At a time when the Asia Pacific is riding on growing investor interest, UOB Alternative Investment Management (UOBAIM), an arm of Singapore-based lender UOB, is not enticed by larger multi-billion dollar vehicles in the region. The investor sees these larger funds as an avenue for exits rather than investment bets.

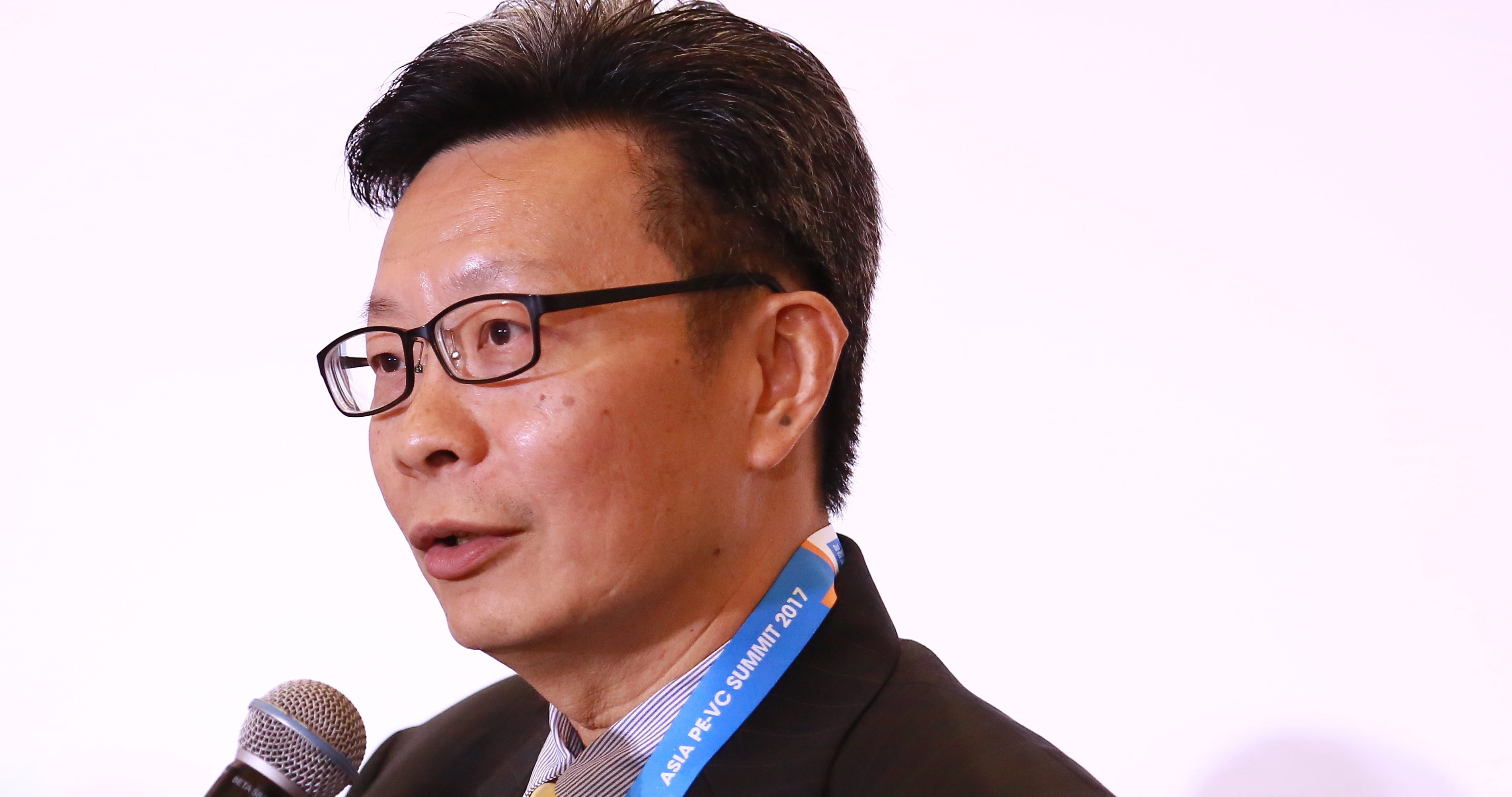

“We generally do not like to invest in funds that are too big. Our thesis is that there are a few good companies and if you are too big you will be diluting your returns,” said UOBAIM chief executive Low Han Seng.

As a limited partner (LP), UOBAIM has raised capital for private equity fund-of-funds for pan-Asia opportunities and is now even considering a Southeast Asia-focused fund of funds with a target corpus of $200-300 million to invest into PE and VC funds and explore co-investment opportunities.

“Sometimes people do invest in funds that are big because they may be from overseas and they have more confidence in a big fund name but we do not have that excuse, because we are sitting here. We can focus more on the smaller end of the market because we can better understand the opportunities, we can do due diligence and that is where we operate. We feel the presence of these big funds is an advantage because it gives us an avenue for exits if we create a good company,” Low pointed out.

Having said that, fundraising in the region has seen increased activity despite the ample amount of dry powder that still needs to be deployed. Amid increased PE activity, last year Asia-Pacific PE deal value soared to $159 billion, exit value was at $115 billion and fundraising rose 6 per cent to $66 billion, above the five-year historical average, according to a report from Bain & Co. Among the large vehicles that were raised last year were KKR’s $9.3-billion buyout fund, CITIC PE’s $2-billion China vehicle and Asia Alternatives Management’s $1.8-billion regional vehicle. In fact, this year, Beijing-based Hillhouse Capital – whose portfolio includes Airbnb, Uber, Meituan, Didi and Tencent, closed its fourth vehicle, Hillhouse Fund IV, at a record-breaking $10.6 billion.

On the phenomenon of large funds being able to raise better than the smaller funds, Low noted, “It also depends on the opportunities and performance track record. For example, if you are a Chinese fund or a small VC that gets 10x returns, investors would still invest as they are profit seeking entities. Suffice to say that large PE investors are easily raising is because of the uncertainty and the risk aversion in Asia.”

In a detailed interaction, Low talked about co-investments, direct investing by LPs in recent times, exits and how the PE landscape has evolved in the region.

Edited Excerpts: