Mistakes aren’t what you’d immediately associate with when it comes to winning Southeast Asia, but Grab’s co-founder Tan Hooi Ling assures there have been several made during the ride-hailing company’s seven-year growth story.

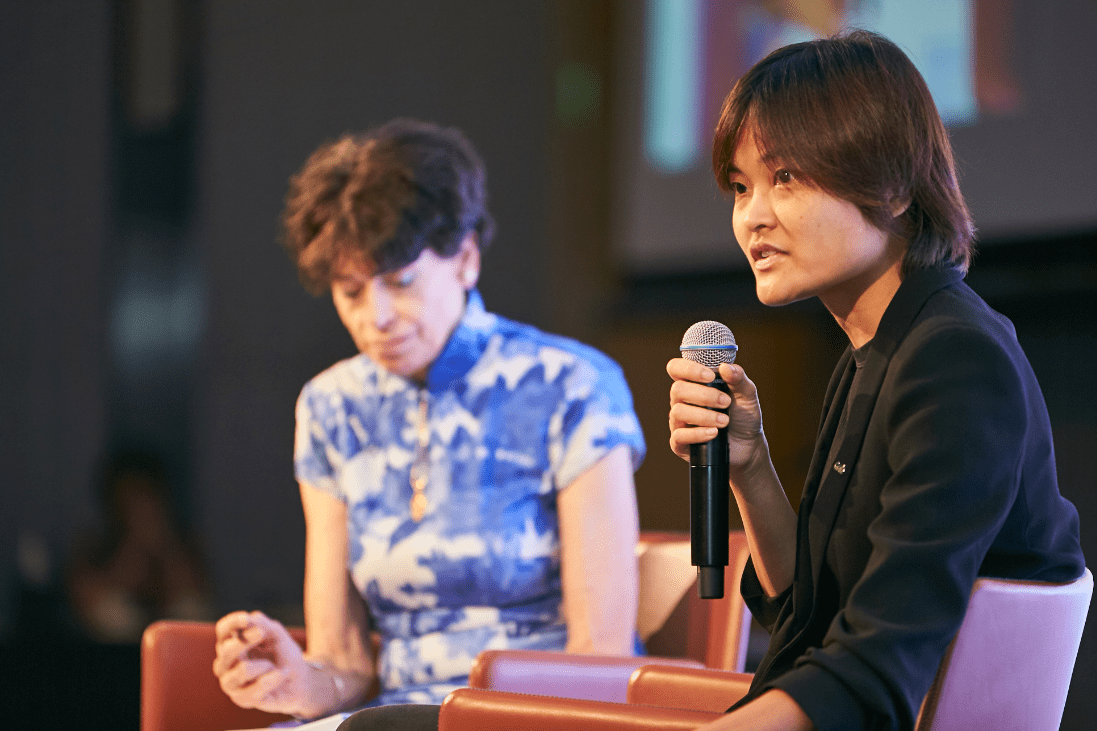

“Whenever I think about mistakes, I always think about my personal mistakes,” shared Tan with Financial Times’s Henny Sender at the Asia PE-VC Summit 2019 in Singapore. “I wish I could have learned to make more difficult decisions earlier and faster, and how to have tougher conversations…(These are) things I guess, our Asian culture doesn’t really prepare us well to do.”

Tan further admitted that she didn’t even foresee herself being an entrepreneur initially, adding that it was something she was quite averse to because it was “highly risky.” While pursuing her studies at Harvard Business School, she met co-founder Anthony Tan, after which the two started MyTeksi in the Malaysian capital city of Kuala Lumpur. The rest, as they say, is history.

Today, Grab is one of Southeast Asia’s leading “super apps” – a term Tan readily asserts wasn’t originally coined by Grab, even though it’s played a significant part popularising it. She added that China’s first super apps like Meituan, WeChat shaped Grab’s journey as a multi-service platform because they took “the super app journey the fastest”.

Tan acknowledged that unlike its ride-hailing predecessors like Uber, Grab didn’t have to tackle legacy players and vested interests because Southeast Asia was such an underserved market. This has helped Grab catapult its super app strategy significantly as a result.

“Over the first half of this year, our food business has tripled regionally. It’s tripled in Indonesia and in fact, it’s quadrupled outside of Indonesia. The only reasons why we can do that is that there is a huge customer need and we have a platform to leverage technology, customer knowhow, insights and local partners as well,” shared Tan.

Tan did not comment on Grab’s IPO progress, even though its paperwork with Uber shows that Grab has until March 2023 to go public before triggering a hefty $2 billion payout to the American ride-hailing firm.

“I think we’re not anchoring on ‘Hey, what does it take for us to get to an IPO?’ That, to us, is not an end milestone…What we want to build is an evergreen company that is sustainable, with a double bottom line, that will be here for generations to come,” shared Tan.