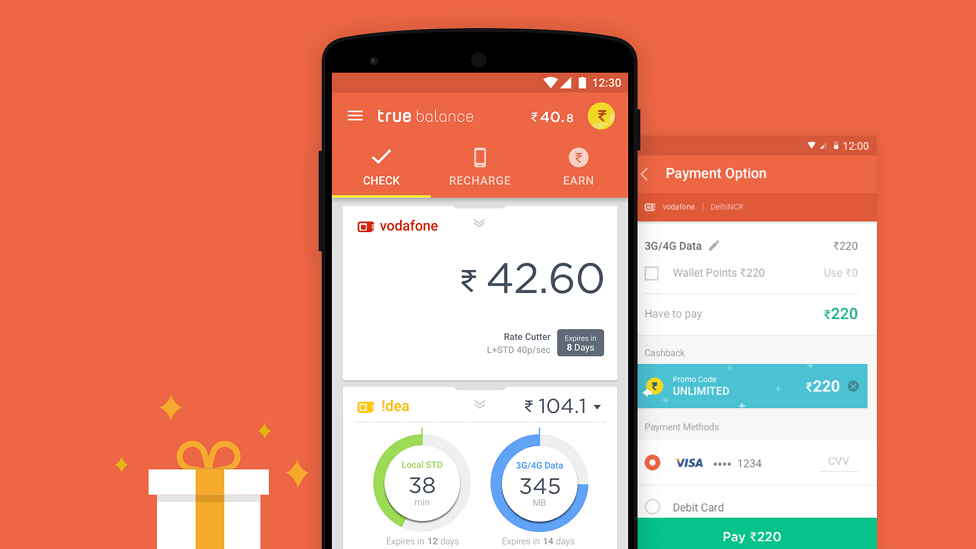

Gurgaon-based digital payments firm True Balance has reportedly raised $23 million in a bridge round from a clutch of foreign institutional investors.

Start your deal-making journey now!

Subscribe now to enjoy unlimited access at just $59.

Premium coverage on private equity, venture capital, and startups in Asia.

Exclusive scoops from our reporters in nine key markets.

In-depth interviews with industry leaders shaping the ecosystem.

Already a Subscriber? Log in

Contact us for corporate subscriptions at subs@dealstreetasia.com