar workforce management platform Smartstaff, denimwear brand Freakins, and battery-swapping platform Battery Smart.

Blume Ventures made the final close of its fourth India-dedicated fund with a corpus of $250 million last December. This June, the firm marked the first close of its new opportunity fund, Fund 1Y, at nearly $25 million.

Venture Catalysts, along with its accelerator fund 9Unicorns, made it to the second spot with a total of six investments.

Inflection Point Ventures was at the third spot with a total of four investments, including hyperlocal grocery store DusMinute, B2B commerce enabler Beyobo, women’s nourishment brand Nutrizoe, and drone manufacturer InsideFPV.

In June, the venture firm announced that it made 12 exits from its portfolio companies in 2022, giving an internal return rate (IRR) of 160% to its investors. Some of the key exits included high-performing startups like BluSmart, Otipy, Stage, and Buyofuel.

Meanwhile, venture debt firm Alteria Capital, Peak XV’s Surge, and angel investing platforms Hyderabad Angels and Mumbai Angels made three investments each.

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

China Deals Barometer Report: Startup fundraising volume, value sees a decline in July

Startup fundraising in Greater China dipped slightly in both deal value and volume terms in July, which recorded 205 deals worth $4.2 billion.

Venture Capital

SE Asia Deals Barometer Report: Lazada's capital raising lifts startup funding to 11-month high of $1.78b in July

Investors poured $1.78 billion into Southeast Asian startups in July this year—an 11-month high.