India Deals Barometer Report: At $1.5b in May, startup funding highest so far this year

Startups in India raked in a total of $1.55 billion across 89 private equity (PE) and venture capital (VC) transactions in May, the best so far in 2023, according to proprietary data compiled by DealStreetAsia. The growth was about 55% over April when startups had collectively garnered $1 billion through 72 transactions.

The jump in both value and volume came in as a breather to entrepreneurs as they have been staring at a funding winter ever since mid-last year owing to macroeconomic headwinds.

On a year-on-year comparison, the amount raised by startups is almost 30% lower than the high of $2.2 billion clocked in May 2022. The deal volume, too, has dropped by almost the same percentage from 127 in the year-ago period.

Of the total deals in May this year, it’s worthwhile to note that the value of 11 transactions was not disclosed.

After witnessing a huge high in 2021, venture capital funding took a nosedive across the world from the second quarter of last year with geopolitical tensions, equity market correction, higher interest rates, and higher inflation – all occurring in unison.

The impact has been such that the entire startup ecosystem has been mired in controversies with news pertaining to valuation correction and mass layoffs surfacing almost every second week.

In terms of mega deals (those at $100 million or above), May recorded five transactions worth $875 million, which comprised 56% of the total deal value in the month.

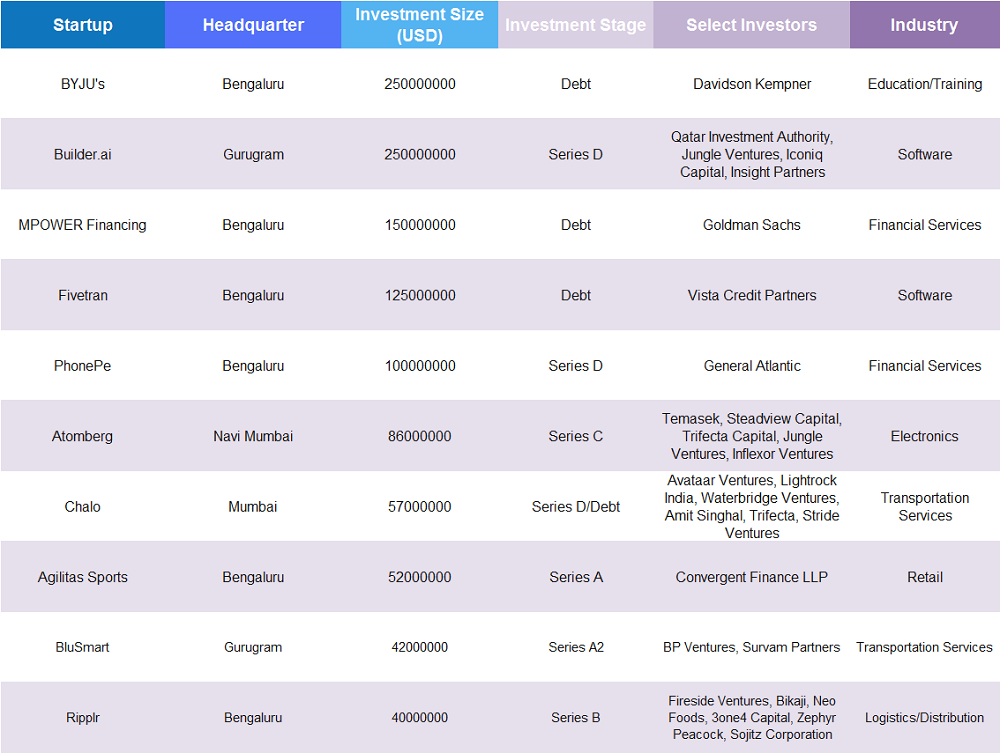

Despite all the controversies surrounding it, Indian edtech decacorn BYJU’s is understood to have clocked the biggest deal by raising $250 million in debt funding from US-based investment firm Davidson Kempner. According to media reports, the funding is part of a larger $1 billion round that the Bengaluru-based edtech company is trying to raise.

Top ten deals in May

Builder.ai, an AI-powered composable software platform, too, raised $250 million in its Series D funding round led by Qatar Investment Authority (QIA). The company’s existing and new investors, including Iconiq Capital, Jungle Ventures and Insight Partners also joined the round.

Other prominent deals in the month include fintech startup MPOWER Financing ($150 million), automated data integration platform Fivetran ($125 million), and digital payments startup PhonePe ($100 million).

The pace at which startups were turning unicorns dipped considerably in 2022. India has not seen a single startup enter the unicorn club since September last year. Unicorns are privately-held companies valued at $1 billion and above.

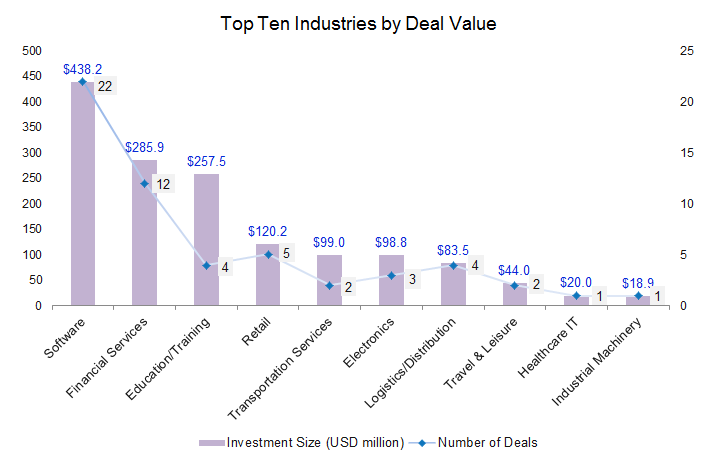

Software startups back in vogue

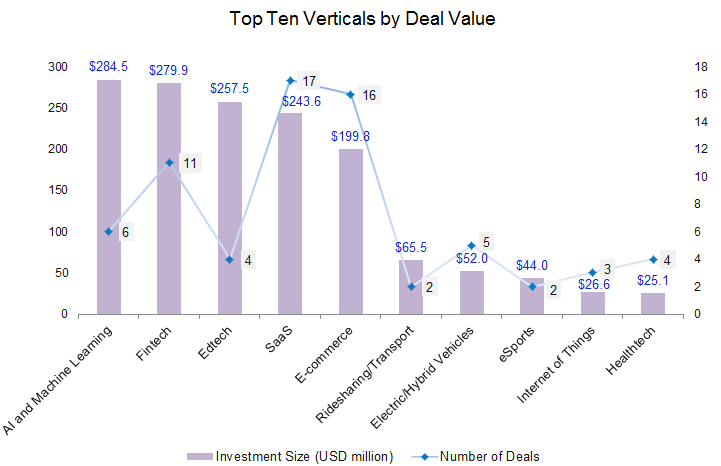

When broken down by industry, software emerged as the most funded industry in May with a total of $438.2 million in funding across 22 transactions. This is almost thrice the amount raised by software startups in the previous month. Two deals – Builder.ai ($250 million) and Fivetran ($125 million) helped pushed the industry to the top.

Other prominent deals within software included data analytics and artificial intelligence (AI) solutions company Course5 Intelligence ($28 million), AI-powered video creation platform Gan.ai ($5.25 million), sales platform RevenueHero ($5.1 million), and customer communications platform Thena ($5 million).

The financial services industry occupied the second spot with a total of $286 million in funding across 12 deals. MPOWER Financing and PhonePe were the two big deals within the industry followed by XFlow ($10.2 million), Aqex Technologies India ($7.5 million), Kiwi ($6 million) and Castler ($5 million).

BYJU’S deal helped push the education/training industry to the third spot with total funding of $257.5 million. The other three deals within education include Ulipsu ($3.2 million), uFaber ($3 million), and ixamBee ($1.34 million). Edtech is among the worst impacted startup segment by the funding slowdown as India’s online education startups are struggling to survive in a post-pandemic world.

Together the top three industries – software, financial services, and education/training raised a total of $981.6 million, accounting for about 63% of the total deal value in the month.

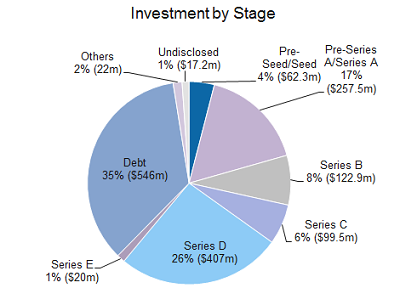

Early-stage deals steal the limelight

The share of early-stage (seed to Series A) deals in total funding has been growing quarter-on-quarter as risk capital investors, sitting on massive dry powder, continue to chase founders with strong business ideas.

There were a total of 32 pre-seed and seed stage deals in May that together scooped up funding worth $62.3 million, recording a growth of about 49% in value over April. The deal volume of such deals was also up 45%. Aqex Technologies India, SquareX India, Newtrace, StepChange, Thena, PYOR, Fundly.ai, InCore Semiconductors, RootFi, and EMO Energy were among the startups that raised seed rounds during the month.

The funding raised by startups in pre-Series A and Series A stages stood at $257.5 million across 28 deals in May as against $141.5 million across 22 deals in the previous month. In the biggest Series A round, sportswear startup Agilitas Sports raised about 52 million from PUMA India executives Abhishek Ganguly, Atul Bajaj and Amit Prabhu. Other Series A rounds were closed by startups including NODWIN Gaming, Course5 Intelligence, Rooter, e-con Systems, Agraga, and ZestIoT.

Growth-stage deals, defined as Series B or post-Series B rounds (including private equity) mopped up $649.4 million across 10 deals as against $278 million across eight transactions in April. The growth transactions during the month were closed by startups including Ripplr, Ace Turtle, Pando, Infinite Uptime, Atomberg, XYXX, Builder.ai, PhonePe, Chalo, and Hopscotch.

There were seven debt deals worth $546 million in May as against three deals worth $14.5 million in the previous month.

Most active investors

Venture Catalyst, along with its early-stage startup fund 9Unicorns, emerged as the most active investor in May with a total of six deals including TagZ Foods, SoleSearch, Rooter, XFlow, and Castler.

Venture capital firm Antler, Trifecta, Inflection Point Ventures, and Sequoia Capital followed with four deals each. Sequoia India, along with its startup accelerator programme Surge, invested in startups including SquareX India, Newtrace, Gan.ai, and InCore Semiconductors.

Anicut Capital, Stride Ventures, and Jungle Ventures made at least three investments each.

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

China Deals Barometer Report: May was second weakest month so far for startup fundraising in 2023

May was the second weakest month this year for startup fundraising in Greater China.

Venture Capital

SE Asia Deals Barometer Report: Startup fundraising crosses $1b for the first time this year in May

Startups in Southeast Asia raised $1.05 billion from 73 transactions in May, the first time that fundraising in the region surpassed the $1-billion mark this year...