India Deal Review: Startup funding climbs for second straight month to touch $1.4b in Oct

Fundraising by Indian startups rose about 15% month-on-month to touch $1.38 billion in October, showing signs of recovery after the record lows of August.

At 91, the volume of venture capital (VC) and private equity (PE) transactions was also up 23% from September’s tally of 74 deals, according to proprietary data compiled by DealStreetAsia.

On a year-on-year basis, the total deal value was marginally higher from October 2022’s $1.37 billion across 87 transactions.

The values of eight deals in October were undisclosed.

Fundraising by startups in the country has been mostly on a downward trajectory since the second half of 2022. The macroeconomic conditions coupled with an extended funding winter made it difficult for several Indian startups to secure funding. As a result, many companies resorted to cost-cutting measures including rationalised marketing and advertising spending, shutting down of business verticals, and layoffs.

Investments this year peaked in May when Indian startups scooped up $1.55 billion across 89 transactions. Post that fundraising stayed below the $1-billion mark until August, and started to recover only from September.

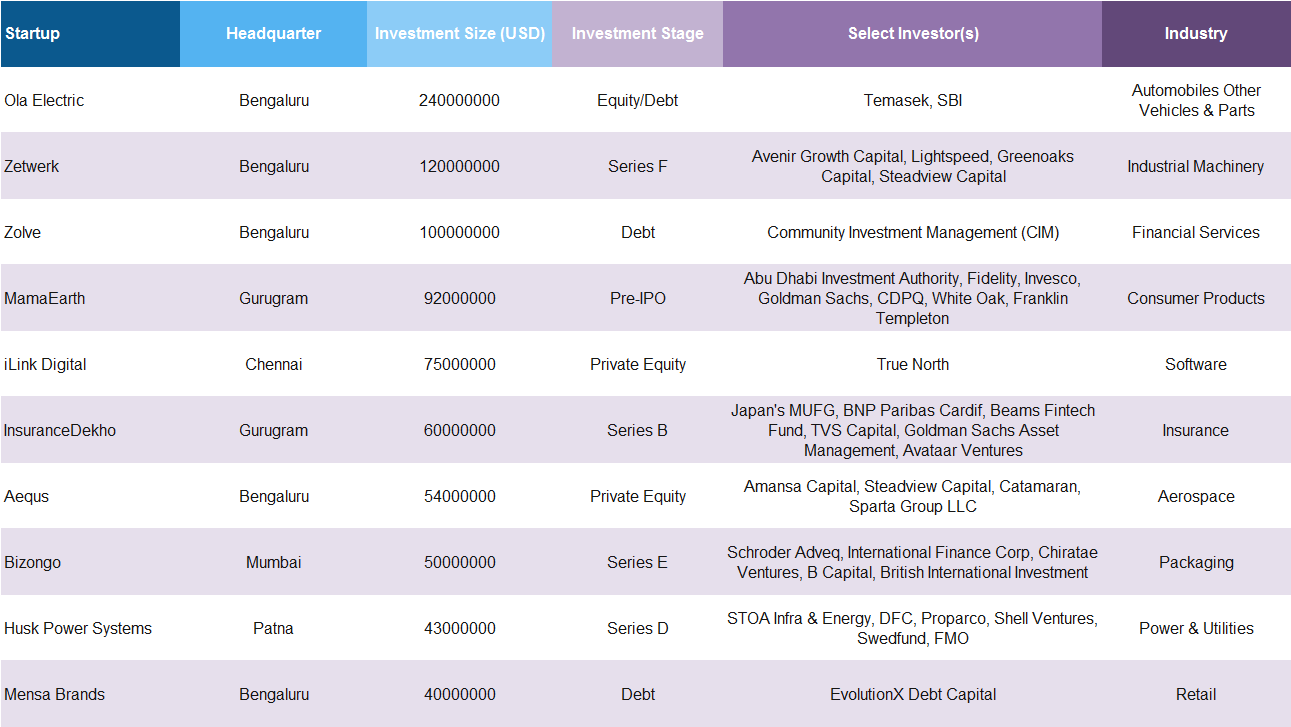

Top ten fundraisers in October 2023

Three mega deals, or deals worth at least $100 million, were sealed in October, with Japan’s SoftBank-backed electric vehicle maker Ola Electric leading the pack with $240 million. The share of these three deals in October’s overall investment stood at almost 33%.

The funding in Ola Electric was part of the round spearheaded by Temasek-led investors and the State Bank of India (SBI). While Temasek had invested $140 million in September, $240 million was pumped in by SBI in October. The funds raised will be utilised for the expansion of Ola’s EV business and for setting up India’s first lithium-ion cell manufacturing facility in Krishnagiri, Tamil Nadu.

Zetwerk, an end-to-end manufacturing supply chain solutions provider, occupied the second spot with $120 million in funding in its Series F round led by Avenir Growth Capital. The fundraiser marked the startup’s first equity investment in 2023. Zetwerk entered the unicorn club in 2021 after a $150 million financing led by New York-based D1 Capital Partners.

Neo-banking platform Zolve followed with a warehouse debt facility of $100 million from Community Investment Management (CIM).

No startup in India made it to the unicorn club in September and only one company has earned the tag so far this year—Zepto. The instant grocery delivery startup had raised $200 million in a new funding round at a valuation of $1.4 billion in August.

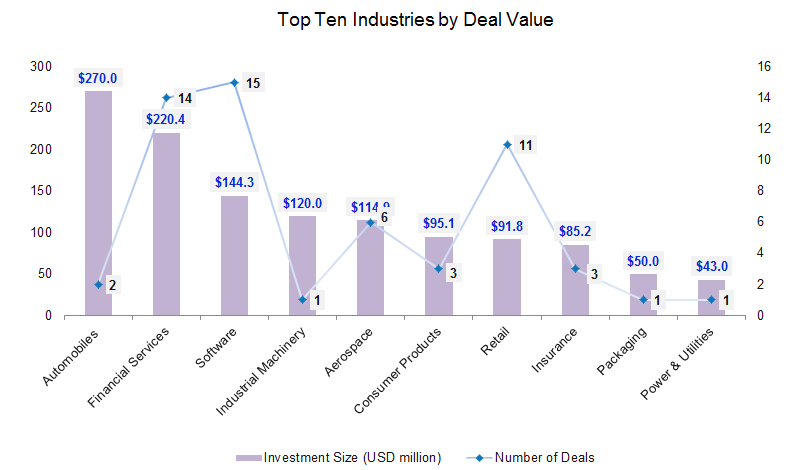

Ola Electric pushes auto industry to the top

Automobile was the most funded industry in October with total investments worth $270 million across two transactions. In comparison, the industry had garnered $251 million across three deals last month.

While Ola Electric raised the bulk of the amount, electric bus maker PMI Electro Mobility scored $30 million in funding from Piramal Alternatives, the fund management business of the Piramal Group.

Financial services followed with $220.4 million across 14 deals, recording a spike of about 50% in value over September. Zolve led the industry with $100 million in funding followed by Neo Wealth and Asset Management, which secured $35 million from Peak XV Partners.

Other prominent deals within software include affordable housing finance company Vastu Housing Finance Corporation ($30 million), housing finance lender Vridhi Home Finance ($18 million), gold loan platform Oro Money ($12.5 million) and fintech startup Jiraaf ($8.7 million).

Occupying the third spot was software with a total funding of $144.3 million across 15 transactions. This is, however, a drop of about 70% in value from September. Mid-sized private equity firm True North’s $75 million investment in digital transformation solutions provider iLink Digital marked the largest software deal in the month. The investment is aimed at expanding iLink Digital’s organic and inorganic growth in the IT services space in India and overseas.

Other software deals include Krutrim SI Designs ($24 million), SuperOps.ai ($12.4 million), Leucine ($7 million), Blubirch ($6.37 million) and BIVA Analytics ($5 million).

Together the top three industries—automobile, financial services and software—raised a total of $634.7 million, accounting for 46% of the total deal value in the month.

Investors favour early-stage deals

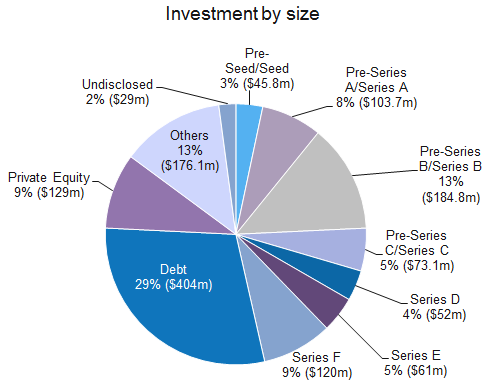

Investors continued to show their faith in early-stage deals.

Thirty-three pre-seed and seed transactions together raked in $45.8 million in October as against $37.9 million across 29 transactions in September. The prominent seed rounds during the month include BIVA Analytics ($5 million), iSprout ($4.8 million), GigaML ($3.6 million), DPDzero ($3.25 million), and ClearFeed ($2.7 million).

Pre-Series A and Series A deals had raised a combined $103.7 million across 22 deals, marking a 63% jump over September when 12 pre-Series A and Series A transactions had raised $63.6 million. Vridhi Home Finance raised the largest Series A round of $18 million (Rs 150 crore) led by Elevation Capital.

Among other prominent Series A deals were Oro Money ($12.5 million), Sugar.fit ($11 million), Inc.5 Shoes ($10 million), and Leucine ($7 million).

In terms of value, growth-stage deals (including private equity rounds) led the funding with a share of about 43% of the total deal value in October as against 58% in September. Companies in the Series B or post-Series B rounds collected an aggregate of $599 million through 19 investments in the month compared with an aggregate of $697 million raised last month across 18 transactions.

Large growth rounds in the month include Zetwerk’s Series F round of $120 million, InsuranceDekho’s Series B round worth $60 million, Bizongo’s Series E round of $50 million, Husk Power Systems’ Series D round of $43 million, Neo Wealth and Asset Management’s Series B round worth $35 million and PMI Electro’s Series C round of $30 million.

The value of debt deals also rose almost four-fold to touch $404 million in the month. Meanwhile, two corporate deals raised a combined $36.6 million.

Most active investors

Angel investing platform Inflection Point Ventures (IPV) and venture capital firm Gruhas emerged as the top investors in October with four investments each.

Gruhas, which focuses on early venture, and debt investments in the proptech, cleantech, media & entertainment, and consumer space, led funding for startups. It backed workspace marketplace Qdesq, eldercare platform Age Care Labs, data-driven platform Done Deal, and real estate sustainability startup Smarter Dharma in October.

On the other hand, IPV led investments for drone tech startup Urban Matrix, logistics technology company Oorjaa, wellness platform Answer Genomics, and healthcare startup Welcome Cure.

Peak XV Partners (formerly Sequoia Capital India & Southeast Asia) and Zerodha’s investment arm Rainmatter Capital followed with at least three investments each. Other prominent investors in the month were Blume Ventures, Alteria Capital, 021 Capital, Cornerstone Ventures, Nexus Venture Partners, Matrix Partners, Steadview Capital, and Prime Venture Partners.

- Avenir Growth Capital

- Krutrim SI Designs

- Leucine

- Neo Wealth and Asset Management

- Ola Electric

- Oro Money

- Peak XV Partners

- Piramal Alternatives

- PMI Electro Mobility

- SuperOps.ai

- Temasek

- Vastu Housing Finance Corporation

- Vridhi Home Finance

- Zepto

- Zetwerk

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

China Deals Barometer Report: Startup fundraising rises to eight-month high of $5.5b in Oct

Startup financing in Greater China climbed to an eight-month high in October, as 199 privately-owned firms raised nearly $5.5 billion in the month—the second-highest monthly deal value in 2023.

Venture Capital

SE Asia Deals Barometer Report: Startup fundraising plunges 40% MoM to $663m in Oct

Startups in Southeast Asia continued to stare at a challenging fundraising environment in October as macroeconomic headwinds prompted investors to pull their purse strings and go slow on fresh investments.