Partner content in association with

Indonesia PE-VC Summit Conference Report: Startup fundraising in SE Asia halved in 2023 to $7.96b

Private capital raised by startups in Southeast Asia plummeted 53% year-on-year in 2023 to $7.72 billion as macroeconomic factors weighed heavily on investor sentiment. The region witnessed 717 venture deals last year, down 30% from 2022, according to the Southeast Asia Deal Review 2023 report by DealStreetAsia and multi-stage investment company Rigel Capital.

The report was released at the Indonesia PE-VC Summit 2024 in Jakarta on January 25.

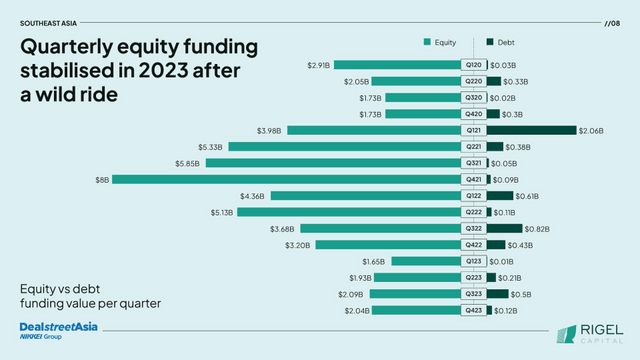

The report noted, however, that in the final quarter of the year (Oct-Dec 2023) the region’s private funding landscape saw emerging signs of stability. In Q4 2023 there was a 10% increase in deal volume to 166 following a concerning three-year low of 151 hit in the third quarter.

This decline in fundraising becomes even more pronounced given the outsized role played by e-commerce giant Lazada, which alone raised $1.89 billion last year, accounting for a quarter of all equity funding in the region.

The haul by other top fundraisers of 2023 was far behind that of Lazada—fintech firm Kredivo sealed a $270 million Series D deal, insurtech firm Bolttech raised a $246 million Series B round and aquaculture startup eFishery sealed a $200 million Series D round. The report excludes Investree’s $231 million Series D round, which was announced in October, due to uncertainties surrounding the deal.

These were among the rare deals last year that were valued at over $100 million, as sceptical investors withheld from writing large-sized cheques amid geopolitical uncertainties, high-interest rates, and persistent inflation.

The question now remains whether the Q4 recovery can be sustained in 2024 and lead to a more robust funding environment for Southeast Asia’s startups.

“The stage is set for there to be a favourable recovery in dealmaking and fundraising if the unfavourable conditions of the preceding year prove transient,” said Guo Sun Lee, partner at King & Wood Mallesons, the largest international law firm in Asia-Pacific in an interview to DealStreetAsia.

Other industry experts, however, are predicting a potential rebound only in the second half of 2024. which means startups in the region may have to endure growth pangs for longer. “Anticipate sustained prudence in 2024, coupled with opportunities arising from regional collaborations and a focus on sustainability themes,” said Sebastian Togelang, Rigel Capital’s founding partner.

Singapore, Indonesia remain investors’ favourite

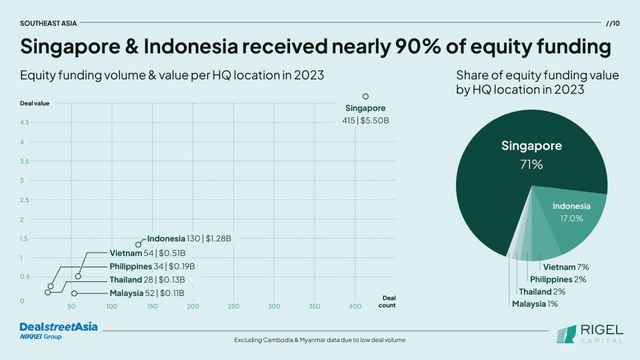

Last year, Singapore and Indonesia received nearly 90% of total equity funding in Southeast Asia—Singapore cornering $5.5 billion from 415 deals and Indonesia raising $1.28 billion from 130 transactions, the report further showed.

Vietnam managed to pocket $0.51 billion from 54 deals that its privately-held companies signed in 2023. The Philippines raised $0.19 billion from 34 deals while Thailand scored $0.13 billion in total from 28 Deals. Malaysia saw 52 transactions that secured $0.11 billion in total.

The 2023 figures underscored how Thailand and Malaysia witnessed the most extensive corrections in total private capital raised—Thailand clocking a steep 86% fall in deal value and Malaysia posting an 83% plunge. In terms of declines in deal volume, Indonesia led with a 49% drop last year while the Philippines saw a 38% fall.

Singapore saw a 21% drop in deal volume, the lowest among the six largest markets in the region, while deal value fell 44% to $5.5 billion. Vietnam also displayed a degree of resilience when compared to the rest, with equity funding value experiencing a 28% decline as deal volume fell 34%.

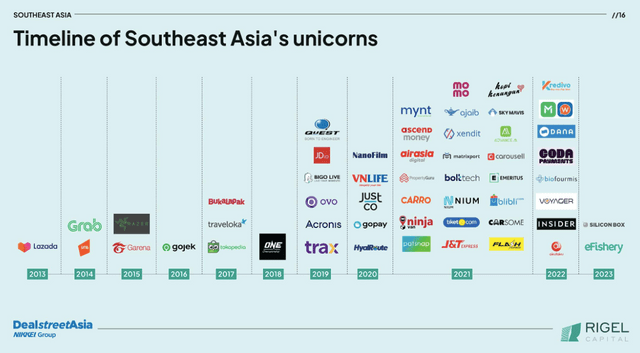

Unicorns, startups valued at $1 billion or more, continued to be elusive last year. In May, Indonesian aquaculture company eFishery became the year’s first unicorn following a $108-million funding round. The region waited until December to mint its second unicorn—Singapore-based semiconductor integration service provider Silicon Box, which closed the first tranche of a $200-million Series B round.

In 2022, eight startups had earned the much sought-after unicorn tag. In 2021, there were a record 23 startups in the region that crossed $1 billion in valuation.

Tough times for early-stage dealmaking

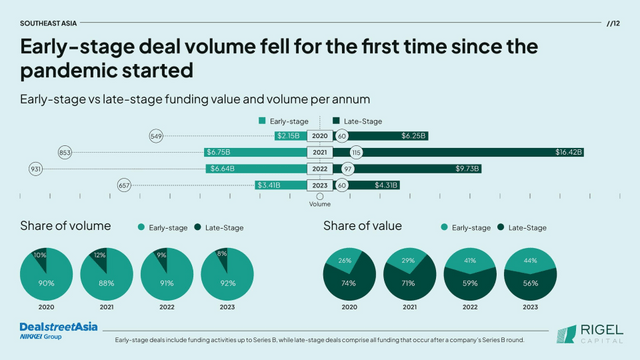

The DealStreetAsia-Rigel report, which cited data from company announcements, regulatory filings, media reports, and DealStreetAsia’s research, noted that fundraising woes in 2023 extended beyond late-stage companies as early-stage deals dropped 29% year-on-year to 657 while total capital raised in the stage fell 49% to $3.41 billion.

“Seed funding, considered a bellwether for early-stage investment trends, has exhibited a downward trajectory since the second quarter of 2022, signalling a pullback from the peak exuberance that characterised the market in 2021,” the report said.

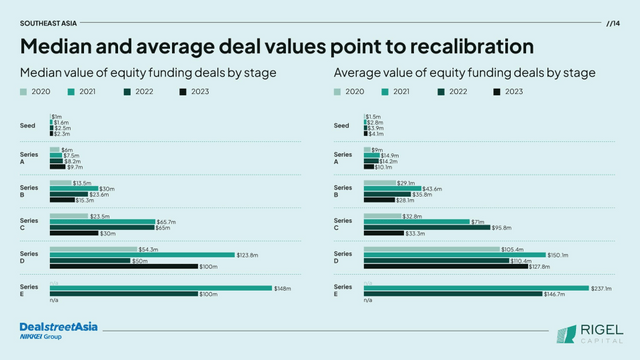

The median seed round in Southeast Asia also dropped 10% year-on-year to 2.3 million after consistent increases in the previous five years.

Series A rounds, however, maintained their upward trajectory as their median value jumped by 19% to 9.7 million. In Series B and C rounds, the median value saw deeper corrections. According to the report, Series B’s median value dropped 35% while Series C’s fell 54%.

Despite funding challenges, some sectors are poised for growth

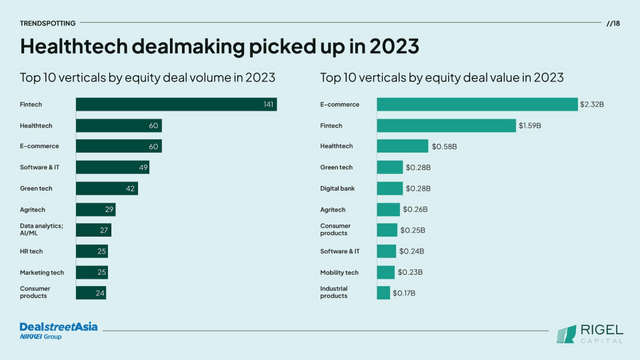

Healthtech continued to see strong investor interest in 2023, bucking the downward trend affecting the region’s startup scene. The sector saw at least 60 deals last year, up 20% year-on-year. The value, however, dropped by 34% to $582 million owing to smaller health tech deal sizes, per the report.

Fintech remained the most active business vertical in Southeast Asia, although the number of deals sealed by startups in the sector dropped 39% year-on-year to 141. Deal value for the fintech sector fell 71% to $1.59 billion—the second highest. E-commerce startups raised the most funds at $2.32 billion, thanks to Lazada.

For this year, some sectors are poised for growth despite the current funding challenges and new themes are likely to attract venture capital investments. “Sustainable sectors, including green tech, electric vehicles, climate tech, and health tech are gaining increased attractiveness and paving the way for robust and fundamentally sound companies,” Togelang said.

The clean mobility ecosystem, artificial intelligence, and sustainability-related sectors are expected to continue their growth, he added.

The DealStreetAsia-Rigel Capital report covers Southeast Asia-headquartered private companies that have received venture funding at any stage in their lifecycle. The companies referred to in this report are categorised based on the location of their headquarters.

Read the ‘Southeast Asia Deal Review 2023’ report: