India Deals Barometer Report: Indian startup funding drops further to $2.2b in May amid slowdown fears

Indian startup funding fell for the second month in a row this year, touching $2.2 billion across 127 venture capital and private equity transactions in May, hinting at an overall subdued investor sentiment amid the economic slowdown.

This marks a drop of almost 25% in value over April when startups had collectively racked up $2.93 billion across 129 transactions, reveals proprietary data compiled by DealStreetAsia.

The deal value in May, however, marks a growth of about 20% over the corresponding period last year that saw investments worth $1.83 billion. Last May, the country was hit by the second wave of COVID-19, the deadliest so far, and several states were forced to go into lockdowns. The deal volume has also risen 37% since.

The only startup to make it to the unicorn club (startups valued at least $1 billion) in May was Bengaluru-based neo-banking startup Open, which raised $50 million in its Series D investment round led by IIFL, with participation from existing investors such as Temasek, Tiger Global and 3one4 Capital. The company’s value hit $1 billion in the month, making it India’s 100th unicorn.

In comparison, India did not see any startup enter the unicorn club in April. So far this year, India has produced a total of 16 startup unicorns.

In May, there were about eight deals where the funding size crossed $100 million. These deals together raised funding worth $1.3 billion, accounting for about 59% of the total deal value. Social media platform ShareChat’s $300-million round marked the biggest funding deal of the month. The new capital was raised from Alphabet Inc’s Google, media behemoth Times Group and Singapore’s Temasek Holdings at a valuation of nearly $5 billion.

Deals worth over $100m in May

| Startup | Headquarter | Investment Size (USD) | Investment Stage | Lead Investor(s) | Industry | Verticals | |

|---|---|---|---|---|---|---|---|

| ShareChat | Bengaluru | 300,000,000 | Undisclosed | Google, Times Group, Temasek Holdings | Internet | Social Media | |

| Rippling | Bengaluru | 250,000,000 | Series D | Bedrock, Kleiner Perkins | Software | HR Tech | |

| Zepto | Mumbai | 200,000,000 | Series D | Y Combinator’s Continuity Fund | Retail | E-commerce | |

| Ather Energy | Bengaluru | 128,000,000 | Series E | National Investment and Infrastructure Fund Limited (NIIFL), Hero MotoCorp | Automobiles Other Vehicles & Parts | Electric/Hybrid Vehicles | |

| GreyOrange | Delhi | 110,000,000 | Undisclosed | Mithril Capital Management | Software | Robotics & Drones | |

| Country Delight | Gurugram | 108,000,000 | Series D | Venturi Partners, Temasek | Food | E-commerce | |

| Fashinza | Gurugram | 100,000,000 | Series B | Prosus VentureS, Westbridge Capital | Retail | E-commerce | |

| Absolute | Delhi | 100,000,000 | Series B | Sequoia Capital India, Alpha Wave Global, Tiger Global | Agribusiness | Agtech |

Other mega-deals that were closed during the month include HR software firm Rippling ($250 million), quick commerce startup Zepto ($200 million), electric scooter maker Ather Energy ($128 million), warehouse robotics and automation company GreyOrange ($110 million), food essentials brand Country Delight ($108 million), B2B manufacturing marketplace Fashinza ($100 million) and agritech startup Absolute ($100 million).

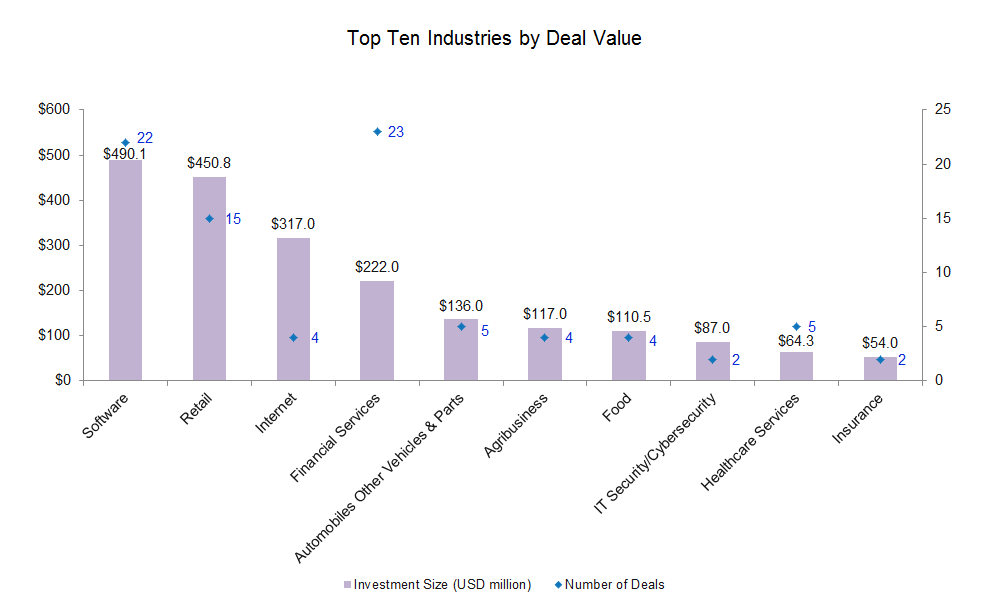

Software makes it to the top yet again

Broken down by industry, software startups topped fundraising in May by mopping up $490 million across 22 transactions. San Francisco- and Bengaluru-based HR software firm Rippling topped the list with a $250-million funding led by venture capital firms Bedrock and Kleiner Perkins. It attained a valuation of $11.25 billion in the round. GreyOrange followed with $110 million in a growth funding round led by Peter Thiel-backed Mithril Capital Management.

According to a report by venture capital firm Chiratae and management consultancy Zinnov released in April, the overall funding for Indian software-as-a-service (SaaS) startups is expected to touch $6.5 billion this year, an increase of 62.5% from $4 billion in 2021.

Retail, led by e-commerce startups, was the second most-funded industry with a total of $450 million in its account. Within retail, quick commerce startup Zepto grabbed the highest funding of $200 million in its Series D round led by Y Combinator’s Continuity fund along with a new investor, Kaiser Permanente. Other prominent deals within the sector include Fashinza, SUGAR Cosmetics, 1K Kirana, Melorra and BlissClub, among others.

ShareChat’s deal helped move Internet up to the third spot with $317 million in total funding across four transactions, followed by financial services ($222 million) and automobiles, other vehicles and parts ($136 million). Together the top three industries – software, retail, and Internet – scooped up $1.23 billion, accounting for about 56% of the total deal value in May.

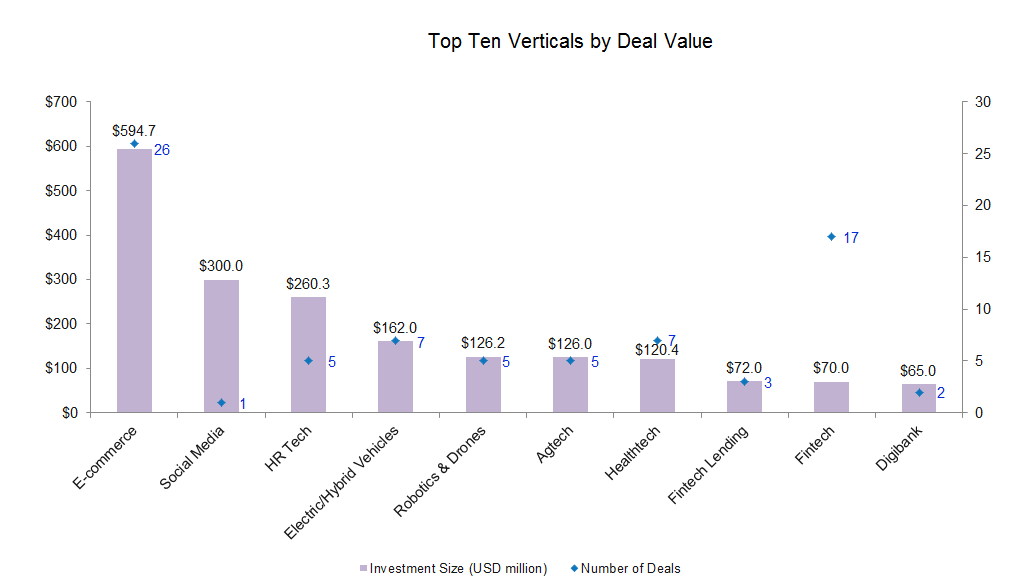

Meanwhile, the top three verticals — e-commerce, social media and HR tech — raised a total of $1.15 billion across 32 transactions.

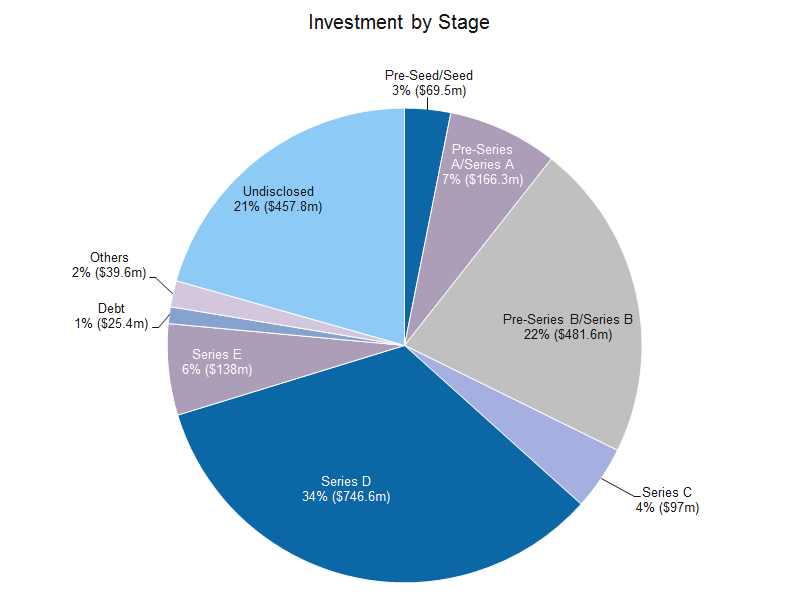

Growth-stage deals account for bulk value

Deal value was led by growth-stage transactions in May, with $1.3 billion raised by companies in Series B or post-Series B stages across 26 transactions, accounting for 59% of the total value. This is a drop of about 43% over April when growth-stage deals mopped up $2.3 billion across 34 transactions.

Startups that raised big growth rounds in the month include Zepto, Country Delight, Digit Insurance, Open, toothsi, Vviriti Capital, GoKwik, Fashinza, Skillmatics, Traceable AI, and others.

In terms of volume, early-stage funding continued to dominate the deal tally as investors backed business ideas that are impactful and relevant in a post-COVID-19 era.

The majority of venture capital deals during the month were in the pre-seed and seed stages, with these startups raising $69.5 million across 43 deals. In comparison, there were a total of 39 pre-seed and seed deals worth $122 million in April. Startups that raised seed rounds in May include supply-chain financing provider Nakad, music NFT marketplace FanTiger, marketing automation startup Inflection.io, full-stack electric mobility platform MoEVing, fintech startup BharatX, smart interviewing platform BarRaiser and home construction marketplace Kolo, among others.

The number of pre-Series A and Series A deals stood at 29, with deal value at $166.3 million in the month. Electric vehicle cab company BluSmart raised the biggest Series A round of $25 million in a combination of equity and debt funding from BP Ventures, Green Frontier Capital, Stride Ventures, Alteria Capital, BlackSoil and UCIC. Other Series A deals include Toplyne, Wint Wealth, BlissClub, Coinshift, ApnaKlub and The Wheels United.

Most active investors

Venture Catalysts, along with its early-stage fund 9Unicorns, and Silicon Valley investor Sequoia Capital were the top investors in May with a total of eight investments in their accounts. Venture Catalysts and 9Unicorns led the funding round for companies, including NutriTap, Fyllo, SuperBottoms and Monrow Shoes and Accessories.

Sequoia, an early investor in global technology behemoths such as Google and Apple, invested in startups including Toplyne, Absolute, Digit Insurance, Skillmatics, Rippling, GoKwik and Coinshift.

New York investment firm Tiger Global occupied the second spot with seven investments, including Absolute, ApnaKlub, Shopflo, Coinshift and Toplyne.

IIFL, through its various arms, Elevation Capital, Y Combinator and LetsVenture stood third with five investments each.

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

China Deals Barometer Report: Startups raise over $3.8b as PE-VC funding activity climbs in May

Startups headquartered in Greater China raised more than $3.8 billion in PE-VC funding in May 2022...

Venture Capital

SE Asia Deals Barometer Report: Startup fundraising falls to five-month low of $1.42b in May

Dealmaking in Southeast Asia dropped by almost 30% month-on-month in May to $1.42 billion...