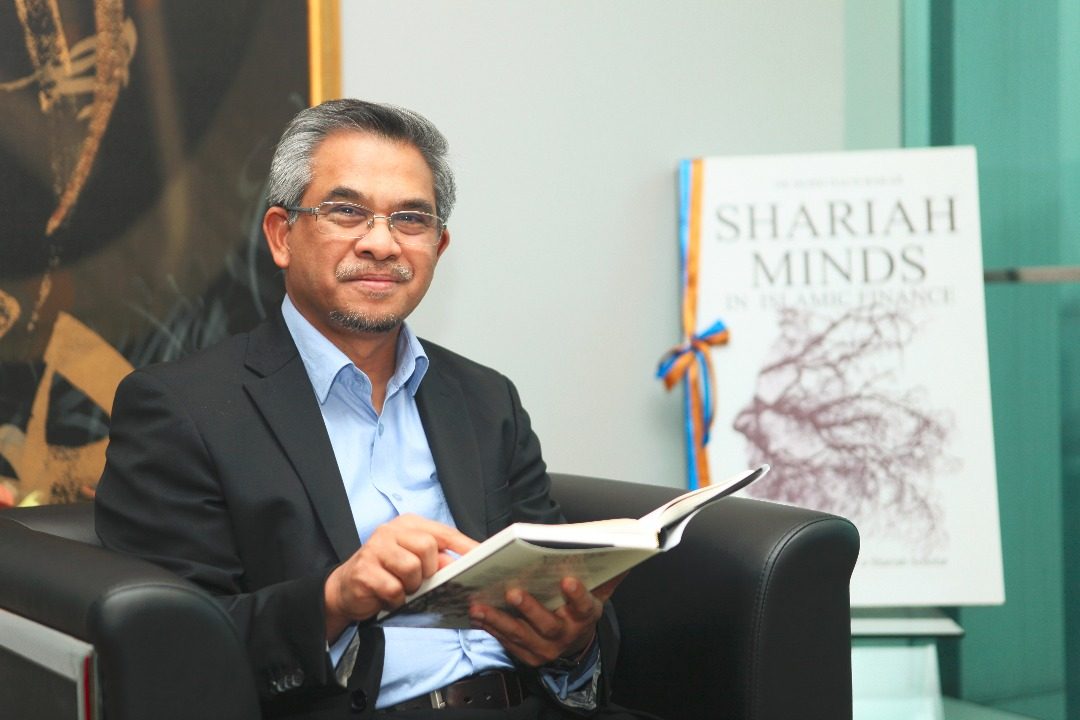

Malaysia needs to develop a vibrant and holistic blueprint at the national level to build a successful Islamic finance-based digital economy in the country, according to Mohd Daud Bakar, executive chairman of global shariah advisory firm Amanie Group and chairman of the Shariah advisory council for Malaysia’s central bank.

Start your deal-making journey now!

Subscribe now to enjoy unlimited access at just $59.

Premium coverage on private equity, venture capital, and startups in Asia.

Exclusive scoops from our reporters in nine key markets.

In-depth interviews with industry leaders shaping the ecosystem.

Already a Subscriber? Log in

Contact us for corporate subscriptions at subs@dealstreetasia.com