SE Asia Deals Barometer Report: Startup fundraising falls to four-month low of $445m in June

Dealmaking in Southeast Asia dropped by almost 58% month-on-month in June to about $445 million—the lowest since March this year—as megadeals remained elusive in the month, show proprietary data compiled by DealStreetAsia.

There were only 67 deals in the month, compared with 73 transactions that raised $1.05 billion in May— the only month when fundraising in the region has surpassed the $1-billion mark so far this year.

On a year-on-year basis, the drop was a stark 68% as startups in the region had raised $1.42 billion from 89 deals in June 2022.

The lowest monthly funding value this year was recorded in February, when private companies managed to secure just $0.41 billion from 55 transactions (see chart below).

The June figure brings the total amount raised by startups in Southeast Asia so far this year to at least $4.16 billion from 497 deals. There were 21 deals in June that did not disclose the funds raised.

Besides venture capital and private equity transactions, the deals last month included debt financing, convertible notes, corporate round, secondary market deals, and equity crowdfunding.

For the entire 2022, total funding in the region had dropped 32% to $15.8 billion from 2021’s record highs. Annual deal volume, however, defied the trend, closing 9.6% higher at 1,062, signalling a shift away from big-ticket deals.

Elusive megadeals

Data compiled by DealStreetAsia show that there was only one megadeal—a transaction worth at least $100 million—in June, bringing the total number of megadeals in the first six months of the year to 13.

The month of May had posted the most number of megadeals so far this year at five, raising about $649 million in total.

Indonesia-based fintech firm Amartha Nusantara Raya (Amartha) scored the only megadeal in June after it raised $100 million in debt financing from San Francisco-based investment firm Community Investment Management (CIM).

Amartha runs an online marketplace that channels capital from urban investors to women micro-entrepreneurs in the form of loans. This helps them raise working capital for their businesses.

Amartha is the first Southeast Asian firm that has raised capital from CIM.

The lone megadeal of June 2023

| Company Name | Headquarter | Amount Raised | Funding Stage | Lead Investor | Vertical |

|---|---|---|---|---|---|

| Amartha | Indonesia | $100,000,000 | Debt Financing | Community Investment Management | Fintech |

No startup in Southeast Asia made it to the unicorn club in June and only one company has earned the unicorn tag so far this year—eFishery, which became Indonesia’s latest unicorn after its $108-million funding round in May.

In 2022, eight privately-held startups in the region earned the much sought-after unicorn tag. In 2021, there were a record 23 startups in the region that crossed the $1 billion valuation.

Singapore remains a funding magnet

In June, Singapore continues to corner the biggest chunk of the money raised in the entire region, DealStreetAsia’s compilations showed.

Privately-held companies in the city-state raised a combined $226.5 million, or about 51% of the total amount raised in the month, from 37 transactions.

In May, Singapore-based startups had raised about $551 million from 41 deals.

Biotech company Lion TCR raised the biggest amount of funding among Singapore-based startups in June, at $40 million, in a Series B2 funding round led by state investor Guangzhou Industrial Investment and Capital Operation Holding Group.

Apeiron Bioenergy, a Singapore-based bioenergy solutions provider, also raised about $37 million, through a five-year senior unsecured green bond guaranteed by the Credit Guarantee & Investment Facility.

Indonesian startups were involved in 10 funding deals that raised a total of $176.75 million, led by the $100 million funding in Amartha. PT Alba Tridi Plastics Recycling Indonesia also secured a $44.2-million loan from the Asian Development Bank in June.

Startups in Thailand raised $33.2 million from six deals while in Malaysia, seven transactions resulted in funding worth a total of $2.2 million. The Philippines and Vietnam posted three funding deals each that raised $3.3 million and $2.7 million, respectively.

Cambodia, meanwhile, saw one funding transaction in June when Singapore-based PE fund manager Emerging Markets Investment Advisers (EMIA) backed homegrown transportation firm FWF Full Well and Nisshin Logistics Co Ltd.

Most funded sectors: Fintech, greentech

Financial technology (fintech) companies were the busiest in June, signing 19 deals that raised $225.5 million in total, or about 51% of the total money raised in the month.

Amartha’s $100 million fundraising was the biggest among fintech players last month, followed by the $30-million Series C funding in Thunes, a Singapore-based startup that operates a global B2B cross-border payments network.

Fintech accounted for a third of all private funding last year, up from a quarter in 2021, according to DealStreetAsia DATA VANTAGE’s SE Asia Deal Review: Q4 2022 report.

It also accounted for 22% of the deal volume in 2022, down from 31% in 2021 as the easing of COVID-19 restrictions spurred investments in other verticals.

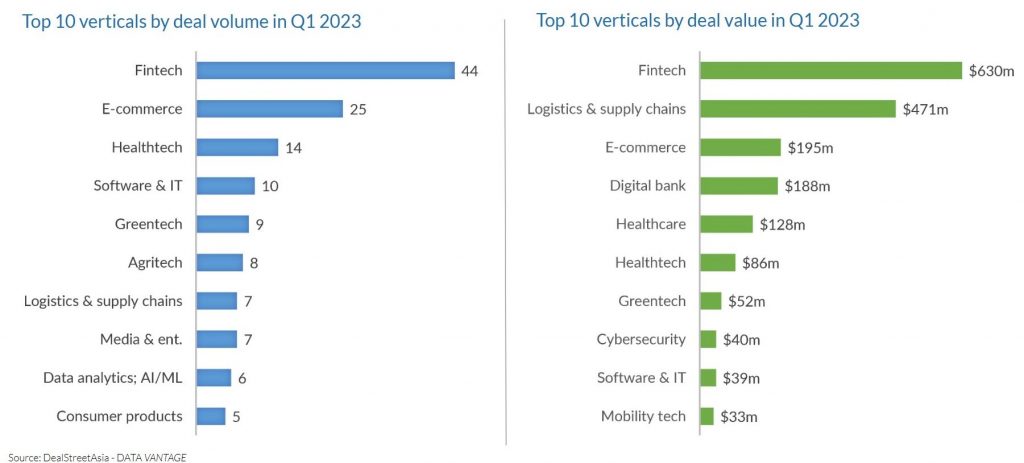

Fintech was also the most active vertical in the first quarter of this year, clocking 44 deals and bagging $630 million in proceeds.

Source: DATA VANTAGE

In the greentech space, startups raised $44.8 million in total from two deals in June while healthtech company Lion TCR, raised $41.5 million. E-commerce startups, which were the busiest in May in terms of deal volume, at 10, managed to secure just $16.35 million from eight deals.

Marketing tech startups were involved in four deals in the month, raising $37 million in total while agritech companies secured nearly $38 million in total from three transactions.

Early stage funding in favour

Seed and pre-seed funding rounds continue to dominate Southeast Asia’s fundraising scene in June, with a combined 29 deals under these stages, DealStreetAsia’s compilations show.

Nine transactions did not disclose funding stages.

Poko, a fintech startup in Singapore raised the biggest seed funding in June at $4.5 million, backed by prominent investors including Y Combinator, NAZCA, Global Founders Capital, Orange DAO, SOMA Capital, and Goodwater Capital.

In the pre-seed stage, Hybr1d, a workforce management platform in the city-state, topped the table after raising $3.2 million from Global Founders Capital, Japan’s MS&AD Insurance Group, tech investment firm 468 Capital, and early-stage VC 1982 Ventures.

Related Stories

Venture Capital

China Deals Barometer Report: At $4.8b, PE-VC dealmaking rebounds to hit four-month high in June

Dealmaking activity in Greater China rebounded to a four-month high in June as 231 startups raised a combined $4.8 billion, a 75.7% month-on-month (MoM) jump, according to proprietary data compiled by DealStreetAsia.

Venture Capital

India Deals Barometer Report: Startup funding drops to 34-month low at $652m in June

After rebounding to touch a high of $1.5 billion in May this year, private equity and venture capital investments in India plunged to $652 million in June, hitting a 34-month low, according to proprietary data compiled by DealStreetAsia.