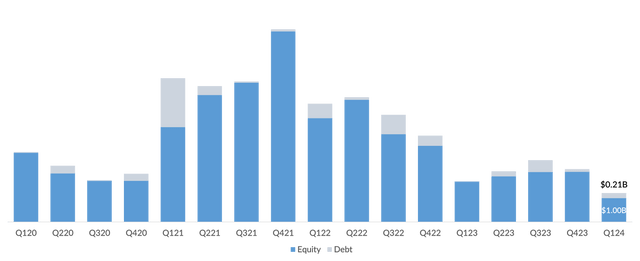

The first quarter of this year saw private funding secured by Southeast Asia-based startups nosedive to the lowest level seen in over five years, finds the latest report from DealStreetAsia – DATA VANTAGE.

Regional startups raised a total of $1 billion in the first three months of the year, marking a 41% year-on-year drop, according to SE Asia Deal Review: Q1 2024. The Q1 haul is less than half the $2.2 billion raised in the fourth quarter of 2023.

The silver lining was an uptick in the number of funding rounds recorded in Q1. Homegrown startups inked 180 equity deals during the January-March period, a modest improvement from the 164 deals recorded in the previous quarter. However, the Q1 deal count still lagged behind the 193 rounds secured in the same period last year.

For context, Southeast Asia’s quarterly fundraising performance reached its peak in Q4 2021, when venture-backed companies raised a staggering $8 billion. This was followed by a peak in deal volume in Q1 2022, which witnessed 312 equity funding rounds. Dealmaking in the region has been on a downward trajectory since hitting those peaks.

Equity vs debt funding value per quarter

Capria Ventures managing partner Dave Richards attributed the shift to fund managers becoming more selective after many regional startups failed to demonstrate a path toward cash flow break-even.

He believes many startups have poor unit economics, characterised by high customer acquisition costs and insufficient gross margins, as well as unrealistic valuations that do not convincingly predict business growth or the potential to deliver venture-scale returns within a reasonable timeframe.

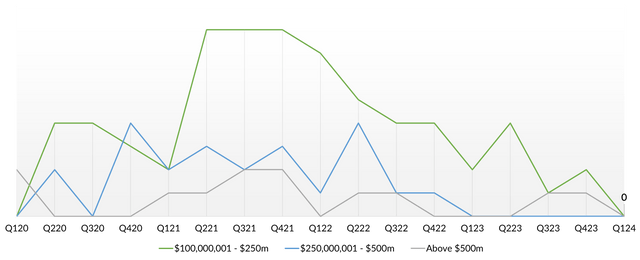

Late-stage woes

The steep fall in total funding raised in Q1 can largely be ascribed to the ongoing global liquidity crunch and its impact on valuations and investor appetite for late-stage investments (Series C rounds and beyond).

According to the DATA VANTAGE report, only five late-stage deals were closed by SE Asian startups in the first three months of this year – the fewest since at least the first quarter of 2019 – with total proceeds of $181 million.

As investors pared down large funding rounds, not a single startup in the region raised over $100 million in funding during Q1 2024 – a rarity not witnessed in over five years in a fast-growing market.

Quarterly equity deal volume with value above $100 million

As financial headwinds persist, startups in Southeast Asia may have to brace themselves for an extended late-stage capital drought, particularly as geopolitical turbulence intensifies in the SWANA region and the ongoing US-China decoupling.

“We are fortunate that Southeast Asia remains relatively stable despite the geopolitical turbulence happening throughout the rest of the world. In many cases, the region’s neutrality has benefitted from some of the developments,” said Susli Lie, a partner at Monk’s Hill Ventures.

Lie noted that global supply chain diversification away from China has resulted in record levels of foreign investment flowing into the region. Domestically, she said, Southeast Asia is seeing a surge in domestic consumption due to a pick-up in travel and a growing middle class that is insulating the region against some of the incoming headwinds.

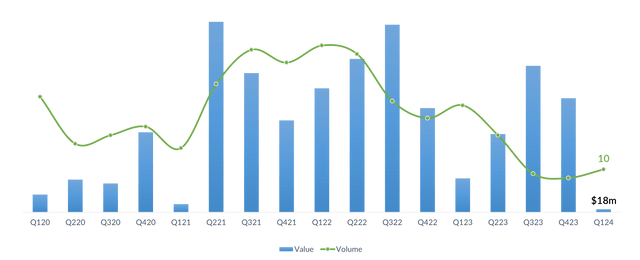

E-commerce in distress

Despite clear signs of improving consumption, venture capital funding into e-commerce startups across Southeast Asia hit a fresh low in the first quarter of 2024 as investors shied away from capital-intensive bets.

In Q1, 10 e-commerce startups raised a mere $18 million in total. This paltry figure is a far cry from the dizzying heights of Q2 2021, when startups in the sector had raked in a staggering $1.2 billion as excess global liquidity sloshed through both public and private markets.

The e-commerce funding drought has been particularly acute in Indonesia, which has traditionally been the sector’s primary investment destination. Only two Indonesian e-commerce startups could secure deals in the latest quarter, although this represented a slight uptick from zero deals in Q4 2023.

Equity funding for e-commerce firms per quarter

On the other hand, fintech showed a gradual recovery in Q1, thanks to a renewed interest in blockchain-powered fintech services, better known as decentralised finance (DeFi). This aligns with the surge in cryptocurrency prices, particularly bitcoin, which has seen a 105% increase over the last six months.

While DeFi investments are primarily reflected in the wealthtech category, they also influence other fintech sectors such as lending and e-payments. DeFi deals contributed 43% to the overall fintech deal volume in the first quarter, marking a significant improvement from a 5% share in Q1 2020. In terms of deal value, DeFi startups generated 42% of the total proceeds attributed to fintech, the highest quarterly proportion to date.

The quarterly trajectory suggests that investments in DeFi may, for the first time, surpass traditional fintech in terms of volume and value in the next few quarters, the report concludes.

The SE Asia Deal Review: Q1 2024 report has extensive data on:

- Quarterly fundraising trends

- Median and average deal values by funding stages

- Deal volume and value for top verticals

- Fundraising performance for individual SE Asian markets

- Fund manager perspectives

Unlock the report for only $299 or upgrade to a Premium Plus subscription for greater savings and enjoy full access to up to 36 research reports a year, all for just $1200 ($100/month). Still not sure? Opt for a one-month trial.