China Deals Barometer Report: At $4.8b, PE-VC dealmaking rebounds to hit four-month high in June

Dealmaking activity in Greater China rebounded to a four-month high in June as 231 startups raised a combined $4.8 billion, a 75.7% month-on-month (MoM) jump, according to proprietary data compiled by DealStreetAsia.

The deal count of 231 in June marked a growth of 17.3% from the prior month, the data showed.

In terms of a year-on-year (YoY) comparison, the deal volume in June dropped by 5.7% over the same month last year, while the deal value increased slightly by 2.7%.

When it comes to the first six months of this year, startups in Greater China collectively secured $25.7 billion across 1,253 venture deals. The deal value booked a 8.8% growth over the same period in 2022, while deal volume spiked 29.4%.

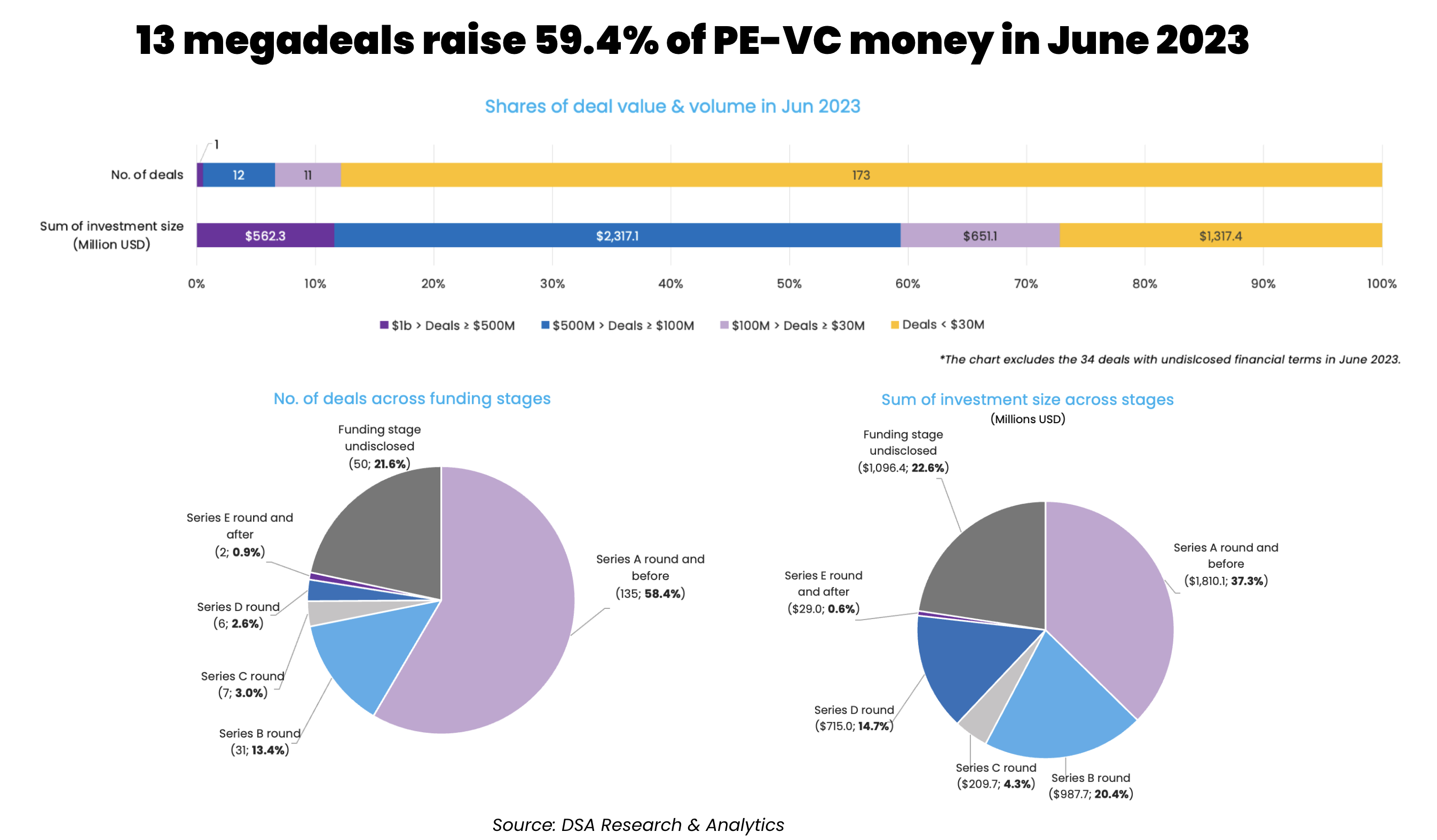

Megadeals make up almost 60% of deal value

There were 13 megadeals — transactions worth at least $100 million — in June, compared with only five in the previous month. The 13 big-ticket deals raised a combined $2.9 billion, which was up 93% from May’s $1.5 billion, and accounted for 59.4% of the total startup financing in June 2023.

Anhui YOFC Advanced Semiconductor Company (YASC), which engages in the R&D and manufacture of third-generation semiconductor products using materials including silicon carbide (SiC) and gallium nitride (GaN), was the top scorer of the month.

As the largest semiconductor deal in China this year, the firm notched 3.8 billion yuan ($562.3 million) in a Series A financing round, participated by a slew of notable state-affiliated investors such as CNBM New Materials Fund and CICC Capital.

Third-generation semiconductors such as silicon carbide, known as SiC, are equipped with better energy efficiency compared with silicon, which is crucial when it comes to lowering carbon emissions. They are becoming increasingly crucial in sectors including new energy vehicles and mobile communication industry, as China strives for self-reliance in chipmaking amid intensifying crackdown from the US.

The second-largest deal of the month was secured by ESWIN Computer Technology, a Chinese provider of artificial intelligence of things (AIoT) chips and services, which secured 3 billion yuan ($421 million) in a Series D financing round co-led by two state-owned investment platforms — Beijing Financial Street Capital Operation Group and Guoxin Venture Capital.

In another semiconductor megadeal in June, Jiangsu Xinhua Semiconductor Technology also snapped 1 billion yuan ($140.5 million) in a Series B funding round participated by CNBM New Materials Fund, CCB Investment, and Oriza-Rivertown Capital, among others.

Investments at Series A and earlier funding stages continued to dominate the fundraising scene, accounting for 58.4% of the month’s total deal count. The early-stage deals amassed $1.8 billion, or 37.3% of the total deal value.

In contrast, Series E and later funding stages only booked two venture deals worth $29 million, which shows that investors remain picky with late-stage bets.

| Startup | Headquarters | Investment size (Million USD) | Investment stage | Lead investor(s) | Other investor(s) | Industry/Sector | Vertical |

|---|---|---|---|---|---|---|---|

| YOFC Advanced Semiconductor | Wuhu | 562.3 | A | Optics Valley Industry Development Fund, Zhongping Capital, Winsoul Capital, CNBM New Materials Fund, Jiaxing Guoping, and others | Semiconductor | N/A | |

| ESWIN Computer Technology | Beijing | 421 | D | Beijing Financial Street Capital Operation Group, Guoxin Venture Capital | Hefei Ruicheng Private Equity Fund Management, Sino-Singapore Connectivity Private Equity Fund Management, Yixing Private Equity Fund Management, Ultra-HD Video Industry Fund, Goldport Capital, and others | Semiconductor | Internet of Things |

| Light Year | Beijing | 284.4 | M&A | Meituan | Software | AI and Machine Learning | |

| Beijing West Smart Mobility Zhangjiakou Automotive Electronics (BWSM) | Zhangjiakou | 279.3 | A | Zhangjiakou Financial Holding Group | Shenzhen Shenshan Special Cooperation Zone, Yunshi Huanqiu Capital, HOPU Investments, Shenzhen Investment Holdings | Automobiles & Parts | Electric/Hybrid Vehicles |

| Sunwoda Electric Vehicle Battery | Shenzhen | 228.3 | B | BOC Financial Asset Investment, CCB Private Equity Investment Management, CCB Investment, Chongqing Manufacturing Industry Transformation and Upgrading Fund, China Life Private Equity Investment (affiliated with China Life Insurance Company), and others | Energy Storage & Batteries | Electric/Hybrid Vehicles | |

| United Aircraft | Shenzhen | 167.1 | D+ | Longjiang Fund | Lianhe Keli Venture Capital, Heilongjiang Senjiang Industry Investment Group, Longjiang Venture Capital, Harbin Keli Venture Capital Management, Harbin Venture Capital Group, and others | Aerospace | AI and Machine Learning |

| Singularity AI Technology | Beijing | 160 | Star Group Interactive Inc (affiliated with Kunlun Tech) | Software | AI and Machine Learning | ||

| Worg Pharmaceuticals | Shanghai | 151.7 | C | Detong Capital, Baron Capital, Bayland Capital, Jiansu Capital, Kequan Investment, and others | Biotech | Biotech | |

| VIVA Shanghai | Shanghai | 150 | Equity Financing | HLC SPV (affiliated with HighLight Capital), Qingdao Hongyi (affiliated with HighLight Capital), Daxue Investments (affiliated with Temasek Holdings), True Light P (affiliated with Temasek Holdings) | Healthcare Services | Biotech | |

| Xinhua Semiconductor Technology | Xuzhou | 140.5 | B | CNBM New Materials Fund, CCB Investment, Shanghai Pudong Innotek Capital, Chengdu Science & Technology Innovation Investment Group, CRCC Transformation and Upgrade Fund, and others | Semiconductor | N/A | |

| Ruqi Mobility/Chenqi Technology | Guangzhou | 117.2 | B | Guangzhou Automobile Industry Group (controlling shareholder of GAC Group) | Transportation Services | Ridesharing/Transport | |

| Cornerstone Robotics | Shenzhen | 110.3 | BridgeOne Capital, Lenovo Capital and Incubator Group (affiliated with Legend Holdings), Tsing Song Capital, DragonBall Capital (affiliated with Meituan), Qiming Venture Partners, and others | Medical Devices & Equipment | HealthTech | ||

| OpenSource Consensus Technologies (OSChina) | Shenzhen | 107.3 | B+ | FutureX Capital | Winreal Investment, Haiwang Capital (affiliated with Spinnotec), Tianjin TEDA Investment Holding, Shanghai Pudong Software Park, Shanghai Zhangjiang Science and Technology Investment (affiliated with Shanghai Zhangjiang Group), and others | Software | Cloud Computing |

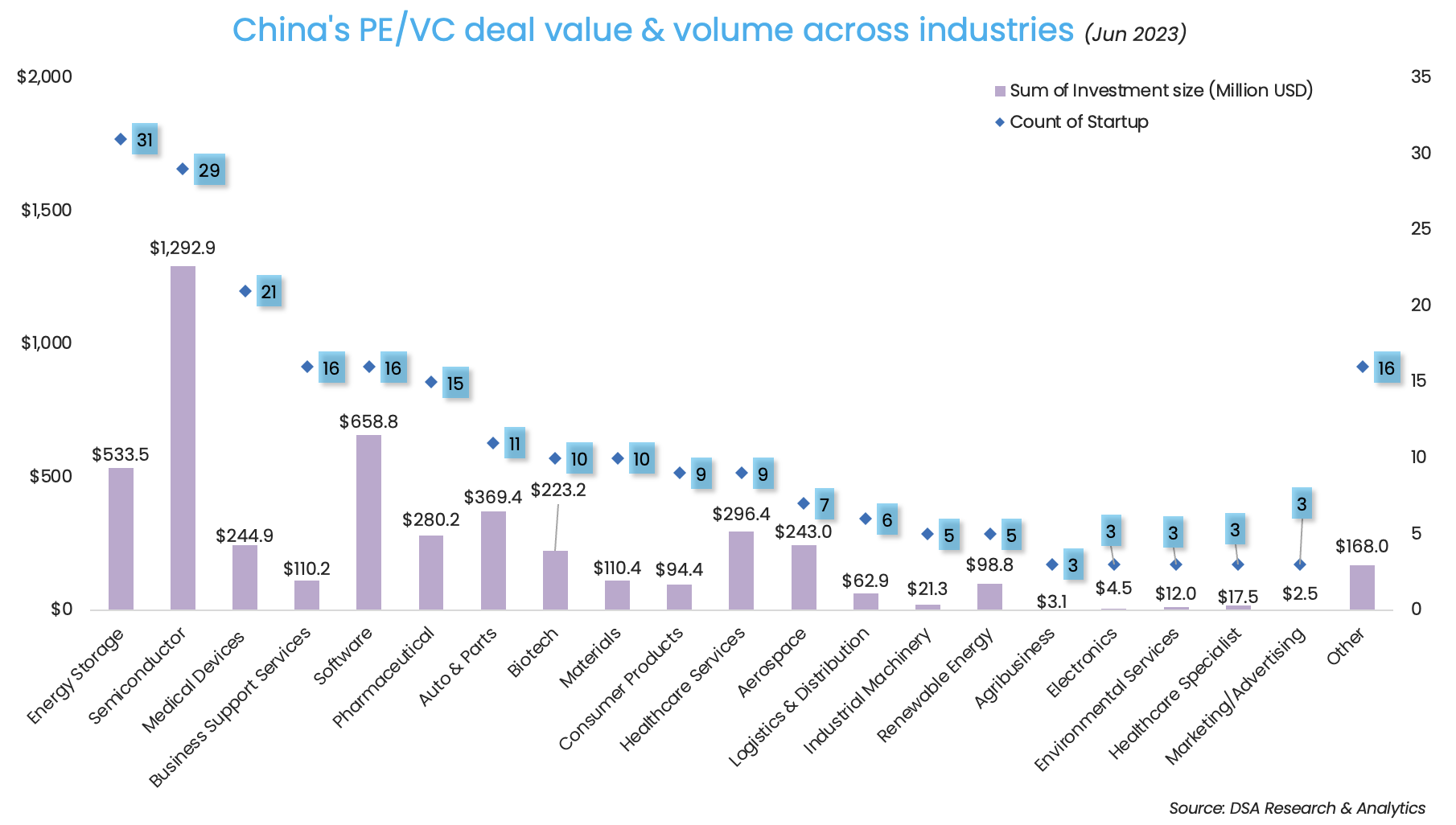

Energy storage bags highest number of deals

China’s 2060 carbon neutrality target has prompted companies from the new energy to energy storage and management sectors to turbocharge the country’s energy transition. Energy storage, in particular, saw heightened investor interest with 31 venture deals worth $533.5 million — the most favoured sector in June in terms of deal count. In one of the biggest deals in this sector, Sunwoda Electric Vehicle Battery (EVB) bagged 1.65 billion yuan ($228.3 million) in an equity financing round.

Unsurprisingly, semiconductor ranked first in terms of deal value, with the completion of 29 venture deals worth $1.3 billion.

Software was the second most-funded sector, sealing 16 deals worth $658.8 million. A total of three megadeals took place in the sector, including Light Year, a nascent artificial intelligence (AI) company, which was acquired by Chinese food delivery giant Meituan. The deal consisted of almost $233.7 million in cash and over 366.9 million yuan ($50.7 million) worth of debt, per exchange filing.

In another megadeal in the sector, Singularity AI Technology Limited, was acquired by Kunlun Tech via its holding subsidiary Star Group Interactive Inc. Kunlun Tech was planning a $400-million capital injection into its subsidiary to acquire all the equity of the AI firm via share issue.

CICC Capital & affiliates top investors’ list

CICC Capital, the flagship private equity (PE) unit of Chinese investment bank China International Capital Corp Ltd (CICC), and its affiliates were the top investors of June, participating in nine deals alongside other investors. The nine startups raised a total of $671.7 million.

In July, the firm closed a new blind-pool equity investment fund at 4.2 billion yuan ($579.2 million) to focus on the technology industry, roping in capital commitments from privately-run financial institutions, listed companies, tech firms, as well as China’s government guidance funds and state-owned companies, the firm said in a statement.

Oriza Holdings, a state-owned investment firm in eastern China’s Suzhou City, ranked second last month with investments in six deals alongside its affiliates.

June also saw venture capital powerhouse Sequoia split into three independent entities — Peak XV Partners, which will focus on India & Southeast Asia, HongShan to focus on China, and Sequoia Capital representing the US and Europe. The split-up did not seem to hinder HongShan‘s dealmaking activity, which injected capital into five startups in June.

Investment company No. of deals Total value of participated deals (Million USD) Lead Non-lead

CICC and affiliates 9 671.7 2 7

Oriza Holdings and affiliates 6 215.9 1 5

Legend Holdings’ affiliates 5 261.1 2 4

HongShan (previously Sequoia Capital China) 5 100.2 1 4

Qiming Venture Partners 5 155.3 3 2

Cowin Capital 5 33.5 3 2

Everest VC 5 46.5 3 2

Shanghai STVC Group 4 144.2 2 2

CoStone Capital 4 51.4 2 2

Zhencheng Capital 4 5.5 4 0

CAS Star 4 6 3 1

Note: In our monthly analysis for June 2023, we have put together detailed charts of prominent deals, active investors, deal stages, and the most attractive sectors that have bagged the maximum venture dollars in the Greater China region.

Our database only considers deals officially announced by the related investee, investor(s), and/or financial advisor, while information based on market rumours and news reports citing sources is excluded.

For a more detailed analysis, and to enable comparison between primary and secondary markets, DealStreetAsia has started tracking deals of all sizes since April 2020, as against considering only transactions worth more than $10 million earlier.

We have also introduced a standardised system for industry classification. It currently includes over 50 industries, as well as over 45 new economy and high-tech verticals, which will progressively increase to adapt to local market conditions in our closely watched regions of Greater China, Southeast Asia, and India.

Related Stories

Venture Capital

SE Asia Deals Barometer Report: Startup fundraising falls to four-month low of $445m in June

Dealmaking in Southeast Asia dropped by almost 58% month-on-month in June to about $445 million—the lowest since March this year—as megadeals remained elusive in the month, show proprietary data compiled by DealStreetAsia.

Venture Capital

India Deals Barometer Report: Startup funding drops to 34-month low at $652m in June

After rebounding to touch a high of $1.5 billion in May this year, private equity and venture capital investments in India plunged to $652 million in June, hitting a 34-month low, according to proprietary data compiled by DealStreetAsia.