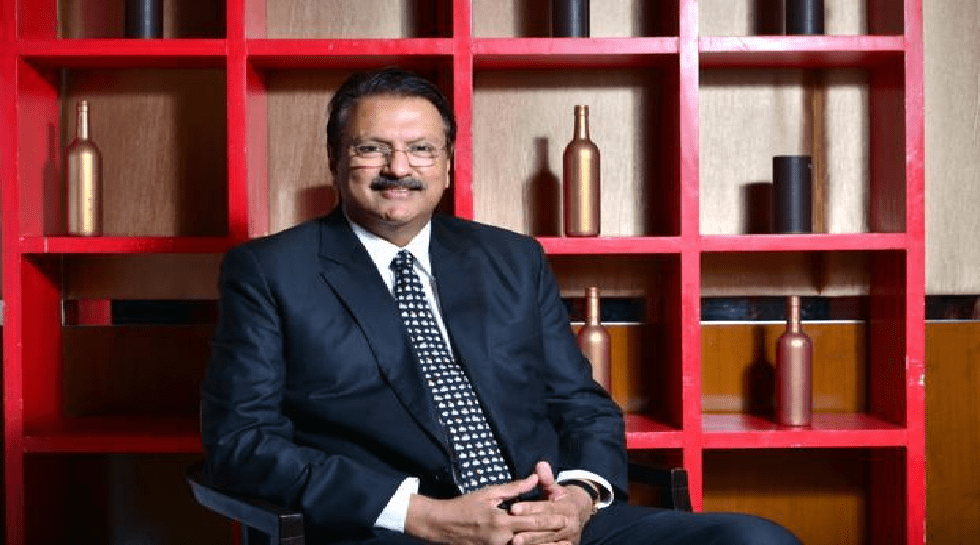

When billionaire Ajay Piramal bought a 20% stake and took management control in Shriram Capital in 2014, it was said that the move was part of Piramal group’s foray into retail lending, which would eventually lead to the merger of Shriram Capital with the financial services arm of Piramal Enterprise. Three years down the line, those plans seem to have changed with the proposed merger with IDFC.

Start your deal-making journey now!

Subscribe now to enjoy unlimited access at just $59.

Premium coverage on private equity, venture capital, and startups in Asia.

Exclusive scoops from our reporters in nine key markets.

In-depth interviews with industry leaders shaping the ecosystem.

Already a Subscriber? Log in

Contact us for corporate subscriptions at subs@dealstreetasia.com