India Deals Barometer Report: Startup funding drops to 34-month low at $652m in June

With fears of a global recession looming large amid mounting economic challenges, the Indian startup ecosystem maybe facing its toughest time yet. After rebounding to touch a high of $1.5 billion in May this year, private equity and venture capital investments in India plunged to $652 million in June, hitting a 34-month low, according to proprietary data compiled by DealStreetAsia.

While the drop in deal value works out to about 58%, deal volume remained almost flat at 90 in June against 89 in May, showed the data. Of the total deals in June this year, the value of 12 transactions was not disclosed.

Year-on-year, the funding value dropped 68% from $2.05 billion last June, while volume was down 29%.

Notably, 2021 set a record high in startup investments, with PE-VC players betting at least $46 billion on Indian startups. Venture funding, however, nosedived to $26 billion in 2022 and the situation has been worsening since because of an extended funding winter, equity market fluctuations, higher interest rates, and higher inflation, among other factors.

Big-ticket transactions have been particularly affected as tight-fisted investors are taking longer to close deals and displaying signs of wariness about leading investment rounds. They are also putting in place stricter vigilance measures after a few startups, including BYJU’S, BharatPe, Trell, GoMechanic, and Zilingo, came under the spotlight for accounting irregularities.

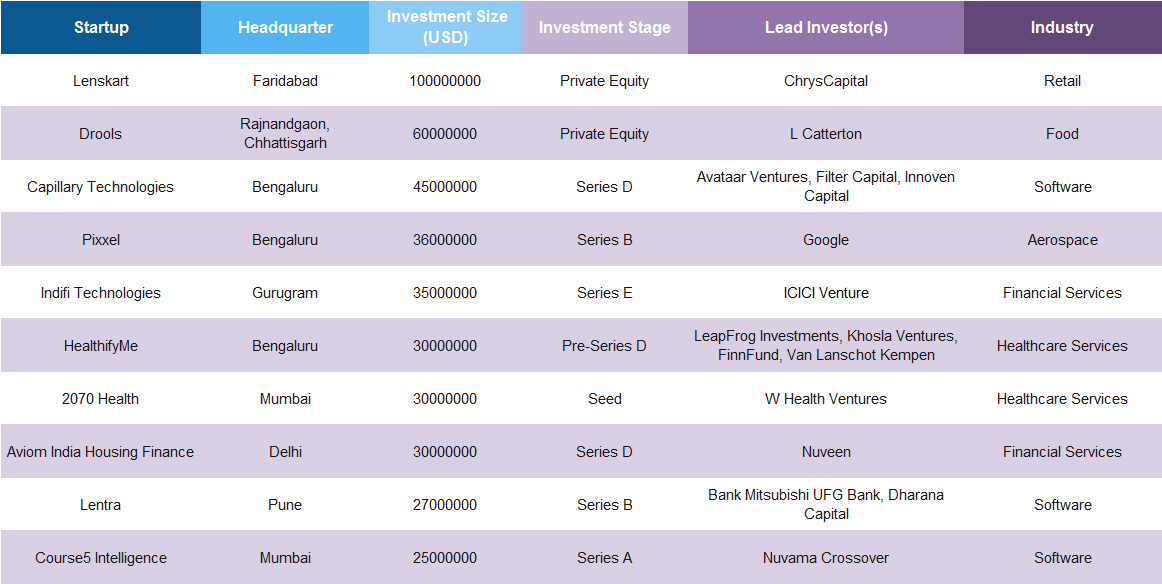

Top 10 deals in June

The biggest and the only mega deal in June worth $100 million was closed by SoftBank-backed eyewear startup Lenskart. The capital was injected by homegrown private equity fund ChrysCapital via primary and secondary share purchases. In March this year, the company had also announced a $500-million investment from sovereign wealth fund Abu Dhabi Investment Authority. The latest investment brings Lenskart’s total capital infusion to nearly $850 million in the past year.

Other prominent deals in the month included pet food brand Drools ($60 million); SaaS startup Capillary Technologies ($45 million); space startup Pixxel ($36 million); digital technology platform for lending Indifi Technologies ($35 million); healthcare startup HealthifyMe ($30 million); health and wellness startup 2070 Health ($30 million); and micro-mortgage lender Aviom India Housing Finance ($30 million).

In comparison, May recorded five mega deals worth $875 million, which comprised 56% of the total deal value in the month.

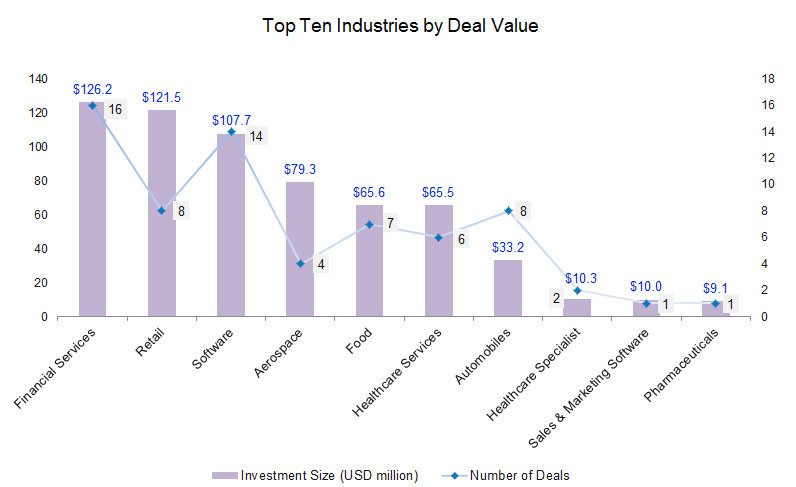

Financial services startups shine

Startups in the financial services sector outperformed those in the other sectors by mopping up $126.2 million across 16 deals. Within financial services, Indifi Technologies raised the largest round of $35 million, led by funds managed and advised by ICICI Venture, along with participation from existing investors, including British International Investment, OP Finnfund Global Impact Fund I, Omidyar Network India, Flourish Ventures, and CX Partners.

Aviom India Housing Finance followed with $30-million funding in a Series D round led by Nuveen. Founded in 2016, Aviom — operational in 12 Indian states — facilitates access to affordable loans for low-income groups in rural and semi-urban regions of India.

Other deals within financial services included Lendingkart ($24 million), Scapia ($9 million), Capital Small Finance Bank ($6 million), KarmaLife ($5.3 million), and Revfin ($5 million).

Startups in the retail industry occupied the second spot with a total of $121.5 million in funding. Lenskart took the lead with $100-million funding, followed by HomeLane ($9.1 million), Koskii ($7.5 million), Mainstreet Marketplace ($2 million), and The Yarn Bazaar ($1.8 million).

Software followed with $107.7 million in funding across 14 transactions. Apart from Capillary Technologies, other prominent deals within software were Lentra ($27 million), Course5 Intelligence ($25 million), Togai ($3.1 million), and HighXP ($2.2 million).

Together, the top three industries — financial services, retail, and software — raised a total of $355.3 million, accounting for about 54% of the total deal value in the month.

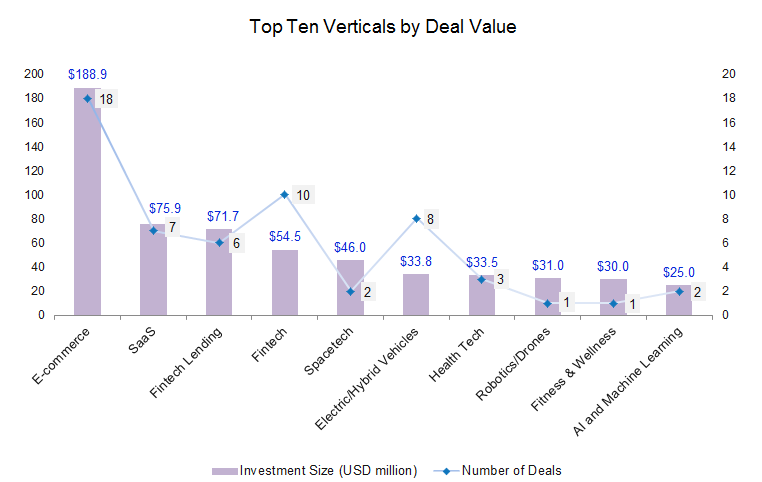

Among verticals, e-commerce, software-as-a-service (SaaS), and fintech lending were the top scorers, with $188.9 million, $75.9 million, and $71.7 million in funding, respectively.

Early-stage deals drive volumes

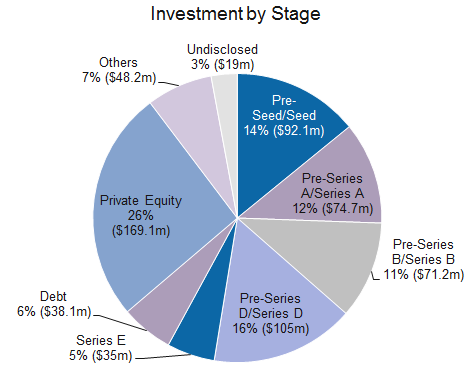

The majority of venture deals during the month were in the pre-seed and seed stages, raising about $92.1 million across 36 transactions. In comparison, there were a total of 32 pre-seed and seed-stage deals in May that together scooped up funding worth $62.3 million.

2070 Health, a healthcare venture studio, raised the largest seed round of $30 million in the month from W Health Ventures. RevSure.AI ($10 million), BillionElectric ($10 million), Scapia ($9 million), GenWise ($3.5 million), Togai ($3.1 million), and BluJ Aerospace were among the other startups that raised seed rounds during the month.

Startups in pre-Series A and Series A stages raked in about $74.7 million across 21 transactions, which is a drop of about 71% from May. In the biggest Series A round, data analytics company Course5 Intelligence raised $25 million in its second tranche of funding led by Nuvama’s crossover fund series, a month after closing $28 million at a valuation of $250-275 million.

Other Series A rounds were closed by startups, including Koskii ($7.5 million), Good Flippin’ Burgers ($4 million), Proklean Technologies ($4 million), and WatchYourHealth ($2.2 million).

In terms of value, growth-stage startups led fundraising in August. Companies in the Series B or post-Series B rounds (including private equity rounds) collected an aggregate of $384 million through 15 investments. This comes to about 59% of the total deal value in the month.

ah! Ventures tops investor charts

Investment platform ah! Ventures topped the investors’ list in June with at least five investments compared with two in May. Its investments included electric scooter startup Starya Mobility, alcoholic beverage startup Barbrew Beverages, wearables startup Neuphony, electric two-wheeler maker Kyte Energy, and workforce analytics software startup We360.ai.

Last year, ah! Ventures announced the launch of its maiden angel fund to empower startups with glocal ambitions. The fund, with a target corpus of Rs 100 crore and a greenshoe option of up to Rs 50 crore, is focused on early-stage and pre-Series A startups across India.

Inflection Point Ventures followed with at least four investments, including B2B fintech platform BharatNxt, multi-modal connectivity platform Tummoc, gardening-focused hyperlocal marketplace Urvann, and used cars platform SheerDrive.

Gemba Capital was the third most active investor, with a total of three deals in the month. Meanwhile, Anicut Capital, Mumbai Angels, Avaana Capital, Conquest Global Ventures, India Quotient, Rainmatter, and Tanglin Venture Partners made at least two investments each.

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

China Deals Barometer Report:At $4.8b, PE-VC dealmaking rebounds to hit four-month high in June

Dealmaking activity in Greater China rebounded to a four-month high in June as 231 startups raised a combined $4.8 billion, a 75.7% month-on-month (MoM) jump, according to proprietary data compiled by DealStreetAsia.

Venture Capital

SE Asia Deals Barometer Report: Startup fundraising falls to four-month low of $445m in June

Dealmaking in Southeast Asia dropped by almost 58% month-on-month in June to about $445 million—the lowest since March this year—as megadeals remained elusive in the month, show proprietary data compiled by DealStreetAsia.