China Deals Barometer Report: Startup fundraising rises to eight-month high of $5.5b in Oct

Startup financing in Greater China climbed to an eight-month high in October, as 199 privately-owned firms raised nearly $5.5 billion in the month—the second-highest monthly deal value in 2023.

Even as the deal count slid by 4.3% month-on-month (MoM), the deal value grew 14.1% from September, show proprietary data compiled by DealStreetAsia.

Dealmaking by startups based in mainland China, Taiwan, Hong Kong, and Macau, showed signs of recovery compared to the same period last year. The monthly deal value was 7.2% higher than in October 2022, while the deal count recorded an 11.8% year-on-year (YoY) growth.

However, monthly fundraising remains far below the levels seen in October 2020 and October 2021 when around $7.1 billion and $6.8 billion were raised respectively by Greater China startups.

A total of $45.2 billion was invested across 2,122 deals in the first ten months of 2023. The deal value grew only marginally (3.2%) from Jan-Oct 2022, but the volume of deals was 15.6% higher.

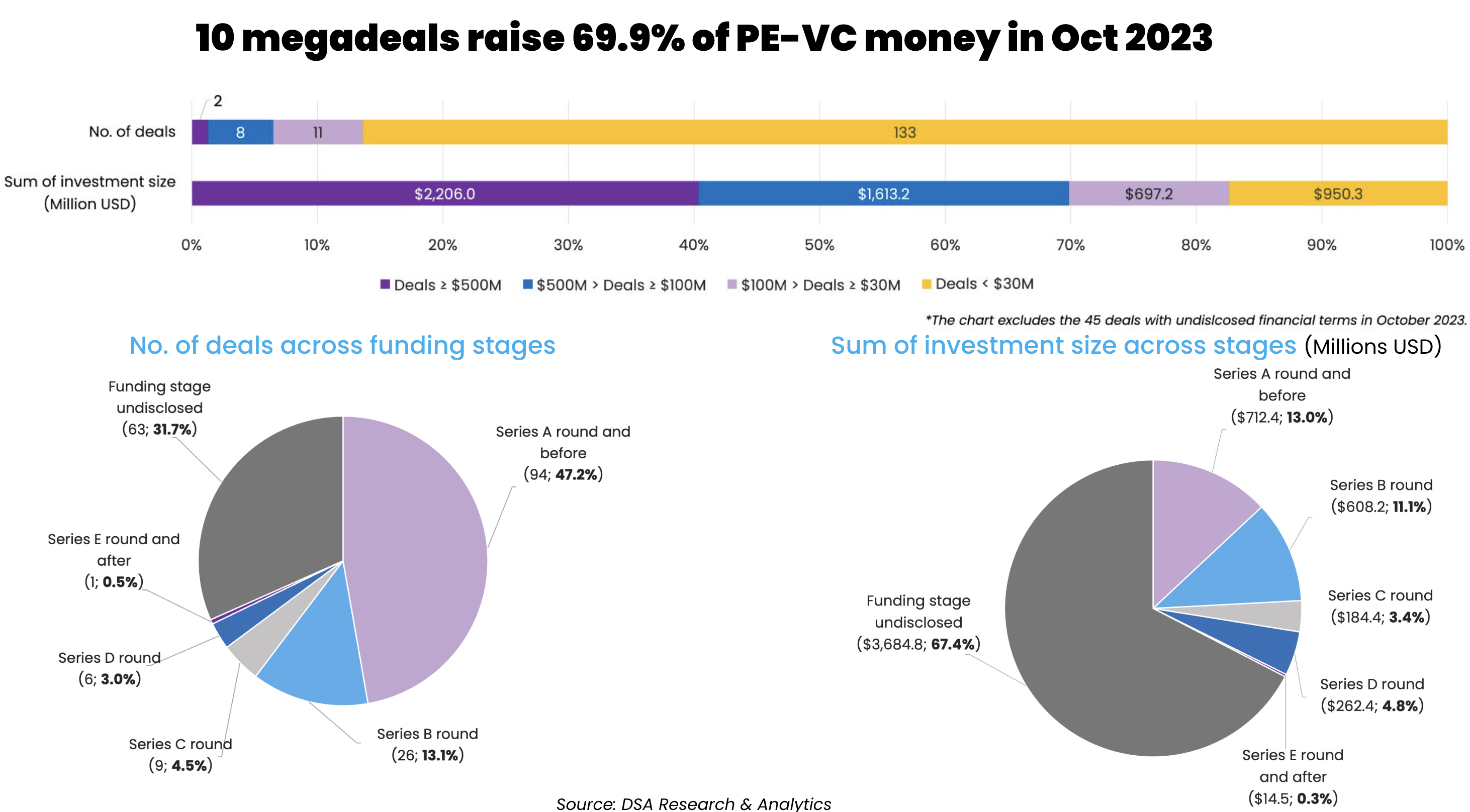

Ten mega deals rake in 70% of the capital

The biggest venture deal in October was raised by EV maker Leapmotor, which clinched the only billion-dollar investment in the month. Global automaker Stellantis announced that it plans to pick up a 21% stake in Leapmotor for $1.6 billion and ramp up its sales in China, the world’s biggest EV market, and in other regions including Europe.

Including Leapmotor’s billion-dollar deal, the month saw the completion of ten mega deals—investments worth at least $100 million—which cumulatively raised around $3.8 billion, or almost 70% of the month’s total fundraising. In comparison, there were four mega deals in September that raised a combined $3.2 billion.

Mega deals in Greater China (Oct 2023)

| Startup | Headquarters | Investment size (Million USD) | Unspecified size | Investment stage | Lead investor(s) | Other investor(s) | Industry/Sector | Vertical |

|---|---|---|---|---|---|---|---|---|

| Leapmotor Technology | Hangzhou | 1590 | Stellantis | Automobiles & Parts | Electric/Hybrid Vehicles | |||

| Chongqing Ant Consumer Finance | Chongqing | 616 | Registered Capital Raise | Ant Group, Sunny Optical Technology Group, Transfar Zhilian, Guangzhou Boguan Telecommunication Technology (affiliated with NetEast Inc.), and others | Financial Services | Fintech Lending | ||

| Zhipu Huazhang Technology | Beijing | 341.82 | Social Security Fund Zhongguancun Independent Innovation Special Fund (managed by Legend Capital), Meituan, Ant Group, Alibaba Group,Tencent Holdings, and others | Software | AI and Machine Learning | |||

| Baichuan Intelligent Technology | Beijing | 300 | A1 | Legend Star (affiliated with Legend Holdings), Alibaba Group, Tencent Holdings, Xiaomi Corp | Business Support Services | AI and Machine Learning | ||

| Wenfeng New Materials | Tangshan | 266.9 | Equity Financing | United Company Rusal | Materials | N/A | ||

| Kongjian Zhihui Decoration | Beijing | 212.1 | M&A | Beike Meijia (affiliated with KE Holdings) | Consumer Services | N/A | ||

| DiDi Autonomous Driving | Beijing | 149 | GAC Capital (affiliated with GAC Group), Guangzhou Development District Investment Group | Transportation Services | Autonomous Driving | |||

| Chengshi/Allcheer Intelligent Automobile | Jinan | 136.6 | B | Hidden Hill Capital (affiliated with GLP) | Gravity Investment, Ganfeng Lithium, Zhongxiangjusheng | Automobiles & Parts | Electric/Hybrid Vehicles | |

| Nullmax | Shanghai | 106.8 | B | Shanghai Stonehill Technology | Stonehill Technology Limited | Software | Autonomous Driving | |

| Pony.ai | Beijing | 100 | Strategic Investment | NEOM Investment Fund (NIF) | Automobiles & Parts | Autonomous Driving |

Two mega deals were from the artificial intelligence (AI) sector, as investors pumped in money to fan the next wave of AI innovations. That includes Beijing Zhipu Huazhang Technology’s 2.5 billion yuan ($341.82 million) fundraising and Baichuan Intelligent Technology’s $300 million Series A1 funding round.

Chinese tech giants are splurging on the up-and-rising companies in AI. A case in point is the participation of Alibaba Group, Tencent Holdings, and Xiaomi Corp in the fundraising of Beijing Zhipu Huazhang Technology and Baichuan Intelligent Technology.

In another mega deal, Chinese property platform KE Holdings acquired a 98% equity share in the home renovation service provider Kongjian Zhihui for a total cash consideration of up to 1.55 billion yuan ($212.1 million).

Also, Chengshi, which designs and manufactures electric vans and trucks catering to last-mile delivery in China, has secured 1 billion yuan ($136.6 million) in a Series B funding round led by Hidden Hill Capital, the private equity arm of global logistics giant GLP.

Companies in their Series A and earlier stages sealed 94 deals, or 47.2% of the month’s deal count, while the $712.4 million capital raised at this funding stage accounted for 13% of the deal value.

Early-stage deals dominated the deal volume amid investors’ hesitancy in splurging into growth- and late-stage startups, as economic headwinds weigh on the country’s stock markets. Dealmaking was stagnant in funding stages closer to public listings, the month saw only one deal in the Series F funding stage.

Self-driving startups garner investor interest

China’s self-driving startups were on a fundraising streak in October. There were three megadeals sealed including by DiDi Autonomous Driving, the self-driving technology arm of DiDi Global, which plans to raise up to $149 million from state-affiliated investors including GAC Capital, the wholly-owned subsidiary of automaker GAC Group; and Guangzhou Development District Investment Group.

Self-driving solutions provider Nullmax, too, raised 780 million yuan (106.8 million) in a Series B funding round led by Shenzhen-listed internet information service provider Shanghai Stonehill Technology.

While state-affiliated investors and automakers have been the major driving forces in advancing self-driving, the month also saw Saudi Arabia’s NEOM inject $100 million into autonomous driving firm Pony.ai via its strategic investment arm NEOM Investment Fund (NIF) in a bid to deliver autonomous driving services in the Middle East and North Africa (MENA).

The news signifies the growing interest among Chinese electric vehicle players charting plans in the MENA region, which has emerged as a favourable business location amid rising geopolitical tension between China and the US.

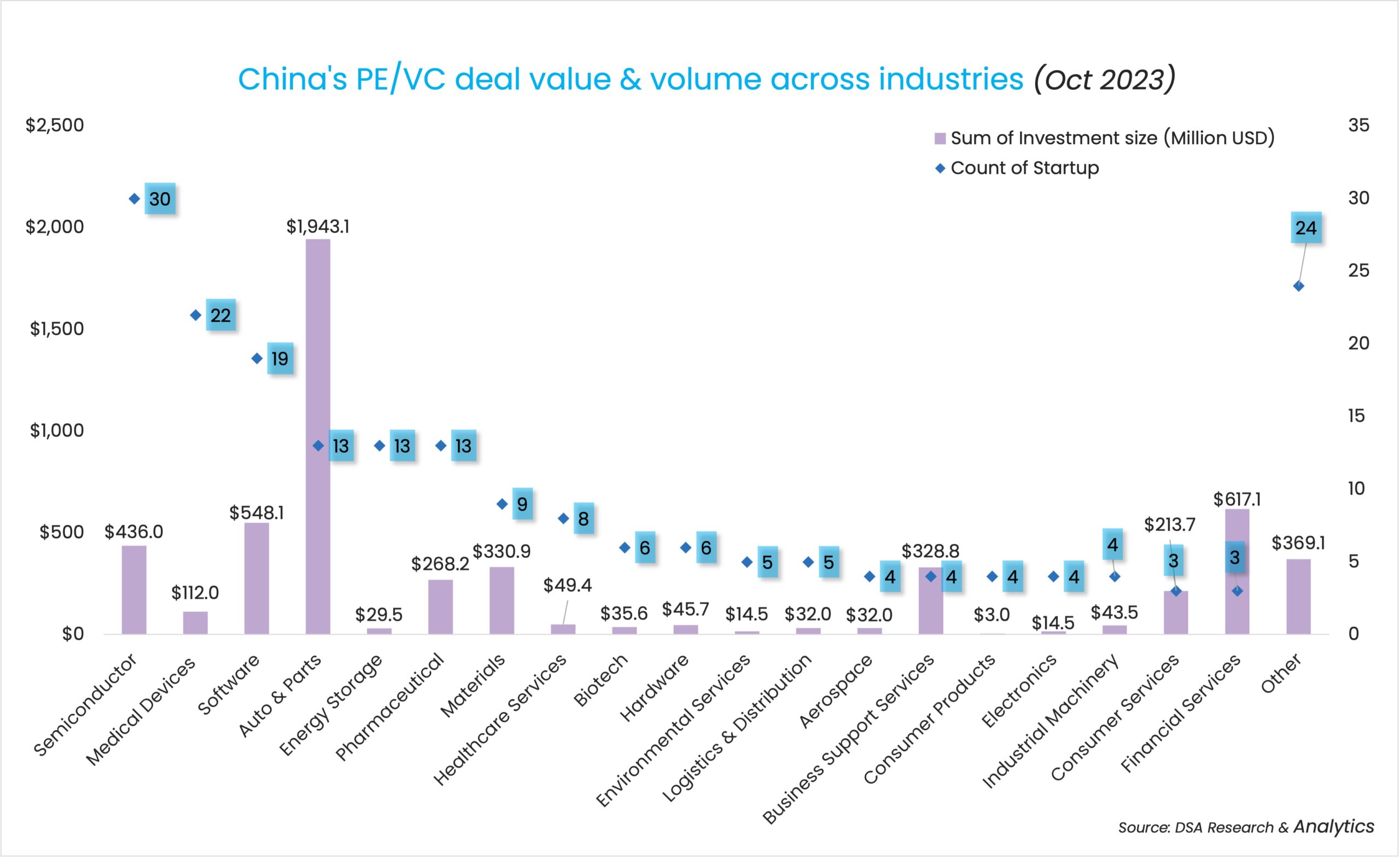

Semiconductors remained the most invested industry by deal count, while auto & parts was the most-invested industry by deal value, largely contributed by the two megadeals—Chengshi and Leapmotor.

The chip-making industry clinched 30 deals despite raising only $436 million, while the automotive sector raised a total of $1.9 billion despite sealing 13 deals.

Legend Holdings and affiliates top investor list

Chinese conglomerate Legend Holdings was the most active investor of the month both in terms of deal count and value. The group pumped around $785.3 million across seven startups through its subsidiaries.

The group’s affiliates include Lenovo Capital and Incubator Group, which focuses more on startup incubation; Legend Star, the early investment and incubation arm of Legend Holdings; and Legend Capital, an affiliate that specialises in early- and growth-stage PE-VC deals.

Top investors of October 2023

| Investment company | No. of deals | Total value of participated deals (Million USD) | Lead | Non-lead |

|---|---|---|---|---|

| Legend Holdings and its affiliates | 7 | 785.32 | 1 | 6 |

| Xiaomi Corp | 5 | 644.82 | 1 | 4 |

| SAIC Motor Corp and its affiliates | 4 | 97.3 | 0 | 4 |

| Addor Capital | 4 | 1.5 | 0 | 4 |

| Oriza Holdings and affiliates | 4 | 157.2 | 2 | 2 |

| Xiamen C&D Emerging Industry Equity Investment | 3 | 43.5 | 0 | 3 |

| Orient Jiafu Asset Management | 3 | 70 | 1 | 2 |

| China Reform Holdings Corporation | 3 | 97.4 | 3 | 0 |

| SDIC Venture Capital and its affiliates | 5 | 14.5 | 4 | 1 |

| Western Capital Management | 3 | 0 | 2 | 1 |

| Fortune Capital | 3 | 98.8 | 1 | 2 |

| CoStone Capital | 3 | 83 | 0 | 3 |

| Shunwei Capital | 3 | 357.82 | 1 | 2 |

| Z&Y Capital | 3 | 96.8 | 0 | 3 |

| CICC Capital | 3 | 29 | 0 | 3 |

| Kunlun Capital | 3 | 18.7 | 2 | 1 |

| Tencent Holdings | 3 | 669.12 | 0 | 3 |

| Hillhouse Capital Group and its affiliates | 2 | 341.82 | 1 | 1 |

Note: In our monthly analysis for October 2023, we have put together detailed charts of prominent deals, active investors, deal stages, and the most attractive sectors that have bagged the maximum venture dollars in the Greater China region.

Our database only considers deals officially announced by the related investee, investor(s), and/or financial advisor, while information based on market rumours and news reports citing sources is excluded.

For a more detailed analysis, and to enable comparison between primary and secondary markets, DealStreetAsia has started tracking deals of all sizes since April 2020, as against considering only transactions worth more than $10 million earlier.

We have also introduced a standardised system for industry classification. It currently includes over 50 industries, as well as over 45 new economy and high-tech verticals, which will progressively increase to adapt to local market conditions in our closely watched regions of Greater China, Southeast Asia, and India.

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

SE Asia Deals Barometer Report: Startup fundraising plunges 40% MoM to $663m in Oct Edit

Startups in Southeast Asia continued to stare at a challenging fundraising environment in October as macroeconomic headwinds prompted investors to pull their purse strings and go slow on fresh investments.

India Deals Barometer Report: Startup funding climbs for second straight month to touch $1.4b in Oct

Fundraising by Indian startups rose about 15% month-on-month to touch $1.38 billion in October, showing signs of recovery after the record lows of August.