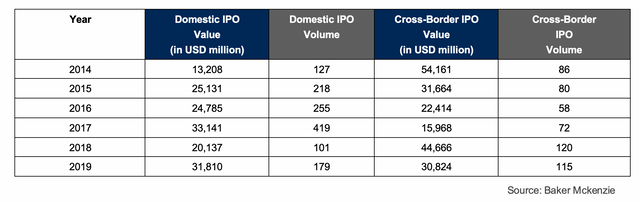

Amid China’s economic slowdown and unsettled trade tensions with the U.S. that have weighed on Chinese firms’ fundraising activities, Chinese companies have raised a combined $30.824 billion through cross-border initial public offerings (IPOs) in 2019, about 31 per cent lower than the full-year total for 2018, according to Baker McKenzie.

Among IPOs on bourses in Hong Kong, London and the United States, Chinese issuers choosing to list on Nasdaq rose by 35 per cent in the past year, but capital raised has declined by 48 per cent from $5.7 billion in 2018 to $3.0 billion in 2019. Domestic IPOs, in comparison, recorded increases across capital raised and issues with rises of 58 per cent and 77 per cent, respectively.

Domestic and cross-border IPOs by Chinese issuers in 2019

Activity in the global IPO market in 2020, says the US-based multinational law firm, is set to remain subdued with the threat of a downturn further enhanced by China-US trade tensions, Hong Kong political unrest, the Brexit saga, and the upcoming 2020 U.S. Presidential election. Even so, here are some of the largest Chinese IPOs expected to come in 2020: