China Deals Barometer Report: Startups raise over $3.8b as PE-VC funding activity climbs in May

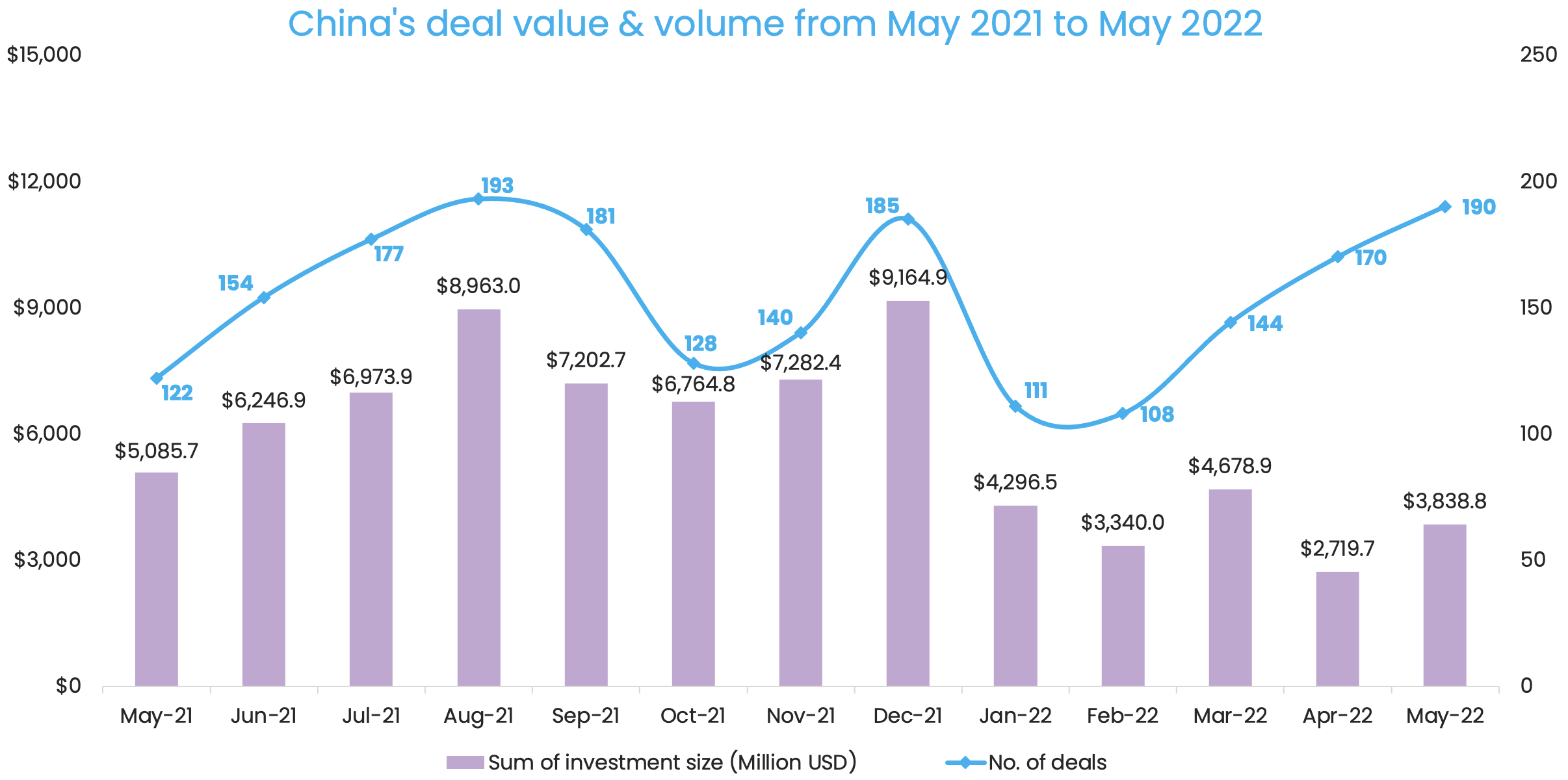

Startups headquartered in Greater China raised more than $3.8 billion in PE-VC funding in May 2022, up 41.2% month-on-month. At 190, the deal volume also increased by 11.8% from April — a sign that funding activity in the second quarter will overtake the previous quarter’s performance as the post-pandemic recovery continues.

The number of venture deals in April and May already amounts to 360, almost on par with the 363 deals clocked in January-March, according to proprietary data compiled by DealStreetAsia.

In general, investors became more active in dealmaking this year, writing 55.7% more cheques in May 2022 than in the same month last year. However, the combined deal value was 24.5% less than in May 2021, potentially because risks in exiting amid a gloomy market environment drove more dry powder to focus on smaller-sized, early-stage deals.

2022’s first billion-dollar venture deal

While big-ticket investments were few and far between in May, the month clocked a billion-dollar deal — the biggest funding round so far this year.

CNNP Rich Energy, the new energy arm of the state-owned nuclear company China National Nuclear Corporation (CNNC), completed its first external financing round at over 7 billion yuan ($1 billion). Everbright Belt & Road Green Fund — a 20-billion-yuan dual-currency fund backed by China Everbright Group, and CNNC Emerging Industry Fund — invested in the deal, alongside other investors such as China Life Insurance and CITIC Securities.

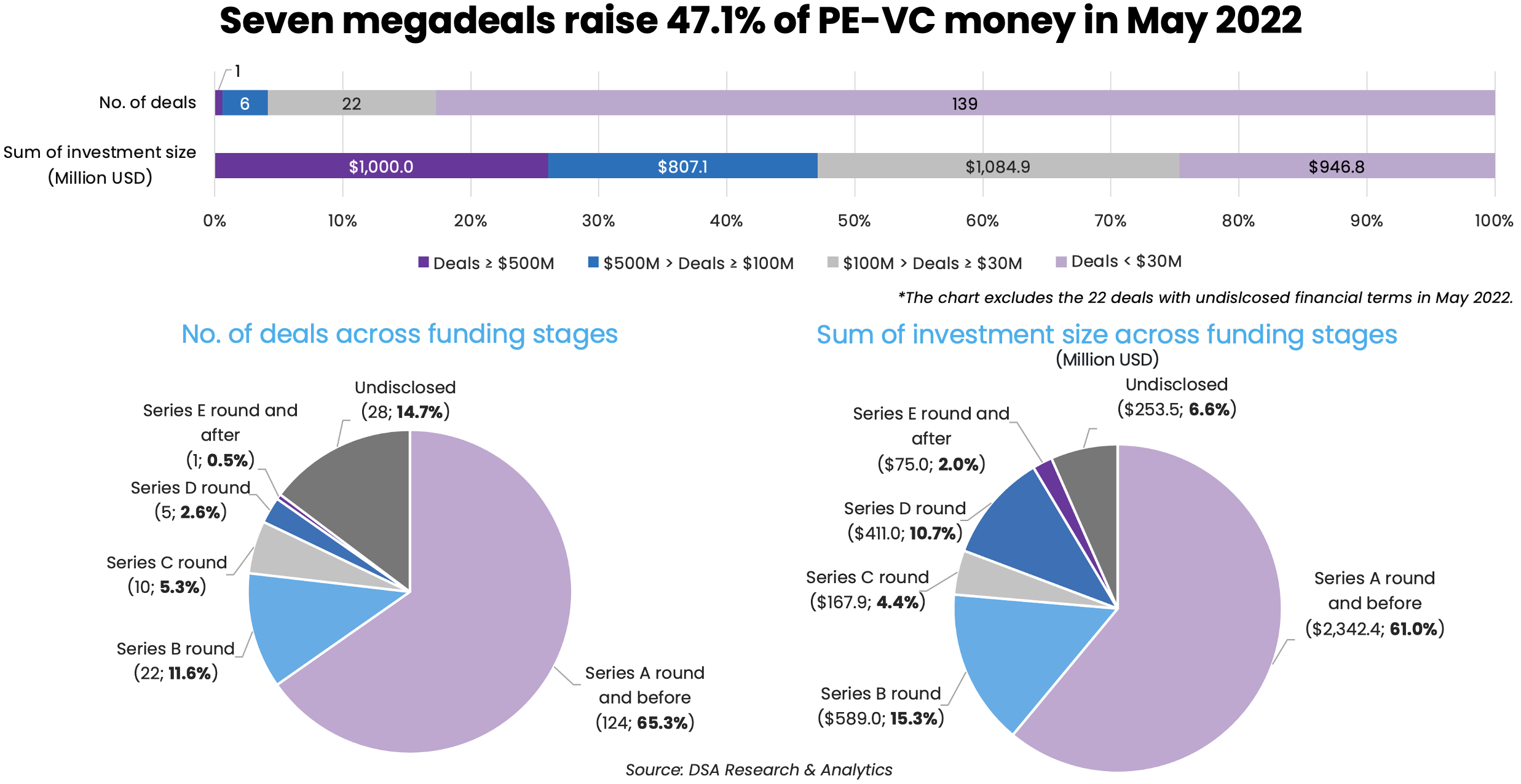

The $1 billion deal and six other megadeals, or investments worth at least $100 million, collectively raised just over $1.8 billion, representing 47.1% of the month’s total financing.

Ranking second in May’s fundraising chart was the $200 million Series D round of Sensors Data, a provider of big data analysis and MarTech solutions, as the firm looks to step up R&D efforts and improve the capabilities of its pipeline of MarTech products.

A $150-million Series A round in Greater Bay Technology came third. Incubated by Chinese state-owned automaker GAC Group, the extreme fast charging (XFC) battery startup reached the unicorn valuation of over $1 billion with the completion of the new round.

In May, the other megadeals spanned the semiconductor, cybersecurity, and biotech industries, which are some of the most sought-after sectors given China’s target to realise technological self-sufficiency and transform into more secured industrial network systems and enhance healthcare services for its ageing society.

Growth- and late-stage startups raised far less capital than their early-stage counterparts as investors became more cautious of the potential impact of market upheavals on investment returns.

Venture investors generated 153.1 billion yuan ($23 billion) in the book value of investment returns from initial public offerings (IPOs) of their Chinese portfolios in Q1 2022, down 61.5% from the previous quarter, according to CVSource. Statistics from the Chinese market data provider show that 97 Chinese companies completed an IPO in Q1 across stock exchanges in mainland China, Hong Kong, and the US, among which 72 IPOs were backed by venture investors.

The stagnant IPO market dampened investor interest in near-IPO deals, but investments in nascent startups stood strong. With 124 transactions, Series A and earlier stages accounted for 65.3% of the deal count, while the over $2.3 billion raised at this funding stage represented 61% of the deal value.

List of megadeals in May 2022

| Startup | Headquarters | Investment size (USD) | Investment stage | Lead investor(s) | Other investor(s) | Industry/Sector | Vertical |

|---|---|---|---|---|---|---|---|

| CNNP Rich Energy Co Ltd | Beijing | $1,000 million | Initial | Everbright Belt & Road Green Investment Fund, CNNC Industry Fund Management Corporation | China Life Insurance Company Limited, Sichuan Chuantou Energy, Zhejiang Zheneng Electric, CITIC Securities, National Military-Civilian Integration Fund | Renewable Energy | CleanTech |

| Sensors Data | Beijing | $200 million | D | Tiger Global Management, Carlyle Group | Sequoia Capital China, Warburg Pincus, Bessemer Venture Partners, GGV Capital, Future Capital, DCM, Linear Capital, M31 Capital, Xiang He Capital, 5Y Capital | Marketing/Advertising | Big Data |

| Greater Bay Technology | Guangzhou | $150 million | A | GF Securities, BOC & UTRUST Private Equity Fund Management, Guangzhou Industrial Investment Fund Management, Scheme Capital | Energy Storage & Batteries | Electric/Hybrid Vehicles | |

| Gowin Semiconductor Corp | Guangzhou | $132 million | B+ | Guangzhou Bay Area Semiconductor Industry Group | Guangdong Macao Semiconductor Industry Investment Fund, Shanghai Semiconductor Equipment & Materials Industry Investment Fund | Semiconductor | N/A |

| HJ Micro | Hangzhou | $120.1 million | Angel, Pre-A | Walden International, GL Ventures, CDH Venture and Growth Capital (VGC) | Biren Technology, Xinlanwei, Xingrui capital, CD Capital, Green Pine Capital Partners (GPCP), Creo Capital, Zhongyiren Investment, Haihe Qirui Capital, Xiao Ventures | Semiconductor | N/A |

| TDHX Industrial Network Security | Beijing | $105 million | D | SPIC Industrial Fund Management, China Electronics Technology Group Corporation, State Grid Yingda Industry Investment Funds Management, Shang Qi Capital, Nanjing Iron & Steel’s industry investment fund, Cash Capital, Suzhou International Development Venture Capital, Green Pine Capital Partners, Fosun Capital, Chinaleaf Capital Management, Yinxinggu Capital | Cybersecurity | N/A | |

| Reistone Biopharma | Shanghai | $100 million | A | Huagai Capital, Shoudu Healthcare Fund | Yunion Healthcare Fund, Zhangjiang Haoheng Investment, Zero2IPO Industry Investment, Hanne Capital | Biotech | Biotech |

Semiconductor space leads in deal count

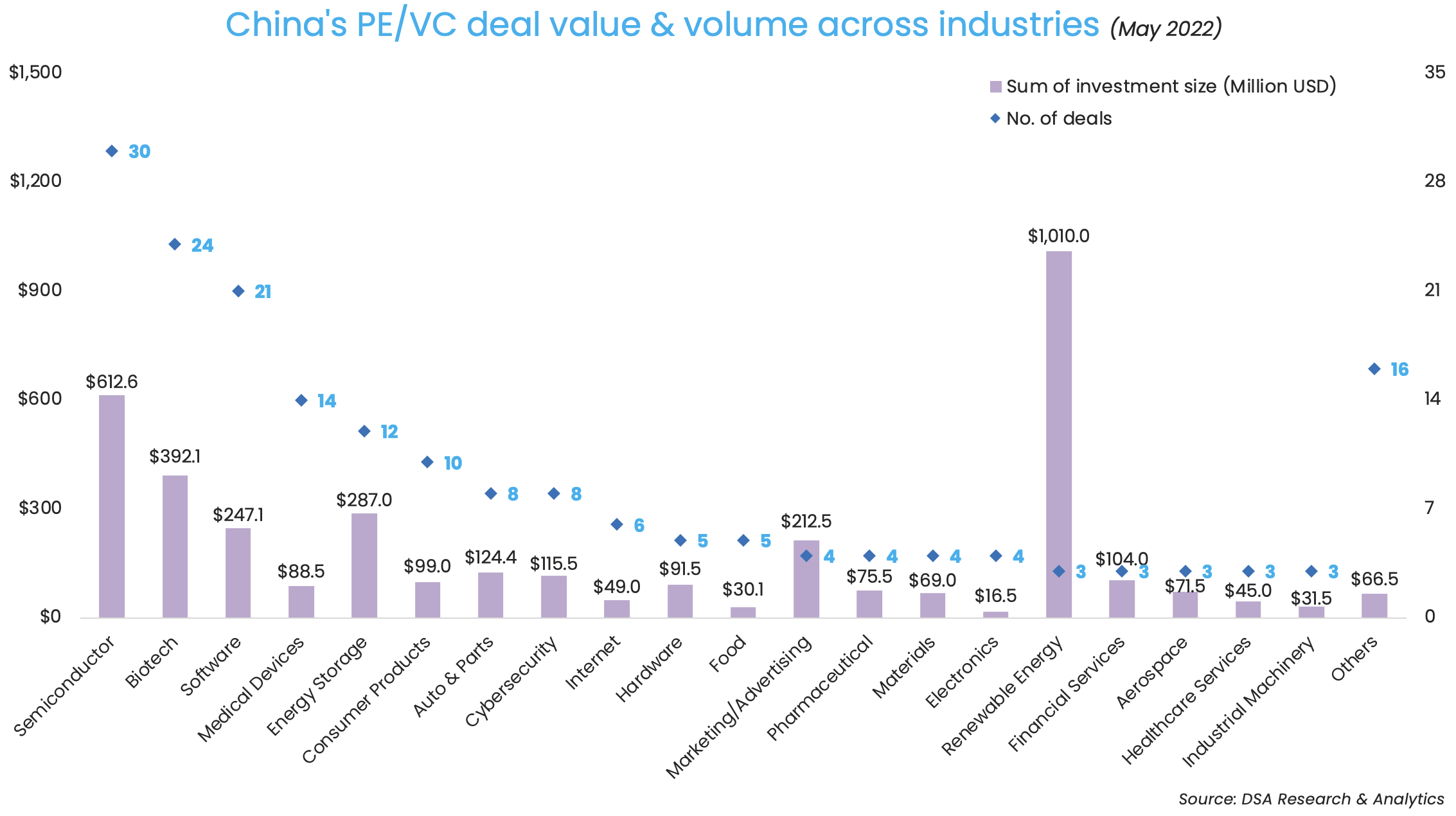

Despite having booked only three transactions, renewable energy emerged as the most funded industry thanks to the $1-billion round in CNNP Rich Energy, whose main businesses cover wind power, photovoltaic power, geothermal power, and charging facilities.

It is a different story, however, when it comes to the deal count across sectors. Semiconductor, biotech, and software topped as the three most popular industries for investors to make new bets in May, with the completion of 30, 24, and 21 investments, respectively.

Thirty semiconductor startups raised a combined $612.6 million, including two megadeals. Guangzhou-based Gowin Semiconductor Corp pocketed $132 million — the biggest investment in a Chinese chip company last month.

HJ Micro, a provider of central processing units used in data centres, also closed a megadeal at about $120.1 million.

The bulk of fundraisers in the semiconductor industry completed their new funding rounds at the early funding stage — i.e the angel, Series Pre-A, A, and B stages. Most non-traditional semiconductor developers focus on the development of chips for the Internet of Things (IoT).

Biotech continued to be a darling of investors seeking to ride on the global trend of increasing health consciousness since the pandemic outbreak.

Biotech companies closed an aggregate of $392.1 million across 24 venture deals, with the largest one being a $100-million Series A round in the clinical-stage biopharmaceutical firm Reistone Biopharma.

The sector also recorded the completion of two mid-sized deals, including biological sample storage device maker Origincell’s $62-million Series A round and a $61-million Series D round in Laekna Therapeutics, which develops innovative therapeutics to treat cancer and liver diseases. A few biotech fundraisers last month are involved in the application of emerging technologies including AI in biotech – a subsector that is still developing at its initial stage in Greater China.

GL Ventures continues its perch on top

GL Ventures, the venture capital arm of Asia-focused Hillhouse Capital Group, continued its perch on top as the most active investor in Greater China.

In May, GL Ventures participated in six venture deals worth a total of $173.6 million. This was a decrease from April when it had backed 11 deals collectively worth $247.5 million.

The two-year-old, dual-currency VC company led three of the six deals that it participated in. Its transactions in May included one megadeal, i.e., the $120.1-million investment in CPU developer HJ Micro.

The other five deals included the LYFE Capital-led, $22-million Series A round in Starna Therapeutics, which specialises in the R&D of new mRNA drugs; and four deals at a size of $15 million or smaller across a range of sectors including semiconductor, healthcare IT, and biotech.

Hillhouse set up GL Ventures in early 2020 to primarily invest in early-stage startups in four areas — biopharmaceutical and medical apparatus, software services, and technological innovation, consumer-oriented Internet and technologies, and emerging consumer brands and services.

Chinese state media Xinhua News Agency reported that the arm started with a 10-billion-yuan ($1.6 billion) fund, and could write cheques worth between 3 million yuan ($471,038.9) and $30 million.

Most active investors in Greater China (May 2022)

| Investment company | No. of deals | Total value of participated deals (USD) | Lead | Non-lead |

|---|---|---|---|---|

| GL Ventures | 6 | $173.6 million | 3 | 3 |

| Fosun International and affiliates | 5 | $150 million | 2 | 3 |

| Sequoia Capital China | 4 | $253.5 million | 1 | 3 |

| Oriza Holdings and affiliates | 4 | $164 million | 1 | 3 |

| Addor Capital | 4 | $76.5 million | 2 | 2 |

| Legend Capital & Legend Star | 4 | $66 million | 3 | 1 |

| Unity Ventures | 4 | $51.9 million | 1 | 3 |

| Qiming Venture Partners | 4 | $41.5 million | 4 | 0 |

| Linear Capital | 3 | $215.4 million | 1 | 2 |

| Sherpa Healthcare Partners | 3 | $52 million | 0 | 3 |

| *If one deal is backed by only two investors, we consider neither of the two investors as a lead investor. | ||||

Note: In our monthly analysis for May 2022, we have put together detailed charts of prominent deals, active investors, deal stages, and the most attractive sectors that have bagged the maximum venture dollars in the Greater China region.

Our database only considers deals officially announced by the related investee, investor(s), and/or financial advisor, while information based on market rumours and news reports citing sources is excluded.

For a more detailed analysis, and to enable comparison between primary and secondary markets, DealStreetAsia has started tracking deals of all sizes since April 2020, as against considering only transactions worth more than $10 million earlier.

We have also introduced a standardised system for industry classification. It currently includes over 50 industries, as well as over 45 new economy and high-tech verticals, which will progressively increase to adapt to local market conditions in our closely watched regions of Greater China, Southeast Asia, and India.

DealStreetAsia Partner Content

‘In an era of virtual dealmaking, stakeholders tend to be more transparent’ – DFIN’s Peter McMillan

Over half the deals in the next 3 months will be hosted virtually according to 79% of the respondents in DFIN’s DealMaker Meter Survey. Peter McMillan, Head of Sales for APAC at DCIN speaks of the advantages of virtual dealmaking as well as the pitfalls to be avoided, in an exclusive interview with DealStreetAsia

Related Stories

Venture Capital

India Deals Barometer Report: Indian startup funding drops further to $2.2b in May amid slowdown fears

Indian startup funding fell for the second month in a row this year, touching $2.2 billion across 127 venture capital...

Venture Capital

SE Asia Deals Barometer Report: Startup fundraising falls to five-month low of $1.42b in May

Dealmaking in Southeast Asia dropped by almost 30% month-on-month in May to $1.42 billion...