China Deals Barometer Report: At $2.6b, PE-VC dealmaking hits record low in March

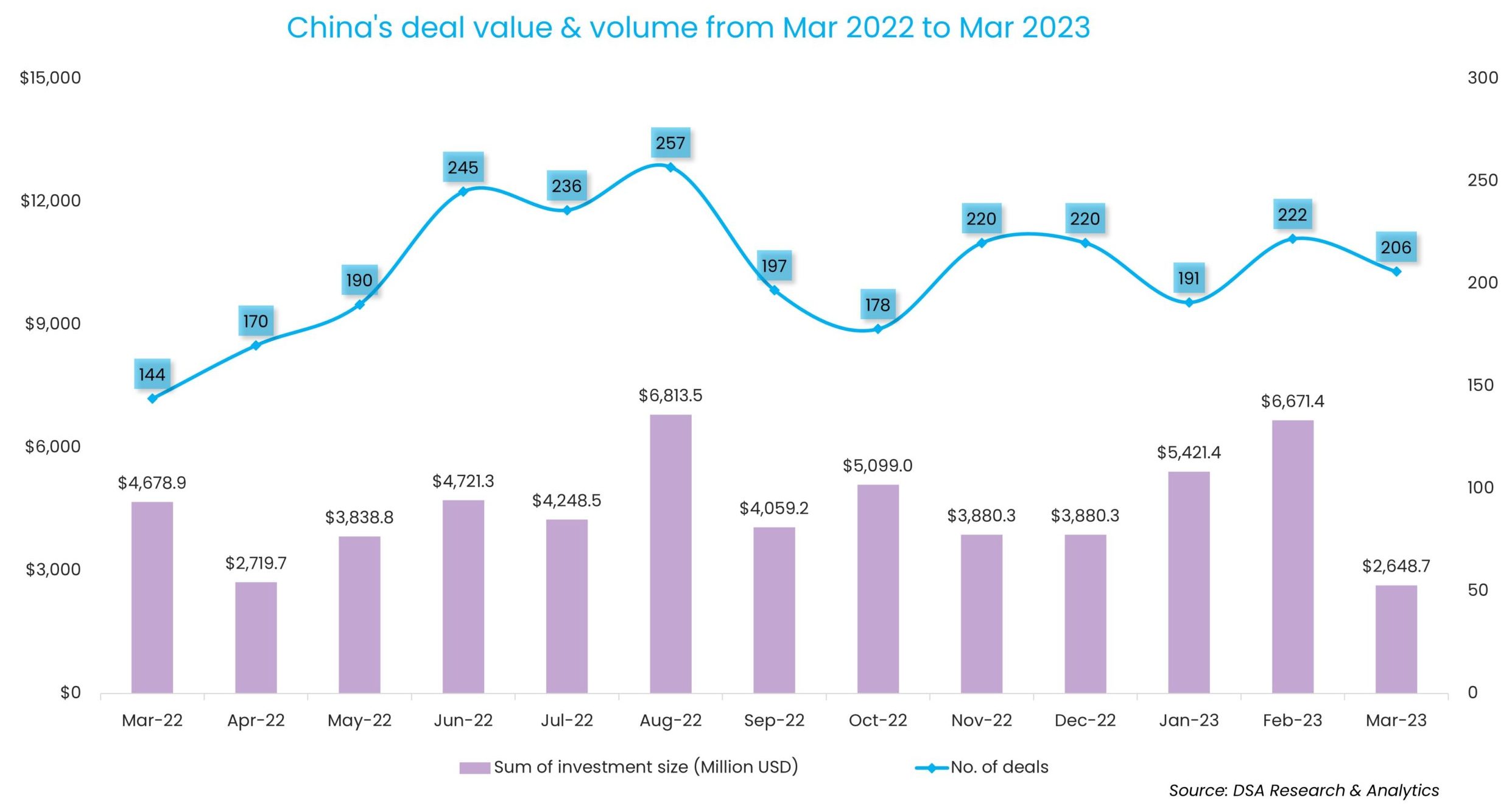

March 2023 was a sluggish month for startup fundraising in Greater China as the number of venture deals and the capital raised, took a severe hit.

Privately-held startups in mainland China, Hong Kong, Macau, and Taiwan collectively raised $2.6 billion in the month— the lowest since DealStreetAsia started tracking deals of all sizes in April 2020. The deal value was down 60.3% from February, mostly due to the lack of big-ticket deals.

In contrast, February was a strong month for fundraising as startups raised $6.7 billion, the highest monthly deal value since September 2022.

There were 206 venture deals in March, down 7.2% month-on-month.

Monthly deal count was 43.1% higher compared with March 2022, but the funding value was 43.4% less than the $4.7 billion recorded a year ago, signifying a shift to smaller deals.

Megadeals become scarce

March saw the completion of five megadeals, or investments worth at least $100 million. Among them, the five deals raised $947.8 million, or 36% of the month’s total fundraising.

In February, six megadeals were sealed, which raised a total of over $4.8 billion accounting for 72.5% of the month’s total financing. The average megadeal size was only $189.6 million in March compared to that of $800 million in the previous month.

JD Industrials, a subsidiary of JD.com that delivers industrial maintenance, repair and operations (MRO) products and services was the biggest fundraiser of March, raking in $300 million in a Series B round. The lead investors in the round included Abu Dhabi’s sovereign wealth fund Mubadala Investment Company and 42XFund, a $10 billion tech fund under Abu Dhabi-based AI company G42.

United Aircraft Group, which engages in the R&D and production of unmanned aerial vehicles (UAV), sealed the second-biggest investment — a Series D round of 2 billion yuan ($290.8 million) led by Chengdu Heavy Industry Longjin, a 40-billion-yuan ($5.8 billion) state-affiliated Fund of Funds (FoF).

In another megadeal in March, electric taxi maker Itbox sealed a 1 billion yuan ($145.2 million) investment in equity financing from two state-affiliated investors, as well as Chinese carmaker Haima Automobile.

List of megadeals in Mar 2023

| Startup | Headquarters | Investment size (Million USD) | Investment stage | Lead investor(s) | Other investor(s) | Industry/Sector | Vertical |

|---|---|---|---|---|---|---|---|

| JD Industrials | Beijing | 300 | B | Mubadala Investment Company, Abu Dhabi’s 42XFund | M&G, BPEA EQT, Sequoia Capital China | Business Support Services | E-Commerce |

| United Aircraft Group | Shenzhen | 290.8 | D | Chengdu Heavy Industry Longjin | China’s National Manufacturing Transformation and Upgrade Fund, Chengdu Heavy Industry Qingyue Fund, Anhui Quantum Science Industry Development Fund, CoStone Capital, and others | Aerospace | AI and Machine Learning |

| ITBox | Beijing | 145.2 | Equity Financing | Zhongyu New Energy Vehicle Industry Fund, Henan Intelligent Connected New Energy Vehicle Development, Haima Automobile | Automobiles & Parts | Electric/Hybrid Vehicles | |

| DeepWay | Beijing | 111.8 | A+ | Shandong Weiqiao Pioneering Group, SoftBank China Venture Capital (SBCVC) | Qiming Venture Partners | Automobiles & Parts | Electric/Hybrid Vehicles |

| EVAHEART/Yongrenxin Medical Instrument | Chongqing | 100 | A | Sinovac Biotech | Taiping Healthcare Fund (affiliated with China Taiping Insurance Holdings), Vivo Capital | Medical Devices & Equipment | HealthTech |

Investments largely took place in startups at Series A stage, while dealmaking remained a laggard in companies closer to a public listing. The 110 deals in the earliest funding stages accounted for more than half of the deal count in March. In contrast, PE-VC deal activity at Series E and later funding stages was completely absent in March, compared with three deals in February.

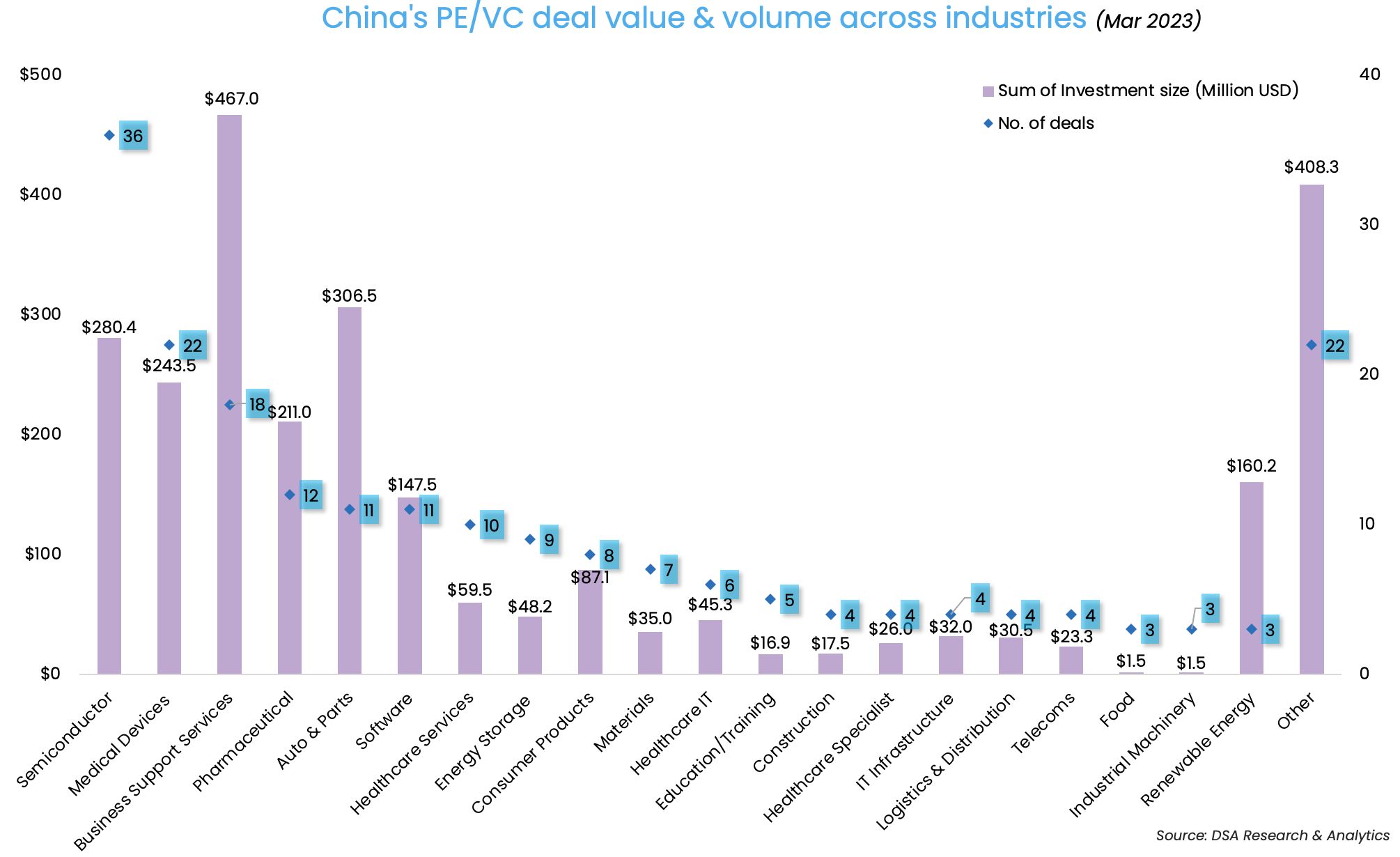

Semiconductor top deal count list

Semiconductor continued to evince investor interest, as evidenced in the deal count. As many as 36 semiconductor startups collected a total of $280.4 million in March. While deal count rose from 27 in February, the investment value dropped by 40.5% in March, meaning investors were more cautious in their capital deployment.

The medical devices industry became the second most-invested sector in March with 22 startups raising a total of $243.5 million. But the lion’s share of the total investment sum came from Yongrenxin Medical Instrument, known as the maker of the implantable artificial heart Evaheart, which notched $100 million in a Series A round led by vaccines maker Sinovac Biotech to build a healthcare platform dedicated to heart failures and severe heart diseases.

Dealmaking in the business support services industry also saw significant action with 18 firms raking in a combined $467 million, making it the most-funded industry. Similarly, a large proportion of financing went into the sector was pocketed by JD Industrials, in a funding round joined by UK-headquartered asset management group M&G, and buyout giant BPEA EQT, as well as existing shareholder Sequoia Capital China.

Sequoia China and its seed fund unit top investor list

Sequoia Capital China and Sequoia China Seed Fund, its investment unit focusing on seed and angel stage deals, was the most active investor by deal value in March pumping in $333.5 million across six deals. The month marked a comeback for the firm and its affiliate since they last notched the top place in July 2022.

The comeback came shortly after Sequoia Capital’s Chinese affiliate confirmed to DealStreetAsia on February 28 that it had officially started deploying capital from a $480-million vehicle as the investor moves ahead with early-stage dealmaking anticipating an expected market rebound in China.

Qiming Venture Partners, founded in 2006, which invests in the Technology and Consumer (T&C) and Healthcare industries at the early and growth stages, was ranked as the second most active investor in the list — by investing $225.8 million in six deals. The firm currently manages eleven US Dollar funds and seven RMB funds with $9.4 billion in capital raised, according to its website.

CICC Capital, the flagship private equity (PE) platform of China International Capital Corp (CICC), together with its affiliates, also invested in six deals, but $158.5 million in the month, making it the third most active investor.

List of top investors (Mar 2023)

| Investment company | No. of deals | Total value of participated deals (Million USD) | Lead | Non-lead |

|---|---|---|---|---|

| Sequoia Capital & Sequoia China Seed Fund | 6 | 333.5 | 1 | 5 |

| Qiming Venture Partners | 6 | 225.8 | 5 | 1 |

| CICC Capital and affiliates | 6 | 158.5 | 3 | 3 |

| Shunwei Capital | 6 | 141.6 | 2 | 4 |

| Shenzhen Capital Group | 6 | 102.5 | 3 | 3 |

| Addor Capital | 6 | 72 | 1 | 5 |

| Matrix Partners China | 4 | 30.5 | 1 | 3 |

| CDH Investments | 3 | 58.1 | 1 | 2 |

| Eight Roads Ventures | 3 | 50.5 | 1 | 2 |

| Hankang Capital | 3 | 43.5 | 2 | 1 |

| Cowin Capital | 3 | 30.5 | 2 | 1 |

| Founder H Fund | 3 | 30.5 | 1 | 2 |

| Sinovation Ventures | 3 | 26 | 1 | 2 |

| BlueRun Ventures China | 3 | 17.5 | 3 | 0 |

| Linear Capital | 3 | 4.5 | 2 | 1 |

| *”Total value of participated deals (Million USD)” refers to the total amount of capital raised by the respected startup in the round, including capital from the listed investor as well as other participating investors. If one deal is backed by only two investors, we consider neither of the two investors as a lead investor. |

Note: In our monthly analysis for March 2023, we have put together detailed charts of prominent deals, active investors, deal stages, and the most attractive sectors that have bagged the maximum venture dollars in the Greater China region.

Our database only considers deals officially announced by the related investee, investor(s), and/or financial advisor, while information based on market rumours and news reports citing sources is excluded.

For a more detailed analysis, and to enable comparison between primary and secondary markets, DealStreetAsia has started tracking deals of all sizes since April 2020, as against considering only transactions worth more than $10 million earlier.

We have also introduced a standardised system for industry classification. It currently includes over 50 industries, as well as over 45 new economy and high-tech verticals, which will progressively increase to adapt to local market conditions in our closely watched regions of Greater China, Southeast Asia, and India.

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

SE Asia Deals Barometer Report: Startup fundraising stays below $1b mark in March despite 90% MoM jump

Fundraising by Southeast Asian startups touched $781 million across 76 deals in March...

India Deals Barometer Report: Startup fundraising jumps 60% to $1.4b in March

Indian startups raked in $1.38 billion in funding in March, recording a jump of about 60% over February when they had amassed $866 million from risk capital investors...