China Deals Barometer Report: May was second weakest month so far for startup fundraising in 2023

May was the second weakest month this year for startup fundraising in Greater China. Privately-held startups in mainland China, Hong Kong, Macau, and Taiwan collectively raised $2.8 billion in the month across 197 deals.

Deal value was down 18% from April due to the scarcity of big-ticket deals. Deal count, too, dropped 4.8% month-on-month.

Monthly funding value was also 28% below levels seen in May 2022 ($3.8 billion), when China was still under the stringent COVID-19 lockdown. The deal count was, however, marginally higher than May 2022’s 190 transactions.

Despite the slump in May, startup fundraising so far this year has been promising. The aggregate deal value of $20.8 billion in the first five months of 2023 is 10.3% more than the $18.9 billion raised in the same period last year.

The growth was more pronounced in terms of deal count, which jumped 40% year-on- year to 1,022 in Jan-May 2023.

New energy firms clinch megadeals

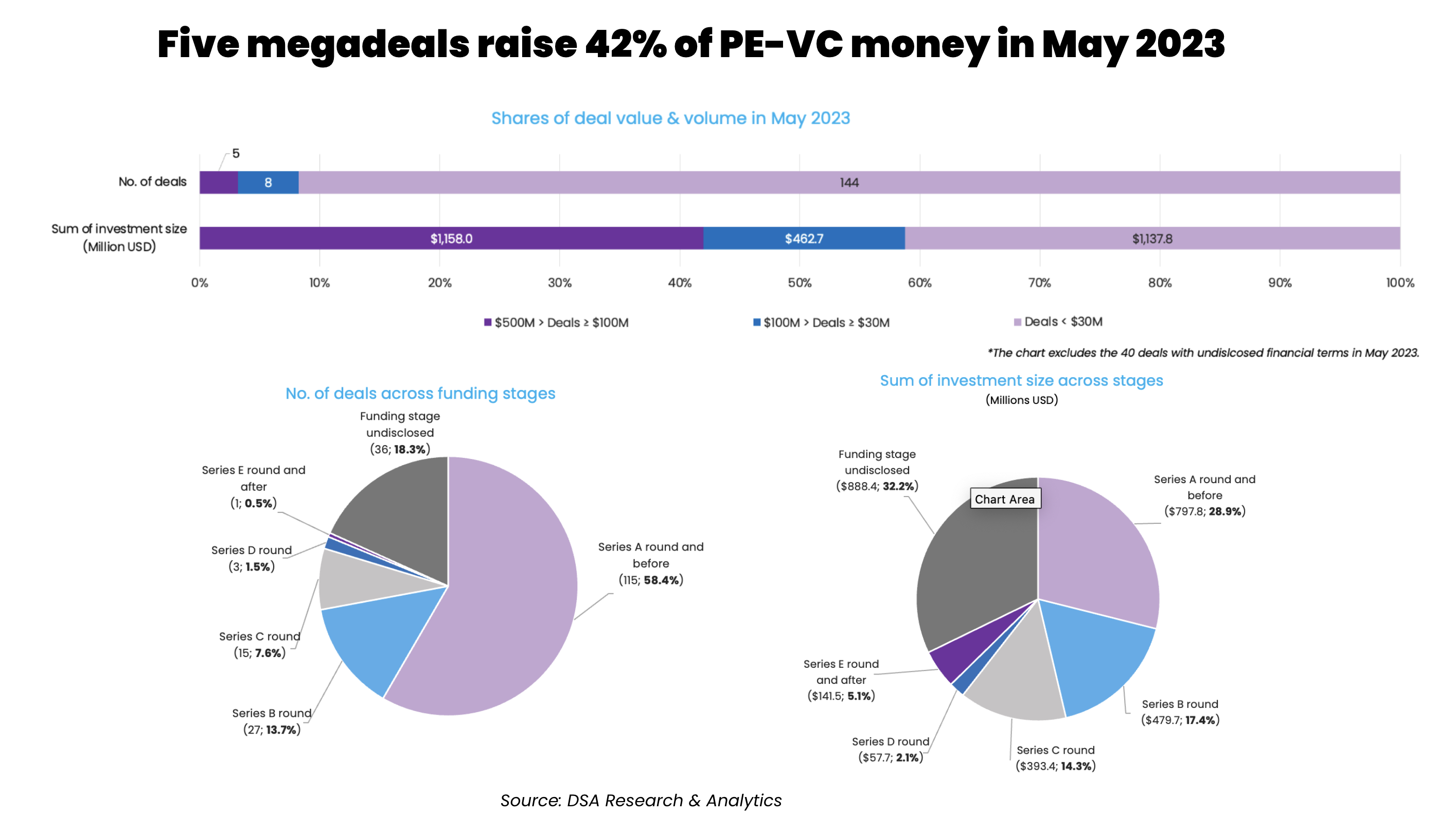

Although billion-dollar deals were absent in May, the month saw the completion of five megadeals, or investments worth at least $100 million. Among them, the five transactions secured a total of $1.2 billion, or 42% of the month’s total fundraising.

The top deal of the month involved solid-state lithium-ion battery maker QingTao (Kunshan) Energy Development, in which state-owned automaker SAIC Motor Corp proposed a 2.7 billion yuan ($382.2 million) investment subject to approval from existing shareholders.

Yunnan National Titanium Metal, a subsidiary of Shenzhen-listed LB Group, was the second-biggest fundraiser of the month. The titanium sponge maker bagged 2.272 billion yuan ($321.2 million) in an equity financing round, roping in a total of 19 strategic investors including Shenzhen Capital Group, the venture investment vehicle of the Shenzhen government.

New energy firm Qingdian Group’s photovoltaic arm Qingdian Guangfu Keji, notched 1.5 billion yuan ($213.1 million) in a Series A funding round led by state-affiliated investors Hefei Industry Investment Group, and Beijing Energy Holding, making it the third largest investment of the month.

Fox ESS, a Chinese developer of solar inverters and energy storage solutions, also secured over 1 billion yuan ($141.5 million) in its pre-initial public offering (IPO) funding round led by Sparkedge Capital.

Fox ESS, Qingdian and QingTao were the three fundraisers from the new energy sector in the month, which is currently seeing increased interest given the country’s ambition to raise non-fossil fuel energy consumption to 25% of overall energy consumption by 2030.

Unsurprisingly, the most active dealmaking took place in Series A and earlier stages, where 115 deals, or 58.4% of the month’s total deal count, was sealed. They cumulatively raised $798 million, or 28.9 % of the total deal value.

The proportion of capital inflows into Series D deals narrowed to $57.7 million in May, or 2.1% of the investment sum, compared to $990 million, or 23.3% of the total capital raised in April, signifying a drop in late-stage investments. Fox ESS’s 1 billion yuan ($141.5 million) investment was the only pre-IPO deal that took place in the month.

Megadeals in Greater China (May 2023)

| Startup | Headquarters | Investment size (Million USD) | Investment stage | Lead investor(s) | Other investor(s) | Industry/Sector | Vertical |

|---|---|---|---|---|---|---|---|

| QingTao Energy Development | Kunshan | 382.2 | Equity Financing | SAIC Motor Corp | Energy Storage & Batteries | CleanTech | |

| National Titanium Metal | Chuxiong | 321.2 | Equity Financing | Shenzhen Capital Group, New Materials Fund (affiliated with China National Building Material), Shang Qi Capital (affiliated with SAIC Motor Corp) | Materials | N/A | |

| Qingdian Photovoltaic Technology/Qingdian Guangfu Keji | Hefei | 213.1 | A | Hefei Industry Investment Group, Beijing Energy Holding | Broad River Capital, Shenzhen DG Capital Management, Sany Renewable Energy | Renewable Energy | CleanTech |

| Fox ESS | Wenzhou | 141.5 | Pre-IPO | Ori-mind Capital/Sparkedge Capital | Energy Storage & Batteries | CleanTech | |

| Coherent Biopharma | Suzhou | 100 | B, B+ | B: HM Capital, B+: Shengdi Investment (affiliated with Jiangsu Hengrui Pharmaceuticals) | B: ABC International Holdings Limited (affiliated with Agricultural Bank of China Limited),V-Capital, Suzhou Harvest Capital Management, 6 Dimensions Capital, B+: Shanghai Alliance Investment, Hefei Industry Investment Holding, Hefei High-tech VC, Suzhou Industrial Park Science and Technology Innovation Fund | Pharmaceutical | Biotech |

Energy storage firms raise the most funds

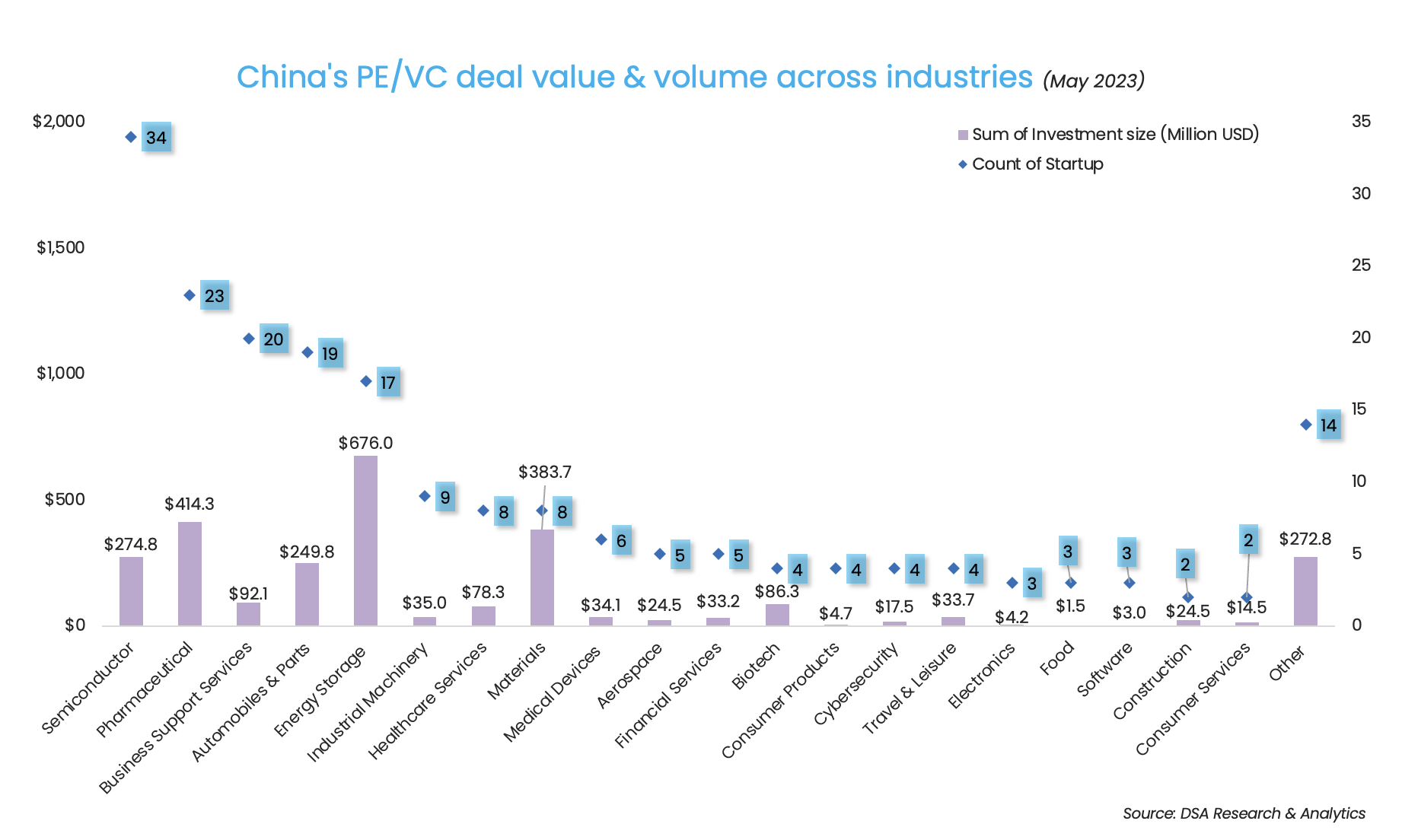

Riding on China’s clean energy transition ambition, energy storage received the most funding in May—$676 million across 17 deals.

China is predicted to become energy self-sufficient by 2060, according to a report by Goldman Sachs. The report said an affordable renewable energy system, equipped with sufficient energy storage and smart grid transmission, will be key to achieving energy self-sufficiency.

Investments in Chinese chipmakers also continued in May. The semiconductor sector topped in terms of deal count in the month. As many as 34 chip-making firms collected a total of $274.8 million in the month.

Pharmaceutical was another sector that gained momentum with 23 firms bagging $414.3 million in the month. Biopharmaceutical firm Coherent Biopharma sealed the only megadeal in the sector, raising $100 million in a Series B and extended Series B round.

Addor Capital, SDIC & affiliates top investor list

Early-stage venture capital firm Addor Capital topped the investor list, together with State Development & Investment Corporation (SDIC), one of China’s largest state-owned investment holding companies, and its affiliates. Both investors completed five deals in May.

Addor Capital pumped in $61.5 million; while SDIC and its affiliates injected $45 million in the month in their investees.

Chinese state-owned automaker SAIC Motor Corp emerged as the top investor by deal value, splurging $7.3 billion across three privately-owned firms — TwinSolution Technology, which manufactures interconnects for testing semiconductor components, Yunnan National Titanium Metal, and QingTao (Kunshan) Energy Development.

The Shanghai-listed automaker plans to set up a 4-billion-yuan ($574.2 million) fund in cooperation with a group of domestic companies to invest in the automobile ecosystem. The fund will be managed by private equity (PE) investment platform Shang Qi Capital, per a stock exchange filing in March.

List of top investors (May 2023)

| Investment company | No. of deals | Total value of participated deals (Million USD) | Lead | Non-lead |

|---|---|---|---|---|

| Addor Capital | 5 | 61.5 | 3 | 2 |

| State Development & Investment Corporation (SDIC) and affiliates | 5 | 45 | 2 | 3 |

| Shenzhen High-Tech Investment Group | 4 | 43.5 | 0 | 4 |

| Oriental Fortune Capital | 4 | 32 | 1 | 3 |

| Shenzhen Capital Group | 4 | 364.7 | 1 | 3 |

| IDG Capital | 4 | 173.6 | 2 | 2 |

| CDH Investments | 4 | 30.5 | 0 | 4 |

| CD Capital | 4 | 115.8 | 1 | 3 |

| Oriza Holdings and affiliates | 4 | 32 | 1 | 3 |

| CITIC Group and its affiliates | 4 | 130.3 | 2 | 2 |

| Sequoia Capital China & Sequoia China Seed Fund | 4 | 32 | 1 | 3 |

| Fosun Pharmaceutical & affiliates | 4 | 30.4 | 2 | 2 |

| ABC International Holdings Limited | 3 | 100 | 0 | 3 |

| Ori-mind Capital/Sparkedge Capital | 3 | 255.8 | 1 | 2 |

| Hillhouse Capital Group and affiliates | 3 | 49.7 | 0 | 3 |

| Source Code Capital | 3 | 114.6 | 1 | 2 |

| Saic Motor Corp and affiliates | 3 | 726.2 | 1 | 2 |

| Jolmo Capital | 3 | 43.5 | 1 | 2 |

| Goldport Capital | 3 | 29.8 | 2 | 1 |

| HM capital | 3 | 157 | 1 | 2 |

| Yonghua Capital | 3 | 3 | 2 | 1 |

| Rising Investments | 3 | 0 | 2 | 1 |

| Legend Holdings’ affiliates | 3 | 58.5 | 1 | 2 |

| CICC and affiliates | 3 | 54.5 | 2 | 1 |

| *”Total value of participated deals (Million USD)” refers to the total amount of capital raised by the respected startup in the round, including capital from the listed investor as well as other participating investors. If one deal is backed by only two investors, we consider neither of the two investors as a lead investor. |

Note: In our monthly analysis for May 2023, we have put together detailed charts of prominent deals, active investors, deal stages, and the most attractive sectors that have bagged the maximum venture dollars in the Greater China region.

Our database only considers deals officially announced by the related investee, investor(s), and/or financial advisor, while information based on market rumours and news reports citing sources is excluded.

For a more detailed analysis, and to enable comparison between primary and secondary markets, DealStreetAsia has started tracking deals of all sizes since April 2020, as against considering only transactions worth more than $10 million earlier.

We have also introduced a standardised system for industry classification. It currently includes over 50 industries, as well as over 45 new economy and high-tech verticals, which will progressively increase to adapt to local market conditions in our closely watched regions of Greater China, Southeast Asia, and India.

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

SE Asia Deals Barometer Report: Startup fundraising crosses $1b for the first time this year in May

Startups in Southeast Asia raised $1.05 billion from 73 transactions in May, the first time that fundraising...

India Deals Barometer Report: At $1.5b in May, startup funding highest so far this year

Startups in India raked in a total of $1.55 billion across 89 private equity (PE) and venture capital (VC) transactions in May...