Partner content in association with

Best practices to maintain cash flow and liquidity in early-stage startups

By Justin Patrick, Director of Risk, Governance and Execution, Rigel Capital

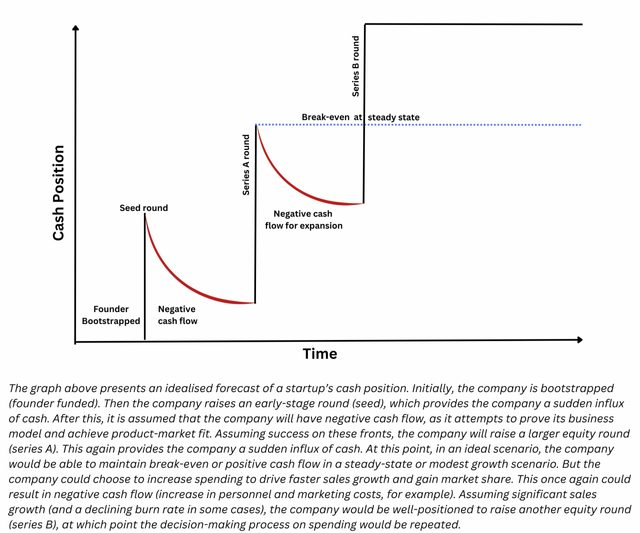

Most startup businesses fail between the pre-seed and Series A stages, known in startup parlance as the dreaded ‘valley of death’. It is imperative for startups that are transitioning from seed to Series A to make fundamental changes in how cash flow is managed, reported and forecasted. Managing cash flow, burn and runway during this transition period is critical. This article is an introduction to obstacles founders and managers should avoid to reduce the risk of a cash crunch, especially in difficult market conditions.

Forecasting approach

After a seed round, the appropriate forecasting and budgeting period for a startup is 24 months, assuming an 18-month gap between equity rounds and an additional six-month buffer. This period represents the ideal timeframe for budgeting and financial forecasting for companies at this stage of development, as advised by experts.

A monthly budget presentation and a routine reporting regime (benchmarked against the original forecast) is advisable at this stage. Such exercises provide managers and investors with an important, although imprecise, framework to track and benchmark spending, and identify obvious deviations. The temptation to dismiss this exercise because forecasts at this stage are never accurate – which is, by and large, a true statement – would be a mistake.

The initial math behind this is deceptively simple. The cash in bank + cash flow from equity financing + revenue for a 24-month forecast should exceed the total cost and expenses forecast for that period. The challenge managers and investors face is to quickly and appropriately reduce spending or raise more money (if feasible) when revenues are below expectations or expenses exceed the forecast. Hands-on portfolio management and talented investor support would be invaluable in such a situation.

In the best-case scenario, between seed and Series A, companies will grow at their fastest rate. More realistically, sales growth may be inconsistent and may even decline. In all these scenarios, operational cash flow will be highly variable and unpredictable. In sharp contrast, in nearly all cases, cash flow from equity financing will be relatively stable and predictable after investors are fully committed and the contracts are signed.

Budgeting and forecasting should take into account these different characteristics. At one end of the spectrum, companies may have to budget for spending with zero or very low revenue. To avoid this, investors may focus exclusively on businesses that already have a reliable revenue source and are approaching positive cash flow. Conversely, in the event that revenue or free cash flow exceeds forecasts, companies must have a framework to manage investments and expansion. Founders and investors should agree on key performance indicators, which include cash flow measurements, such as free cash flow and working capital (current) ratio and variance against forecasts.

Warning signs for investors and managers include: 1) inconsistencies or contradictions in the budget, forecast and fundraising plans; 2) inability of the founders and/or their staff to maintain monthly reporting in a timely and consistent manner (especially in the period leading up to the next round, where this data is extremely critical for gaining and maintaining investor interest); and 3) failure to update budgets and forecasts in a timely manner under changing circumstances. In cash constrained circumstances, these warning signs could quickly become an actual cash crunch scenario.

Spending traps

Expenditures related to human resources and facilities-related spending are potential problem areas. These include: 1) payroll and employee perks, 2) rent, and 3) office-related capital expenditure (furniture, fit-out, equipment). These costs, often perceived to primarily benefit founders and employees rather than customers and investors, are all sensitive areas. Founders may face temptation or pressure to overspend following a round, and this may go unnoticed by investors when times are good.

On the other hand, the senior team should include at least one person who can demonstrate a fundamental grasp of financial forecasting, budgeting and basic accounting. If the founding team lacks this skillset, the gap should be filled by an experienced senior manager, a financial controller and/or a part-time CFO, and their salary requirements should be budgeted appropriately. Without this, neither the founders nor the investors will know the real cash situation.

It is good to benchmark all salaries, particularly those of founders and their direct reports, and for investors to have consent rights over any extraordinary compensation decisions, such as bonuses. While excessively high salaries can drain cash, unusually low salaries may indicate that the person is underqualified for the role and/or is not exclusive to the company (e.g., doing ‘side gigs’ for additional income).

Similarly, unless the founders are independently wealthy, long periods of time without any salary is also a matter of concern. It may indicate that the founding team is disengaging from a company, as it approaches the end of its cash runway from the previous round. Disengagement may take the form of planning another startup, starting another job or job search or doing other work, travel or hobbies. While none of these activities directly drain money, they all severely undermine the business’s viability.

Finally, any capital expenditure or research & development expense that does not directly relate to either (1) revenue growth or (2) a concrete identified operational objective should also be treated with caution. Potential problem areas include personal laptops and computer equipment above minimum specifications for the job (e.g., large and super high resolution monitors), vehicles owned by the company, designer office furniture, and other fixed assets. This might mean that old office equipment does not get replaced or is rented instead of purchased. Of course, this type of cost-cutting should be limited where it negatively impacts productivity.

Understanding debt and financing constraints

The company balance sheet should also be monitored carefully for accruing payables, build-up of bridge financing, such as shareholder or founder loans or any increase in working capital credit facility drawdowns. A build-up of accruing payables can be especially problematic at the end of a company’s runway. If the next funding round is delayed, payment of recurring expenses and discretionary and strategically necessary expenses may be delayed, which could lead to a shorter than expected runway. This situation also calls for a careful consideration of all practical trade-offs between a conservative spending program and faster growth.

For example, consider a situation where a funding round is delayed by two months, and the company has deferred paying salaries, utilities, rent and other payables. Now, the post-funding runway is reduced by approximately two months. If the funding round is further delayed by two months, the founders may have extended personal loans (or used their personal credit cards) to the company to keep it alive. As a result, a round size that would give 24 months of runway under the baseline budget, now only gets 20 months, assuming the founders are repaid.

Moreover, in difficult market conditions, the target round size may be constrained. This may require spending to be reduced in the forecast or the forecasted runway to be shortened beyond investors’ comfort zone. The use of a bridge round to extend runway in these circumstances should also be approached with caution. Typically a bridge round is sized to extend runway by six to nine months of operating expenses. But in a tough market, the runway should be shortened to two to five months in order to get back to fundraising sooner.

Finally, for capital hungry companies, the risk of having to go back and raise additional funds within the following 12 months may be too difficult. Especially for smaller teams, frequent fundraising activities can be a huge distraction, which negatively impacts operational KPIs. The above scenario illustrates why the 6-month cushion between planned rounds is the preferred approach. Founders should not be cutting it fine and having to spend the company’s bottom reserves on the day before the closing of the next round. Therefore, adequate planning and consistent monitoring is extremely important. Having experienced and talented investors in the cap table is critical for building these resources as the enterprise grows.