India Deals Barometer Report: Startup fundraising jumps 60% to $1.4b in March

Indian startups raked in $1.38 billion in funding in March, recording a jump of about 60% over February when they had amassed $866 million from risk capital investors, show proprietary data compiled by DealStreetAsia.

The steep jump can be attributed to some of the big-ticket transactions that were closed during the month including eyewear retailer Lenskart’s $500-million fundraising from a wholly-owned subsidiary of Abu Dhabi Investment Authority (ADIA). Post the investment, ADIA will become one of the largest shareholders in Lenskart.

Meanwhile, deal volume continued to slacken at 70 in March as against 76 transactions in February, thus hinting at an extended funding winter that began towards the second half of 2022.

On a year-on-year basis, deal value was down almost 66% from $4 billion in March 2022. Besides, deal volume more than halved from 163 in the year-ago month. Indian startups raked in at least $2.38 billion across 93 venture capital and private equity transactions in March 2021.

There were at least four mega deals, or transactions worth at least $100 million, in March 2022 that accounted for 66% of the total deal value, the data showed. In comparison, there were only three mega transactions in February, accounting for about 41% of the total deal value.

Top ten deals in March 2023

Lenskart’s $500-million deal topped the funding chart in March. It was also the single largest deal announced by an Indian startup in the past 12 months. Other top grossers of the month included digital payments company PhonePe ($200 million), supply-chain financing platform Mintifi ($110 million), and clinical-stage biotechnology company Bicara Therapeutics ($108 million).

India has not produced a single unicorn so far in 2023. Healthtech startup Molbio Diagnostics was the last to achieve the unicorn status in September 2022. Unicorn is a term commonly used to describe startups valued at $1 billion or more.

Lenskart deal pushes retail to top

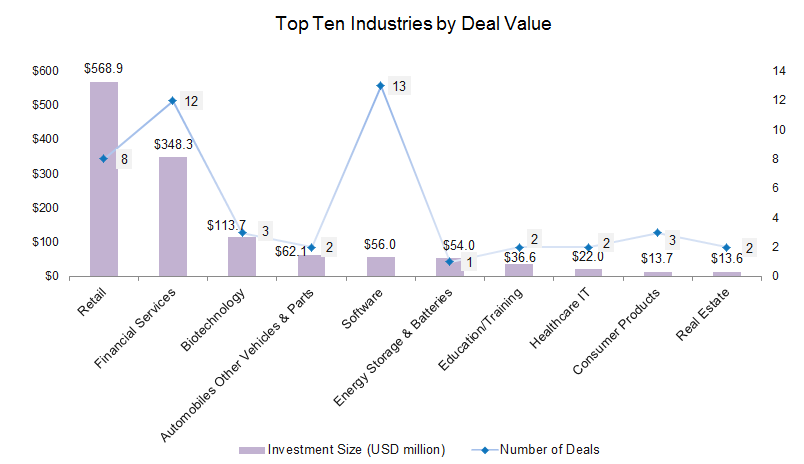

Among the most funded industries in March 2023 were retail, financial services, biotechnology, automobiles, and software. The retail industry, led by the Lenskart deal, scooped up $568.9 million across eight transactions. Other deals within the industry were Fashinza ($30 million), The Souled Stores ($16.4 million), Jumbotail ($9.1 million), and Sorted ($5 million).

In comparison, financial services startups secured a total of $132.7 million across seven transactions in March and biotechnology startups raised a total of $113.7 million across three transactions.

Together the top three industries – retail, financial services and biotechnology – raised $1.03 billion or 75% of the total deal value in the month.

The fintech sector was the second most favourite vertical in March with total funding of $348 million topped by PhonePe’s $200 million deal. The money was injected by its majority backer Walmart Inc. at a pre-money valuation of $12 billion.

Mintifi’s $110-million round was another big funding deal within the industry. The startup’s Series D round was led by Premji Invest, and saw the participation of existing investors Norwest Venture Partners, Elevation Capital, and the International Finance Corporation (IFC). Other prominent deals within financial services were: Growfin ($7.5 million), GrayQuest ($7 million), Zaggle ($6.09 million), Aerem ($5 million), and Nimbbl ($3.5 million), among others.

Big deals make a comeback

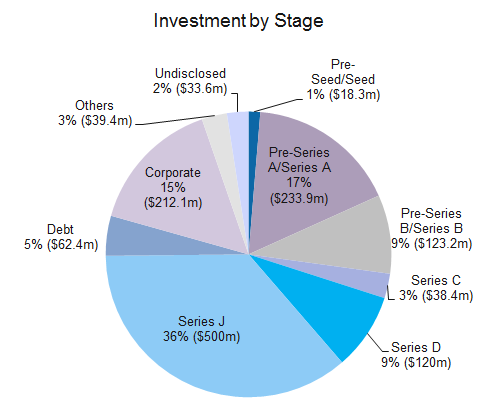

Funding in growth- stage startups saw an uptick in the month with investors pumping a total of $771 million in eight companies between the Series B and Series J stages. In comparison, growth-stage startups raked in an aggregate of about $367.6 million through eight transactions in February.

Startups that raised growth rounds in March include Lenskart (Series J), Mintifi (Series D), Bicara Therapeutics (Series B), HealthPlix Technologies (Series C), The Souled Store (Series C), Bira 91 (Series D), DesignCafé (Series B), among others.

The value of pre-seed and seed stage deals more than halved to $18.3 million in March from $48.8 million in February. Deal volume also fell to touch 17 transactions in March from 26 in the previous month. Sorted, Yellow Metal, Uravu Labs, Houseware, Univest, Finsire, Store My Goods, and Serigen Mediproducts were among the startups that raised seed rounds during the month.

Pre-Series A and Series A stage deals also dropped 19% to $233.9 million across 25 transactions. Charge+Zone raised the largest Series A round worth $54 million led by global impact investment management firm BlueOrchard Finance. There were five debt deals worth $62.4 million in March as against four deals worth $47.3 million in February.

Most active investors

Venture debt provider Alteria Capital emerged as the most active investor in March with a total of four investments including in ayurvedic female-tech brand Gynoveda, business-to-business (B2B) e-commerce company Jumbotail, D2C silver jewellery startup GIVA, and home interior solutions startup DesignCafé.

The firm hit the first close of its third fund at $121.3 million (Rs 1,000 crore) in October last year. The fund is seeking to raise a total of Rs2,000 crore ($242.6 million) for the third vehicle. With assets under management of Rs3,800 crore across three funds, Alteria claims to currently manage the largest venture debt capital pool for Indian startups.

Inflection Point Ventures, Blume Ventures, and PremjiInvest occupied the second spot with three investments each. Other key investors include India Accelerator, Chiratae, Sequoia Capital, Sixth Sense Ventures, and Elevation Capital.

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

China Deals Barometer Report: At $2.6b, PE-VC dealmaking hits record low in March

March 2023 was a sluggish month for startup fundraising in Greater China as the number of venture deals and the capital raised, took a severe hit...

Venture Capital

SE Asia Deals Barometer Report: Startup fundraising stays below $1b mark in March despite 90% MoM jump

Fundraising by Southeast Asian startups touched $781 million across 76 deals in March...