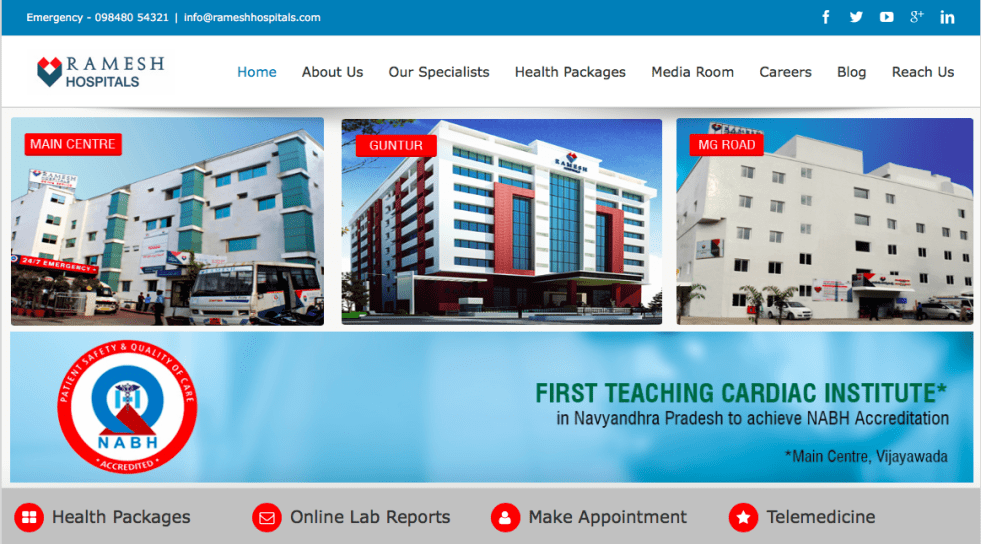

Dubai-based Aster DM Healthcare has acquired Ajay Piramal Group-promoted India Venture Advisors‘ 25 per cent stake in the Vijayawada-headquartered healthcare chain Ramesh Hospitals for Rs 110 crore (around $16 million), according to a report in The Economic Times quoting sources.

Start your deal-making journey now!

Subscribe now to enjoy unlimited access at just $59.

Premium coverage on private equity, venture capital, and startups in Asia.

Exclusive scoops from our reporters in nine key markets.

In-depth interviews with industry leaders shaping the ecosystem.

Already a Subscriber? Log in

Contact us for corporate subscriptions at subs@dealstreetasia.com