The plummeting private equity (PE) and venture capital (VC) exits in Southeast Asia are posing a threat to sustained investments into the region, according to the Pitchbook’s Southeast Asia Private Capital Breakdown report.

During 2015-2023, annual PE exits maintained a low count touching a peak of 45 deals in 2021. Annual exit value has been volatile and heavily impacted by outlier exits. For instance, 2018 saw a record exit value of $22.9 billion, of which three quarters came from the IPOs of Vietnamese companies – Vinhomes and Techcombank.

In 2023, Southeast Asia’s PE industry generated only $7 billion in exits.

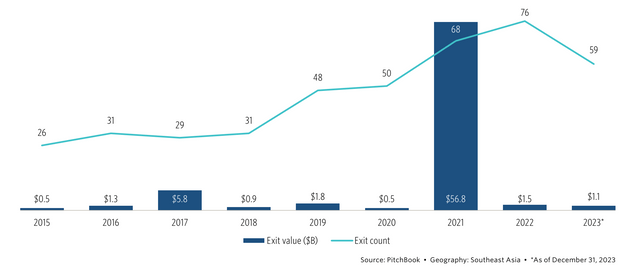

For VC investors, 2021 was a banner year with $56.8 billion recorded in liquidity events in the region. The number significantly dropped to $1.5 billion in 2022 and $1.1 billion in 2023. Last year, Southeast Asia saw no VC exit with a value worth more than $500 million.

The average VC exit value nosedived from nearly $2.3 billion to $76.5 million and $91.1 million between 2021 and 2023.

“While there is not an ideal investment-to-exit ratio, in Southeast Asia it has continually been above 20-1. This further complicates sustained investment into the region as losses pile up for investors,” Pitchbook analysts said in their report.

Investors in the region are experiencing low returns on a recurring basis, while their limited partners (LPs) require a level of performance that can justify the risks involved with the developing market, according to analysts.

At the same time, Southeast Asia is not an exclusive destination for global investors who want exposure to emerging markets. The report indicated that these investors are shifting to other emerging markets, particularly India and Latin America, thanks to more appealing entry prices.

“For startups with similar business models and founder quality, valuations in Indian and Latin American markets are lower, thereby making the deals more attractive,” they added.

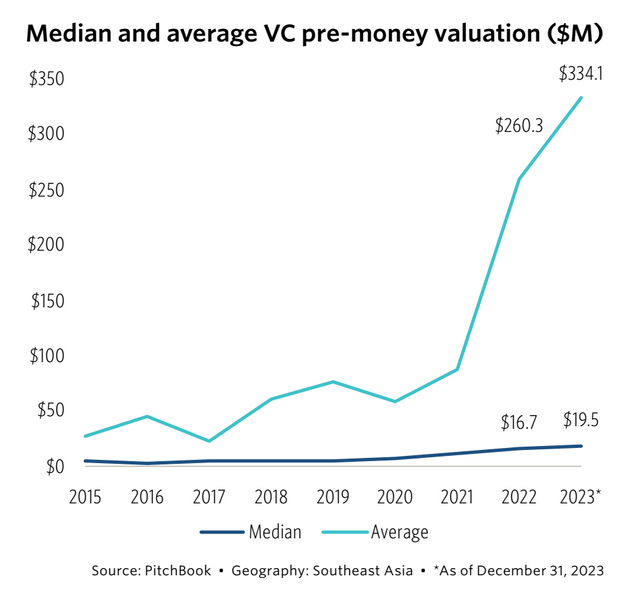

Pitchbook data showed that the average VC pre-money valuation has gone up significantly from below $100 million in 2021 to over $334 million in 2023, despite the overall economic downturn.

Coupled with ballooning valuations, the scalability challenges facing Southeast Asian companies further deter foreign buyers from entering this market.

“Because of the difficulties with expansion across Southeast Asia, acquisitions are generally targeted at companies that have already completed that expansion or are well entrenched in a large market within the region,” the report stated.

It added that the small regional exchanges could not also facilitate sizeable IPOs.

Under such a market context, investors have turned to secondary transactions for liquidity. However, implementing a secondary deal in the region is impacted by the low perception of the strategy and large pricing gaps.

While Southeast Asia has been relying heavily on foreign capital, overseas investors are pulling back in light of fluctuating macro dynamics.

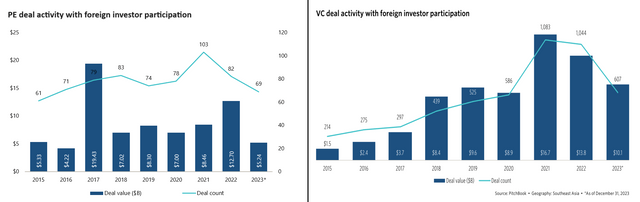

The participation of foreign VC investors has been declining since 2021 in both deal count and value. The share of their involvement in the total deal-making activity has also deteriorated. The same trend is spotted in the PE space.

In 2021 and 2022, more than 60% of PE and VC deals included involvement from an investor based outside of Southeast Asia. These high rates of foreign investor involvement have placed great pressure on their sustained activity, the report pointed out.

The continued interest in Southeast Asia from foreign investors will be determined by its businesses’ ability to convert paper gains from the past few years to cash distributions to LPs, according to Pitchbook analysts.

“TVPI and IRR alone are insufficient to build a strong track record given the inclusion of unrealised gains, and future DPI will help craft a compelling case for LP commitments,” they said.