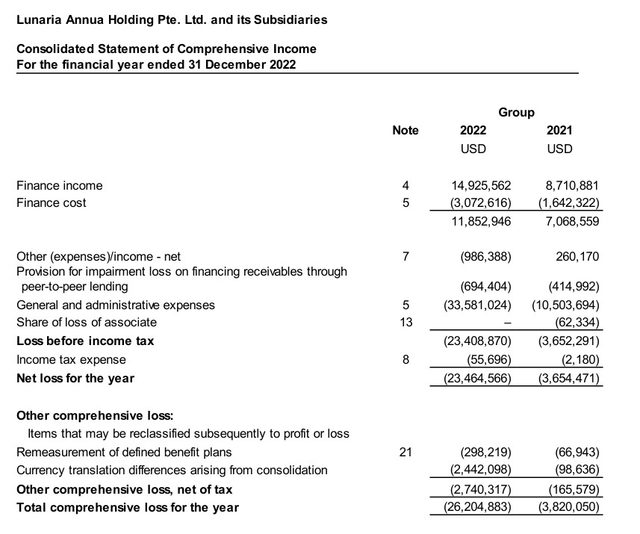

Jakarta-based fintech firm KoinWorks saw its losses widen by 585% in 2022 from a year earlier even as its revenue increased by about 68%, according to regulatory filings by its Singapore-registered parent company.

The group’s net loss widened to $26.2 million in 2022 from just $3.82 million a year earlier, while its income jumped to $11.85 million from $7.07 million during the same period, show Lunaria Annua Holding Pte Ltd’s filings with the Accounting and Corporate Regulatory Authority (ACRA).

General and administrative expenses accounted for the company’s biggest burn in 2022 at $33.58 million, up by more than 200% from $10.50 million a year earlier.

This line expense included employee compensation, which ballooned to $13.60 million in 2022 from just $3.93 million in 2021, the filings show. Marketing expenses also ballooned to $7.78 million in 2022 from just $702,268 in 2021, while bad debt expenses soared to $4.93 million from $422,904.

The expenses continued to widen even as the company attempted to slash its burn in 2022 by, among other measures, laying off about 8% of its workforce and shutting down KoinPintar, its student loan service.

Founded in 2016 as a peer-to-peer (P2P) lending company, KoinWorks caters to micro, small, and medium enterprises (MSMEs) with its marketplace of integrated applications such as accounting software, POS, e-commerce, and budgeting app.

It also offers staple products such as working capital, invoice factoring, early wage access, and treasury management.

According to its ACRA filing, KoinWorks generates revenue through two key channels. It earns a fee-based income comprising an origination fee, which is received from borrowers, and a repayment fee from investors once it returns the borrowed funds to them.

It also earns interest income from the financing receivables invested in its P2P lending platform. These two sources of income generated a total of $18.25 million in revenue, up 79% from 2021’s $10.20 million.

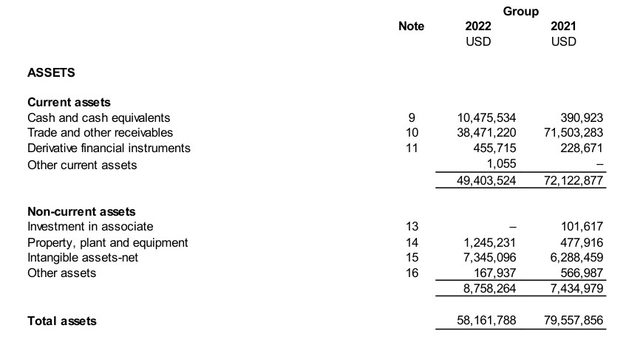

The company’s total assets stood at $58.16 million in 2022, down from $79.56 million a year earlier. Its cash and cash equivalents, however, increased to $10.48 million from just $390,923 in 2021.

Operating activities cost the company $18.36 million in 2022 from an income of $356,042 a year earlier. Meanwhile, the company plowed in $13.63 million in investing activities during the year—a majority of it went towards financing receivables through P2P lending—versus $22.04 million in 2021.

The company had secured $129.32 million in financing for its P2P lending business up to December 31, 2022, compared with $98.64 million a year ago, per its ACRA filing.

The lending business had extended $89.47 million to borrowers at the end of 2022, compared with $39.45 million a year ago. According to its website, the lending business caters to about 2.5 million customers.

Series D funding

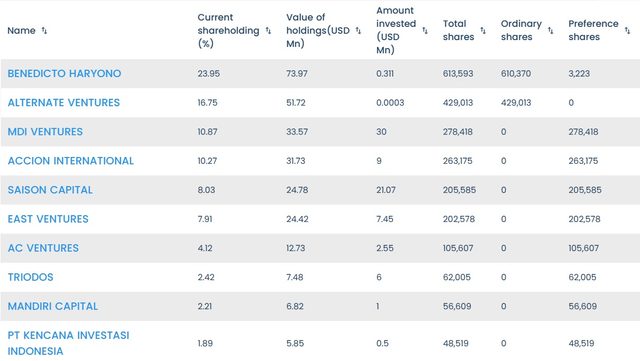

In October last year, the company issued shares worth $18.94 million to investors, led by Saison Capital, as part of a new Series D round. In January 2022, KoinWorks had raised $108 million in a Series C round led by MDI Ventures. The round comprised $43 million in equity and $65 million in debt Funding.

According to DealStreetAsia DATA VANTAGE, KoinWorks’ largest shareholders include its co-founder and CEO Benedicto Haryono, Alternate Ventures, MDI Ventures, and Accion International, and Saison Capital.

Top shareholders of KoinWorks

It also acquired rural bank BPR Asri Cikupa in September 2022 and then rebranded it to KoinWorks Bank, to support the company’s business and expand its financing coverage.

Bolstered by increased demand for funding from MSMEs towards the end of the pandemic, KoinWorks claims to have disbursed loans worth more than 8 trillion rupiah ($527 million) in 2022. It has distributed more than 15 trillion rupiah to MSMEs since 2016.

In comparison, rivals Modalku and Kredit Pintar have disbursed more than 41.2 trillion rupiah and 31 trillion rupiah, respectively, as of 2022.

KoinWorks co-founder Willy Arifin told DealStreetAsia in 2022 that the company expects to book a net profit only by 2024 as its virtual card business is still nascent and requires significant capital infusion.

KoinWorks raised $16.5 million in 2018 in a Series A round backed by Mandiri Capital, Convergence Ventures, Gunung Sewu, and Quona Capital.

It secured $20 million in a Series B round backed by EV Growth (now known as East Ventures (Growth Fund)) and Saison Capital. It also bagged an additional $10 million from London-based lending platform startup Lendable.