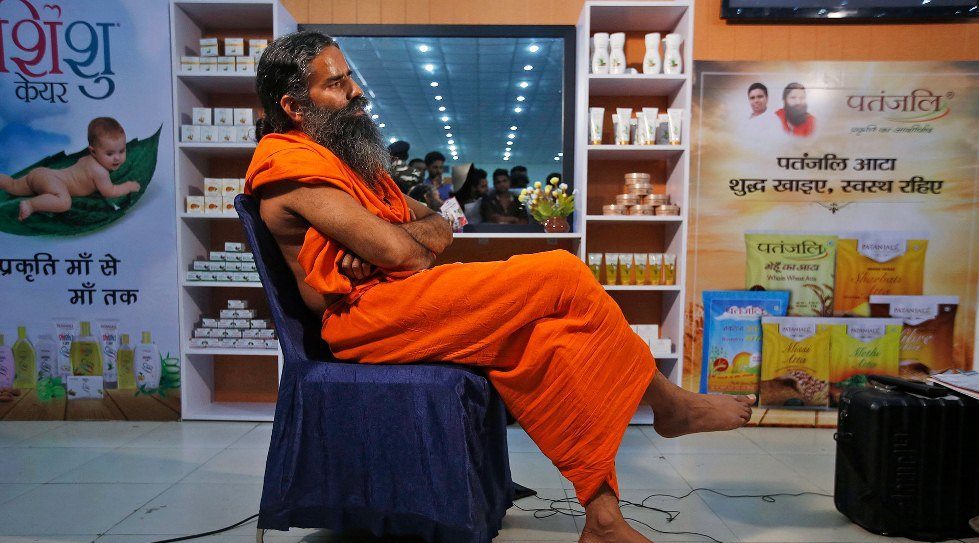

In recent developments in the country’s private equity (PE) space, French group LVMH has expressed interest in buying a stake in Patanjali Ayurved Ltd for up to $500 million. Meanwhile, Mirae Asset Global Investments is looking to enter PE, investment banking and broking businesses in India, while CDC Group has fully exited Ujjivan Financial Services.

Start your deal-making journey now!

Subscribe now to enjoy unlimited access at just $59.

Premium coverage on private equity, venture capital, and startups in Asia.

Exclusive scoops from our reporters in nine key markets.

In-depth interviews with industry leaders shaping the ecosystem.

Already a Subscriber? Log in

Contact us for corporate subscriptions at subs@dealstreetasia.com